Rabobank, Aegon named amongst Celent’s model banks and insurers

Last month at its Innovation & Insight Day, Celent, a leading research, advisory, and fintech consulting firm, announced the winners for its Model Bank, Model Insurer, Model Asset Manager, and Model Wealth Manager Awards. Across these different categories, Celent sought to highlight real-world examples of financial institutions that use technology effectively, to both help them […]

Insurers, Fintech, TechFin …

by Zao Wu, Analyst at Celent Alliances the name of the game Ten days. That’s how long it took for Ant Financial to get over 10 million customers for its P2P insurance product, covering critical illnesses, last October. The numbers far surpassed their own, otherwise lofty goals of reaching 3.3 million customers in three months. Not to […]

McKinsey: insurance beyond digital

The consulting giant has turned its hand to the insurance sector to assess the current and potential impact of fintech disruption in their report: “Insurance beyond digital: The rise of ecosystems and platforms“. It highlights the lessons that can be learnt from comparative sectors on revamping their business models and tracks the potential journey from […]

Synechron taking a leap forward in artificial intelligence

Synechron takes a step forward in its involvement with artificial intelligence in announcing the launch of its AI Data Science Accelerators. The platform consists of a powerful set of accelerators, aiming to help financial services, banking and insurance firms. The accelerators integrate natural language processing (NLP), deep learning algorithms and data science to solve challenging business […]

Recap: Zoetermeer Fintech Meetup

Last Wednesday, Crosspring hosted a fintech meetup bringing together part of the Holland FinTech ecosystem and European start-ups in the Soft Landing program. Don Ginsel, CEO of Holland FinTech, opened the meetup with an introduction of the company and its diverse ecosystem. Consumer Financial Services The first pitch came from Paul Niklaus of Zuper Bank, […]

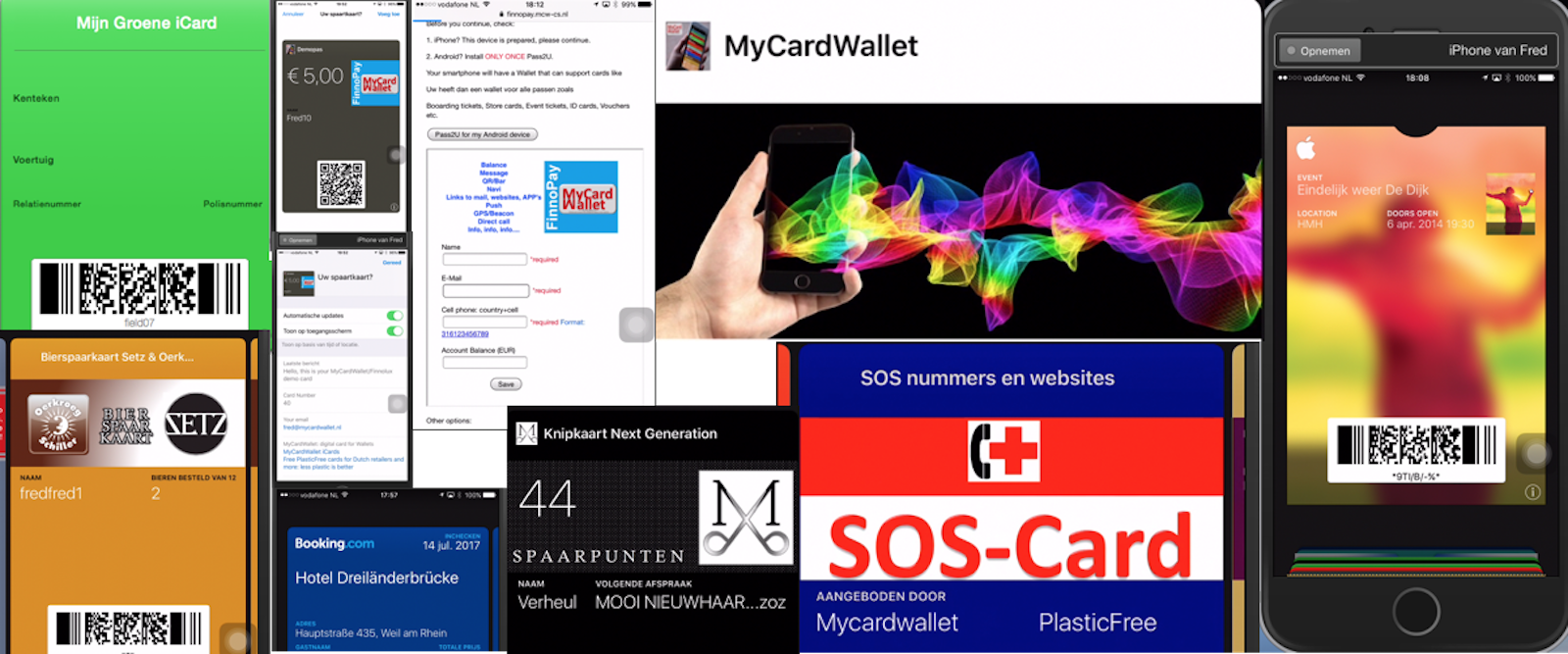

Member Spotlight: MyCardWallet

MyCardWallet is a B2B company helping businesses acquire relevant content about their own customers through their technology, which is offered in an intuitive and personal way via smartphone and digital wallet. What makes MyCardWallet interesting is that no API is required to employ its technology. We sat down with Fred Diepeveen, co-founder of MyCardWallet, to […]

Beat them or join them? Gjensidige’s digital banking unit acquired, Ingenico next

Nordea has announced today that it will be acquiring Norwegian insurer Gjensidige Forsikring‘s digital banking unit for EUR578 million cash, effectively adding 176k customers and EUR4,840 million of their assets onto their balance sheet. With the acquisition of Gjensidige digital platform, Nordea will also be distributing Gijensidige’s insurance products to its own 900,000 customers. The acquisition, Gjensidige […]

Week 22: Research in a Glance

World Wealth Report 2018 by Capgemini An annual report on global high net worth individuals, their changes in net worth as well as the distribution of wealth. Innovate.Collaborate.Elevate. Paynext 2018 by Deloitte The British Business Bank, the UK’s economic development bank, provides fresh insights into business angel investors in the UK. Whose customer are you? […]

How #openness will change insurers’ pricing strategy

Insights by Maarten Bakker, Sector Lead Insurance at Innopay “Data, whether it’s location-based or behavior-based data, will help provide solutions, whenever and wherever they occur.” – Brett King, author of breaking banks Although insurers are improving significantly on enhancing the customer experience during onboarding, pricing still seems to be the most important differentiator for customers. Based […]

Open Insurance’: a new mindset for the Insurance sector

By Maarten Bakker, Sector Lead Insurance at Innopay The Insurance sector evolves at a more leisurely pace than many industries, but according to Maarten Bakker, organisations which are slow to develop open strategies will soon find themselves marginalised. We are experiencing exponential growth in the amount of digital transactions and customer data, and this is fundamentally changing […]