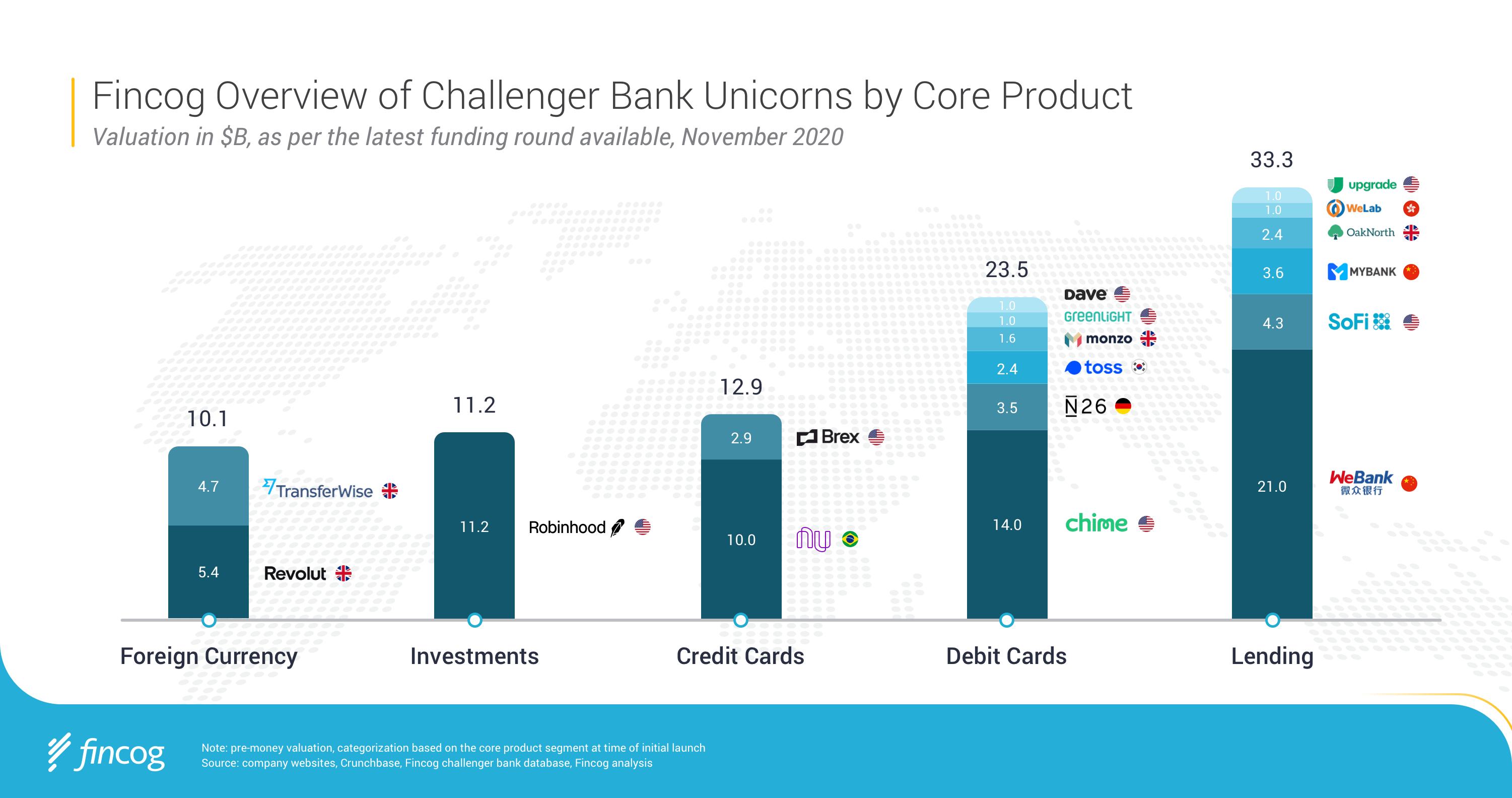

We identified 17 unicorn neo banks (defined by a pre-money valuation over $1 bln) from around the world and categorized them by their core product at time of launch. Even though the categorization can be arbitrary in points (i.e. we put Revolut under FX as their initial pitch was built around spending and sending money abroad), we believe this provides an interesting overview of successful and popular product segments.

Despite the impact of COVID-19 on funding and a decline in the number of deals, the largest digital banks continue to grow ever larger and reach record-height valuations, with a combined valuation of $90.0bln. When ranked by their core product (at time of launch), Lending is the largest category with $33.3bln across 6 neo banks, followed by Debit Cards ($23.4bln, 6 unicorns) and Credit Cards ($12.9bln, 2 unicorns). This shows there are multiple roads to success.

Chime for example, which has been standing at a valuation of just $5.8 bln in February reached $14.0 bln in and therefore can claim the title of the most valuable challenger bank in the western world, topping Robinhood ($11.2 bln) and Nubank ($10.0bln). The Asian-Pacific region however, and China in particular, dominates in terms of their sheer size. WeBank with over 200mln customers and estimated valuation of $21.0bln tops the scale, followed by other regional leaders as MyBank ($3.6bln), Toss ($2.4bln) and WeLab ($1.0bln).

Read the original article here. Find out more about Fincog here.