Explore the latest data on crypto assets, central banks, loan provision, AML, public fintech sector, cash canon of G20 countries and more with today’s research selection! Dive into the selection and discover new insights and statistical analyses. Enjoy the reading!

Supervising crypto assets for anti-money laundering (BIS)

This paper assesses AML/CFT supervisory practices relating to CPS and pays particular attention to emerging practices and common challenges faced by financial institutions in light of the recent supervisory frameworks for crypto assets. While significant progress has been made by SSBs and financial authorities, it is still essential to implementing the FATF standards wherever that has not taken place yet. Read more

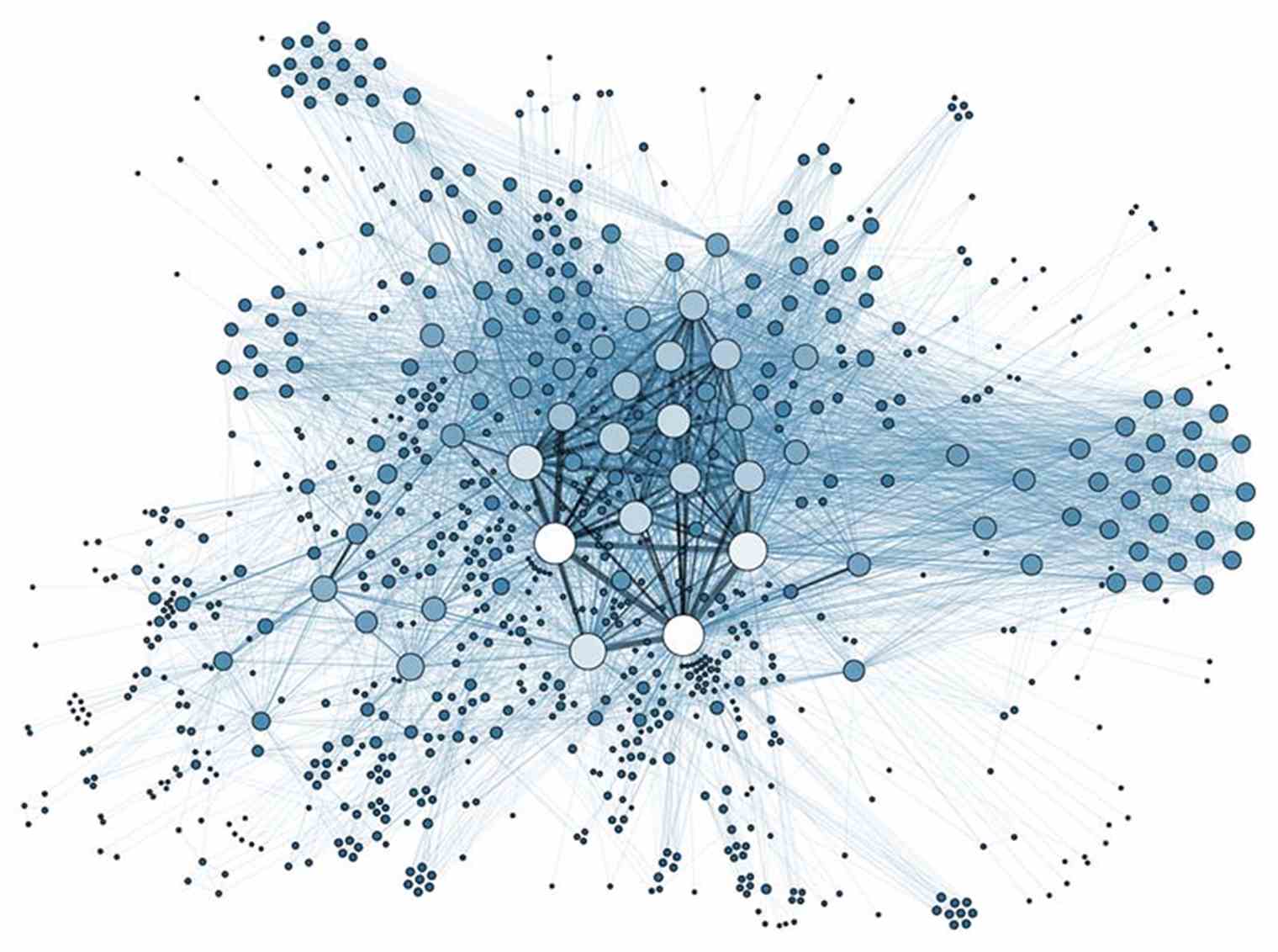

How do central banks use big data and machine learning? (Suerf.org)

This policy brief examines how data are defined and used by central banks and what opportunities and challenges are for them. Results show that a large and increasing number of central banks support their economic analyses with nowcasting models using big data. Around 60% of central banks report the use of big data for suptech and regtech applications, most of which are yet exploratory, but could become more widespread. The use of big data poses challenges such as the high fixed costs by setting up the necessary IT infrastructure, providing adequate computing power and finding the right software tools. Read more

CEO monthly market update & analysis (FT Partners)

This report provides an overview of the universe public fintech sector regarding price/earnings multiples and common stock comparison. Furthermore, it touches upon insights about monthly fintech deal activities, detailed profiles and transaction list of M&A and financing transactions and key upcoming fintech conferences. Read more

