Philippines’ first virtual bank TONIK publicly launched during a live Facebook event hosted by CEO and Founder, Greg Krasnov. Among attendees’ key executives from TONIK Bank were joined by Chuchi Fonacier, Deputy Governor of Central Bank of the Philippines in addition to social influencer Ashley Rivera and Filipino-American basketball champion, Gabe Norwood. Radar Payments by BPC was proud to witness the launch as the bank is using its payment processing to become the Philippines’ first PCI Compliant institution and empower Filipinos with new physical and virtual card payment services. During the virtual launch, many exciting announcements were revealed about TONIK’s capabilities as a neobank.

“Dream Big. Save Bigger”

Greg Krasnov introduced the “Dream Big. Save Bigger” campaign at pandemic times where the key concern for Filipinos lies in the safety of their family members and community. The Philippines are known to save among their community through ‘the Paluwagan’ model, a common pot that can be used by family members or friends when necessary. Inspired by this practice, TONIK Bank is digitising the experience and on top offering savings so that Filipinos can save and grow their money at the same time. The bank made a groundbreaking announcement with deposit interest rate of up to 6 percent and savings account interest rate of up 4.5 percent through the Stash account. This is probably to key disruptor in the Philippines’ banking market as traditional banks offer savings rates below the 1percent on top of which many services are paid, from dormant accounts to making a transfer, demonstrating that, in fact, Filipinos lose money with banks instead of earning. For this reason, TONIK Bank aims to help Filipinos get smarter with their money, without any hidden fees and get more money, not less!

Financial Inclusion

TONIK first realised the need of a digital bank when CEO and Founder, Greg Krasnov apprehended that over 70 percent Filipinos remain unbanked in the nation. After the initiation of Covid-19, the rise in digital wallets and cashless transactions are more important than ever. A digital bank will not only provide financial inclusion, but will also make the entire process easy and less tedious. Welcoming TONIK within the banking space, Chuchi Fonacier, Deputy Governor of Central Bank of the Philippines also appeared at the virtual event. She spoke about how Covid-19 had a positive impact in the way people conducted financial transactions, keeping in mind the need to make payments safely and securely. Financial inclusion agenda is an important consideration in launching new digital banking offering services to unbanked, underbanked and the newer generation like the millennials and Gen Z. The government is confident that TONIK will achieve conversion and advance financial inclusion through the digital ecosystem with the twin objective of converting 15 percent of transactions volume into digital ones and onboard 70 percent of Filipinos adults by year 2023 as part of 3 years’ digital transformation roadmap.

High Security

Knowing your money is secure is another key concern for Filipinos. TONIK wanted to ensure it uses the best security standards. As a result this is the first bank certified PCI DSS compliant. This certification was possible through the efforts of TONIK together with the team at Radar Payments by BPC.

A Bank in the Cloud

Long Pineda, Country President of TONIK mentioned the importance of neobanks and how they are designed from scratch to provide digital experience. A complete banking experience can be provided through the app, creating a different way of thinking about products and experience on savings. Digital banks like TONIK are providing an environment where financial literacy and communication is more comfortable. With the strong partnership between TONIK and Radar Payments, the banking sector in the Philippines will create a digital disruption.

Easy onboarding and Easy to use

Onboarding as a user is a process done in less than 5 minutes, making KYC process quick and secure.

