This research piece contains the latest highlights from fintech in terms of reports, data analysis, trends, and numbers. We dived into the buzz around ETH 2.0, looked at the top 100 international insurance companies for December 2020, found out the state of global fintech based on market performance indicators, analyzed the right steps for business cloud migration, highlighted the 2021 banking and capital markets outlook, explored the topic of tokenised assets in central bank money, and looked at the uneven recession and recovery of global economies. Enjoy the material!

Report Offers Deep Dive Into ETH 2.0 (Altcoin Buzz)

A new report from the blockchain sector shows a new envisioned path for Ethereum: ETH 2.0. This joint paper study report by crypto and blockchain-focused companies Messari and BisonTrails provides a comprehensive overview of what Ethereum’s evolution entails. With the buzz around cryptocurrency and the introduction of ETH 2.0, the findings show the possible risks, such as the poor scalability issue. Read more

December 2020’s Top 100 Digital International Insurance Companies (Digital Scouting.de)

With the insurance system being on the verge of a major transition, this analysis explores the top players from the industry and brings a complete overview of the major 100 digital international insurance companies (see below figure). Read more

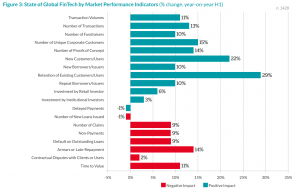

The Global Covid-19 FinTech Market Rapid Assessment Study (Cambridge Center for Alternative Finance, World Bank Group & World Economic Forum)

Covid-19 has profoundly impacted financial systems across the world, including the provision of digital financial services and the functioning of fintech markets. This report gathers empirical data and evidence to show the changes in the fintech landscape across the globe. Based on the findings, investors, business communities, regulators, governments, multilateral institutions and other key stakeholders, can make informed decisions and act. Topics explored include: Covid-19’s overall influence on the fintech industry on a global scale, Covid-19’s impact on the transaction volume for the global fintech industry, customer retention and growth for the sector (see below figure for a complete overview). Read more

E-book: Migration to cloud – your guide to delivering an intuitive customer experience (Fintech Futures)

For this study, NTT emphasizes the importance of customer experience, leading businesses to implement new sustainable strategies in order to attract, retain and grow customers for markets in which brand differentiation is the key element. Due to the fact that the needs of clients are constantly changing, prompted by the economic circumstances, firms are expected to deliver high quality services. In this sense, legacy platforms and applications can act sometimes as an impediment to an agile CX, since they lack certain availability, capability and resources that cloud systems have. Read more

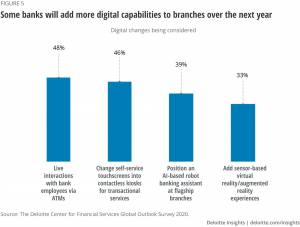

2021 banking and capital markets outlook (Deloitte)

For this analysis, Deloitte gathered data from over 200 industry leaders practicing in the banking and capital markets sectors in order to discover how businesses are managing to recover from Covid-19. As part of the observed trends among banks and finance leaders, results show that the focus goes on strengthening resilience and accelerating transformation in finance (see below an overview on banks’ plans for technological spendings in 2021). Read more

Project Helvetia: Settling tokenised assets in central bank money (Swiss National Bank, BIS, SIX Group AG)

Project Helvetia is a joint experiment by the BIS Innovation Hub (BISIH) Swiss Centre, SIX Group AG (SIX) and the Swiss National Bank (SNB), exploring the integration of tokenised assets and central bank money on the SDX platform. The report investigated two proofs of concept (PoCs), which were confirmed by the experimental settings: (i) issuing a novel wholesale central bank digital currency (w-CBDC) and (ii) building a link between the new securities settlement platform of SDX and the existing central bank payment system. Read more

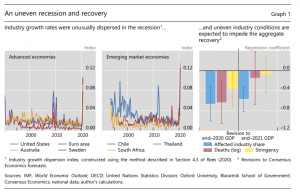

What comes next? Recovery from an uneven recession (BIS)

In this report, Daniel Rees, Senior Economist (BIS), explores the effects of Covid-19 crisis on different sectors (see in the figure below the Covid-19’s uneven impact across sectors). As such, the findings of the study show that economies with large customer service industries could grow more slowly in the near term, even after accounting for the stringency of containment measures and the severity of virus outbreaks. In addition, large advanced economies have been forecasted to face a “98% economy” until constraints on customer service industries ease. The outlook for some economies, such as China, is more positive. Read more

—

Do you have any news to share: please put feed@https://hollandfintech.com/ on your press list.

Curious to read and find out more from fintech? Then subscribe & read our full newsletters here: https://hollandfintech.com/featured/newsletters/. Stay tuned for more insights following up this week regarding news pieces. In order to see our other weekly highlights, check out the following links: analysis & opinion, funding, news.