NFTs: Is the spotlight-stealing blockchain tech A cash grab or the next big thing? (CBInsights)

The findings reveal that by the end of March 2021, more than $500M in USD had been exchanged over sales of NFTs (Non-fungible tokens). NFTs are attracting more attention with the price of ether skyrocketing by more than 1,000% year-over-year, while the price of bitcoin surged more than 600% over the same period to break $50K — meaning major returns for early crypto buyers. In turn, the purchasers of the most expensive NFTs are already deeply embedded in the crypto space. Read more

The General Counsel Imperative: How do you turn barriers into building blocks? (Ey.com)

The General Counsel continues the journey to optimize parts of the law department in 2021. Results show that enabling growth and the business more broadly will be hugely important in the next 18 to 24 months as the global economy rebounds. Furthermore, helping transform risk management so that companies can adjust to new realities and protect from future difficulties will also be crucial. However, expanding these initiatives and maximizing their effectiveness will be the primary challenge for law department leaders in 2021 and beyond. Read more

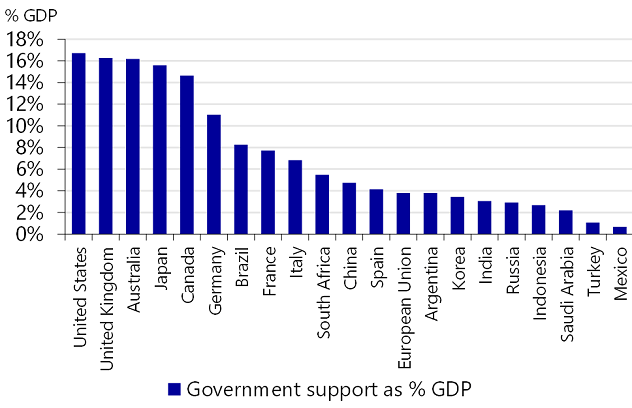

Comparing G20’s cash canon in 2020 (Rabobank.com)

This report shows that governments of G20 countries have spent almost $8 trillion to support their economies during the pandemic. Of all G20 countries, the US tops the list of “big spenders” with additional expenditures of around $3.5 trillion, which is 45% of additional expenditures among G20 countries. Read more

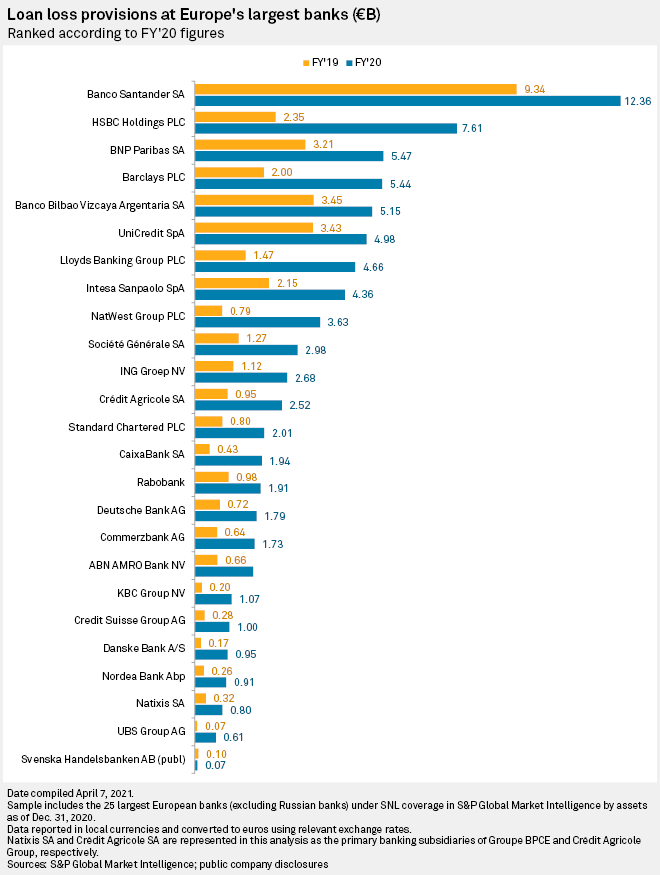

European banks’ loan loss provisions set to decline in 2021 after 2020 peak (S&P Global)

This paper observes 25 largest European banks (excluding Russian banks) by assets as of December, 2020 and shows that in 2020, 24 of Europe’s 25 largest banks booked a year-over-year increase in loan loss provisions, with many doubling or even tripling their reserves as they braced for the impact of COVID-19. Moreover, after assessing the performance of the top 50 banks in Europe, the authors predicted that the banks’ credit loss provisions will fall to around $123 billion in 2021, after their peak of about $135 billion in 2020. In 2022, provisions should fall to approximately $88 billion, but still remain far above the actual credit losses of $54 billion booked in 2019. Read more

—

Do you have any news to share: please put feed@https://hollandfintech.com/ on your press list.

Curious to read and find out more from fintech? Then subscribe & read our full newsletters here: https://hollandfintech.com/featured/newsletters/. In order to see our other weekly highlights, check out the following links: analysis & opinion.