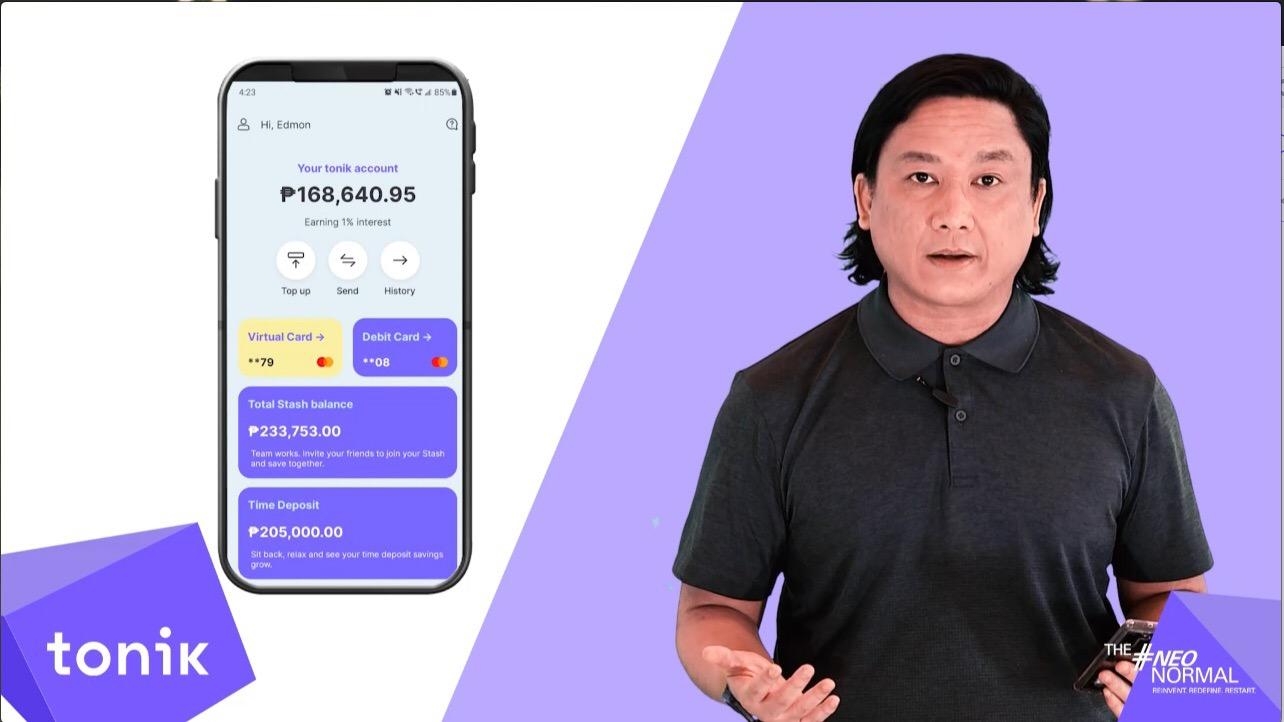

Moving on to the mobile app demo, some interesting features were as follows:

- A user was able to log into the mobile app by integrating it with biometric/finger print recognition

- Register and get virtual cards used online, without the need of a physical one

- It allows a user to better control how they use their card and lock it with a maximum desired amount

- Top up using debit card by using online account from other banks or go to the nearest 7-Eleven stores

- Cash out through GCash and use networks like Cebuana Lhuillier and Instapay networks

- Personalisation at its best; allowing you to upload pictures of family, friends, etc.

- A customised stash to be able to save as a group of users earning up to 4.5 percent interest rate per annum

- Sending P2P transfers will be just a tap away

- At any point of the day, an agent will be available via chat for any customer support

TONIK will be able to add a strong asset to Philippines’ ecosystem, delivering the banking and payments experience the way customers want; fast, affordable, efficient and highly secure while keeping TONIK’s fundamental goal in mind – Dream Big, Save Bigger! The bank wants to move away from formal communications, gold bars and brick and mortar branches to open up new ways of communicating with customers, removing barriers and as per their words starting their ‘financial romance’ with Filipinos. Radar Payments by BPC is proud to be part of this journey in building the first virtual bank of the Philippines and wishes TONIK all the success it deserves.

About TONIK

TONIK is the first digital-only neobank in the Philippines, providing deposit, payment, and card products to consumers on a highly secure digital banking platform. The neobank operates on the basis of its own bank license issued by the Bangko Sentral ng Pilipinas. TONIK is led by a team of retail finance veterans who have previously built and scaled multiple retail banks and fintechs across the global emerging markets. It is backed by top international venture capital funds, including Sequoia India and Point72. TONIK operates out of hubs in Singapore (HQ), Manila, Chennai, and Kyiv