For this analysis and opinion piece, we start the week by providing you with the latest voices from the fintech industry. We look at whether digital euros are really the future of money, understand why Latin American remittances are seeing an uninterrupted path, dive into WealthTech & ESG, find new cloud solutions for open banking, discover the fintech recipe for success, understand the connection between AI and bank treasury, observe good news for fintech ID verification processes, analyze the top trends in commercial banking & AI for 2021, and explore the latest news on Ethereum 2.0 . Enjoy the reading!

Are digital euros the next big thing?

The future of money – innovating while retaining trust (ECB)

Christine Lagarde, President of the ECB, shows a complete overview on the key factors which influence the journey towards the future of money, such as the possible introduction of digital euros. With a digital euro, the cash can be complemented in order to ensure that consumers have unrestricted access to central bank money in a form that meets their evolving digital payment needs. Read more

Latin American remittances keep on steady despite Covid-19…

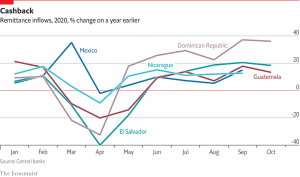

Why the pandemic has not dented Latin American remittances (The Economist)

Although the Covid-19 has hit the fintech sector, The Economist shows that the remittance industry for Latin America has not seen a drastic decrease as expected. Earlier in April this year, the World Bank presented a forecast in which remittances were expected to fall by 20% compared to 2019, but a new correction to the statistics was made last month. Remittances to lower- and middle-income countries are expected to actually shrink by only 7% this year. Read more

Wealth Advisors & ESG…

Wealth advisors must embrace fintech to maximise ESG investing (Fintech Bulletin)

According to Boris Rankov, co-founder and Partner of InCube Group AG, there is a focus from the regulatory environment on ESG investments. When the new EU Disclosure Regulation – March 2021 will come into effect, there will be an emphasis on the integration of ESG in investment decisions, with the purpose of helping private investors find investments that are sustainable. The analysis pinpoints that wealth advisors are playing an essential role, being the link between investors and their investing opportunities. Read more

Is Cloud really the answer for everything in open banking?

How the cloud is the path to open banking (Fintech Futures)

Andrew Beatty, head of global next generation banking at FIS, explains why cloud systems have gained more popularity than ever for open banking services. With Covid-19, banks needed to shift their angle towards data protection and ensure a collaborative relationship with their clients to safely and securely share customer transaction data with third-party stakeholders. Data needed to be processed and analyzed at a large scale, in real-time, thus, new solutions such as cloud services are providing the right opportunities. Read more

Fintech recipe for success: Follow the “3Ds”…

When Fintech Succeeds: The Three Ds (Forbes)

Alex Lazarow, Investment Director at Cathay Innovation, highlights the increase in fintech market cap on a global scale, which is advancing almost into banking territory. Findings from The Economist show that 64% of consumers around the world have used a fintech product. However, with more popularity comes a fierce competition. For just the first half of 2020, over $20 billion in venture capital were invested in fintechs globally. The analysis pinpoints that for fintechs to succeed in the arena, they usually follow three patterns (the “3 Ds”): distribution advantage, data advantage, and delivery advantage. Read more

AI for treasury tech?

Buyers’ brief: The future of bank treasury tech is AI (Bobsguide.com)

According to Chrissy Chiu, journalist at Bobsguide.com, treasurers are looking for advanced technology over wire payments in order to connect with more payment counterparties. AI is already enhancing banking operations by providing real-time transaction monitoring and fraud prevention, and could further be used to bring numerous opportunities for treasury technology. AI could reduce the grunt work for treasuries, freeing up time to make strategic decisions. Read more

ID Verification is no longer an issue for fintechs…

ID Verification is no longer an obstacle to global growth (Finextra)

Barley Laing, UK Managing Director Melissa, emphasizes that for a long period of time, banks and challenger fintechs struggled to obtain proper growth due to issues related to effective identity (ID) verification. With Africa and Asia lacking verifiable private addresses and internationally recognised IDs, financial institutions were restricted from doing proper ID checks. However, with the proliferation of mobile smartphones for these territories, new opportunities arise that can play a key role in the ID verification process: biometrics, access to billions of records in real time, and social media as an insight indicator. Read more

Top Trends in Commercial Banking for 2021…

Top Trends in Commercial Banking: 2021 (Capgemini)

For 2020, traditional commercial banks have faced numerous challenges which put them on a path of becoming more creative, intelligent and experiential. COVID-19 is the primary element that forced banks’ operational models towards becoming lean and agile. Incumbents continue to leverage open ecosystems while aiming to keep their customers informed, engaged, and satisfied. This analysis outlines the top trends in commercial banking for 2021. Read more

Top Trends in AI for 2021…

Top AI Trends to Watch in 2021 (Interesting Engineering)

According to Susan Fourtané, science and technology journalist, artificial intelligence (AI) has been established as the main driver of emerging technologies such as big data, robotics, and the Internet of Things (IoT). By further looking into the next year, AI is expected to act as the main driver for technology innovations. As expected trends, AI and Machine Learning (ML) may permeate new use cases and experiences, while workplace AI could be a facilitator to boost automation and augmentation needs. Read more

RPA in Banking & Finance…

RPA in Banking and Finance Industry: The Use Cases and Benefits (Datafloq)

According to Shailee Parikh, writer at Datafloq, Robotic Process Automation (RPA) has become an essential instrument for most businesses to drive cost optimization, process efficiency, improved data accuracy, and turnaround time, with banks and financial service providers not being an exception. The main uses for RPA in banking and finance operations highlighted by the analysis include: AML solutions, KYC techniques, regulatory report generation, customer service, and account closure processing. Read more

Ready, set, go! ETH 2.0 is now launched…

Ethereum 2.0: All You Need To Know About The Crypto (Programming Insider)

In this analysis overview, Marc Berman, founder and Editor-in-Chief for Programming Insider, explores the features of Ethereum 2.0 (ETH 2.0). When it comes to the difference between ETH 1.0 and ETH 2.0, Ethereum 2.0 uses a Proof of Stake (PoS) mechanism, while Ethereum 1.0 uses Proof Of Work (PoW) and it requires a minimum of 16,384 validators which makes it more decentralized and secure. Read more

—

Do you have any news to share: please put feed@https://hollandfintech.com/ on your press list.

Curious to read and find out more from fintech? Then subscribe & read our full newsletters here: https://hollandfintech.com/featured/newsletters/. In order to see our other weekly highlights, check out the following links: funding, research, news.