In terms of fintech research, this week we selected trends regarding the potential cashless economy we are heading towards, check the latest stats on the fintech ecosystem market, look at cybersecurity, understand why chatbots may be a thing of the past, analyze ESG matters, map down the fintech Singapore landscape, unlock the full potential of 5G technology, and explore why the potential end of cash is about more than money, and check out the latest figures from insurance.

Happy reading!

Heading towards a cashless economy…

What will drive the journey towards cashlessness and digitalisation? (Finextra & HPS)

The direction that the market shifts pinpoints towards a cashless and digital economy. The underlying reason behind this transition include the benefits of the digital environment, such as enabling connections between unbanked consumers, merchants and services through mobile money; greater visibility and view on liquidity for merchants, including real time confirmation and settlement; reduction in fraud and crime by implementing a digital trace and, hence, audit system and also a new potential for financial inclusion. Read more

Fintech industry check…

Overview of the fintech industry: stats, trends, and companies in the ecosystem market research report (Business Insider)

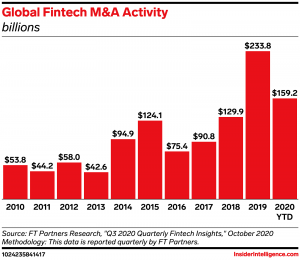

With the rise of fintech activity and disruptive technologies in financial services, consumers are also turning to digital methods of managing their finances. Tech-savvy startups and traditional financial institutions (FIs) alike are diving into the fintech industry and investors are also noticing this digital shift (see below graph). The Global Fintech Market is anticipated to grow at a CAGR of around 20% over the next four years. The main expected trends revolve around Big Techs diving into wealth management, high levels robo-advisor adoptions, and further regulatory initiatives. Read more

On cybersecurity…

Global Digital Trust Insights 2021 (PwC)

The results of this survey, which gathered data from over 3,249 business and technology executives around the world, highlight what’s changing and what’s next in cybersecurity. The current security landscape has been maturing. Cyber stands at a critical, pivotal, exciting time for the industry and the organisations and people it serves. The findings show five moves that could help businesses get to the next level, such as: resetting the cyber strategy, rethinking the cyber budget, investing, building resilience for any scenario, and having a future-proof security team. Read more

Where did all the chatbots go?

Lessons From The Failed Chatbot Revolution — And 7 Industries Where The Tech Is Making A Comeback (CB Insights)

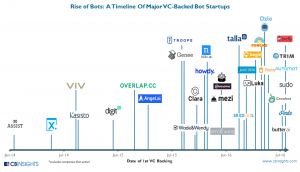

While in 2016, chatbots were the new hype, with the likes of Facebook making the Messenger bot platform the centerpiece of its F8 developer conference, the current landscape looks different. Firstly, consumers found that many of the tasks the first chatbots were built to perform — like relaying the news or finding a recipe — took more time when a bot was involved. Secondly, bots regularly needed human assistance to understand commands. This report highlights the industries where the real “chatbot revolution” is taking place — and shows the most important lessons for companies hoping to leverage the technology (see below overview for more information). Read more

New perspectives on ESG matters…

ESG Legal Outlook 2021 (Linklaters)

After an eventful 2020, it is expected by fintech and regulatory experts that the pace on all matters environmental, social and governance (ESG) will only continue to accelerate in 2021. For financial institutions and corporations the challenge is integrating the new changes, such as the new US administration and Congress, COP26, growing investor pressure on corporates to address ESG issues, and new disclosure requirements taking effect across the UK and Europe all point to 2021, into business as usual. This study provides an overview of some of these key global ESG legal themes for 2021 and the trends we see in different countries around the world. Read more

Mapping down the fintech Singapore landscape…

Singapore Fintech Report 2021: Blockchain Dominates Singapore’s Fintech Scene (Fintech Singapore)

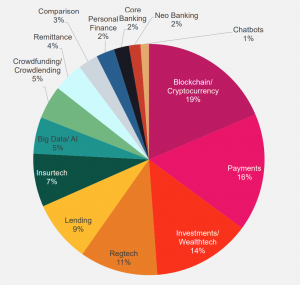

The Singapore Fintech Report 2021 looks at the state of the fintech industry in Singapore, highlighting the key developments made in 2020 that are set to shape the industry for the year to come. Fintech investment in Singapore reached US$346 million in 2020, representing 6.2% of all that was raised in Asia. The sector continued to mature and consolidate with several acquisition deals taking place last year including the purchase of robo-advisory fintech Bento by Grab, and the merger of insurtech player Singlife with Aviva Singapore (see below an overview of fintech segments). Read more

Unlocking the full potential of 5G technology…

5G Outlook Series: Enabling Inclusive Long-term Opportunities (World Economic Forum & PwC)

This report concludes the 5G Outlook Series of publications in 2020 that have been analysing the role of 5G in the short, medium and long term in the context of the pandemic and the economic crisis. Five key takeaways have emerged from interviews and workshops: 5G infrastructure will be foundational to both inclusive economic growth and competitiveness, 5G has the potential to democratize computing, helping to close digital divides, public-private partnerships are essential to success, countries urgently require a clear strategy for cross-industry investment and policy, and 5G is a general-purpose technology enabler, unlocking the potential of cloud, artificial intelligence (AI) and edge computing. Read more

Diving into a digital economy…

Why the potential end of cash is about more than money (EY)

With banks rejoicing at the prospect of a cashless society, the rise of a digital economy imposes questions around identity and inclusion. Cashless transactions are becoming the new standard for the payments industry. Advancing technologies, particularly the smartphone, have driven the fast growth of the digital economy and enabled an explosion of non-traditional financial solutions. However, the pace and nature of the transition differs across the world, with EU account-to-account payment services proliferating, Canada, Australia and Singapore being among the nations that are licensing non-banks to initiate digital and mobile payments. Read more

On Open Insurance…

Findings from the INNOPAY Open Insurance Monitor: front-running insurers and banks are making inroads (INNOPAY)

With insurers encouraged by the fact that digital ecosystems contribute to value creation in other industries, many businesses are on the lookout for capitalizing on these insights in their own sector, such as several front-running insurers and also banks. The INNOPAY Open Insurance Monitor, which keeps track of the development of the global Open Insurance landscape, measures and benchmarks the functional scope of APIs and the developer experience offered in the insurance landscape. Read more

Covid-19 implications for 2021…

The Global Risks Report 2021 (World Economic Forum & Marsh)

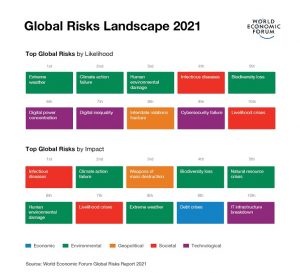

This report presents the effect of Covid-19, with various geopolitical and societal consequences. The findings highlight the disruptive implications of major risks, including the Covid-19 pandemic, that may reshape our world in 2021 and over the next decade. The study draws on the survey results from nearly 700 experts and decision-makers globally who were asked about their concerns for the next decade, how global risks interact, and where opportunities exist to collectively act to mitigate these threats (see a complete overview below). Read more

—

Do you have any news to share: please put feed@https://hollandfintech.com/ on your press list.

Curious to read and find out more from fintech? Then subscribe & read our full newsletters here: https://hollandfintech.com/featured/newsletters/. In order to see our other weekly highlights, check out the following links: analysis & opinion, funding, news.