For this week’s research article, we dive into new insights on fintech market, banking, insurance, payments, trends, diversity in fintech and more. Happy reading!

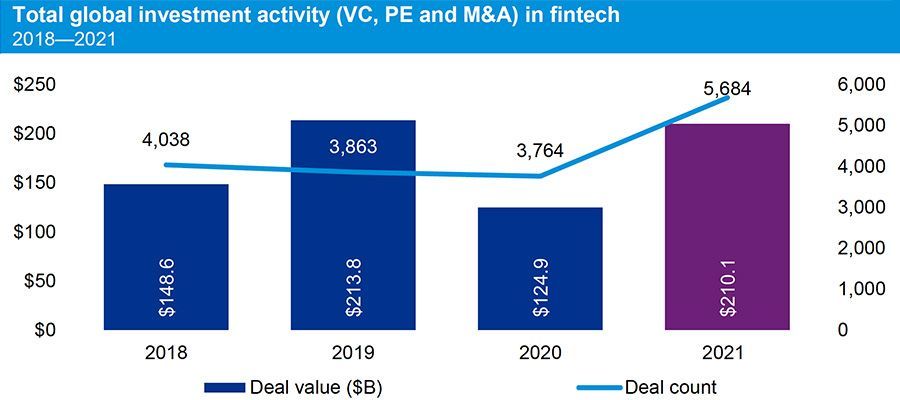

Investments in fintech start-ups and scale-ups return to $200+ billion (Consultancy)

Investments in fintechs have risen sharply over the past year despite the ongoing corona pandemic. In 2021 investors pumped more than $200 billion into start-ups en scale-ups active in the world of financial technology, according to research by KPMG. During the twelve months of 2021 more than 5,600 deals closed successfully – transactions of all shapes and sizes, from small investments in start-ups (seed investments) and investments in growing start-ups (series A or B investments) to investments in established players (series C or D investments) and complete acquisitions. In total, $210 billion was raised by fintechs worldwide, almost $90 billion more than the year previous but slightly less than the amount invested in 2019: $214 billion. Read more.

India fintech investments lead in APAC (TechwireAsia)

According to a new report, the country led in the fintech investments in the Asia-Pacific region, with US$5.94 billion raised across 236 deals last year. In addition, India also attracted the most funding in 2020, with US$1.50 billion raised across 118 deals. The Indian payments industry also witnessed the highest funding accounting for 45% of total funds raised. The country’s fintechs are expected to hit a valuation of US$150 to 160 billion by 2025. Read more.

Fintech Market to Reach $324 billion in 2026 (Global Trademag)

U+ released “The State of Fintech 2022,” a report that analyzes disruptive fintech trends and industry projections including banking, payments and insurance. The report outlines how and why investors have poured $91.5 billion into fintech firms in 2021, nearly doubling the previous year’s figure. As a result, analysts predict the fintech market to reach $324 billion by 2026. “The growth and investment in fintech points to closer collaboration between startups and incumbents, as well as regulators, investors and even consumers, as the industry searches for cost reductions, client-friendly experiences and technology upgrades,” said U+ Founder and Chief Executive Officer Jan Beránek. “Since technology use has redefined the financial services industry, incumbents and challengers are competing to acquire and analyze customer data. In an attempt to secure brand loyalty, developing client-friendly experiences is a key focus.” Read more.

India emerges as 3rd largest FinTech ecosystem globally, claims BLinC Invest report (Express Computer)

In its latest report on India’s FinTech sector, BLinC Invest highlighted the country emerging as the 3rd largest FinTech ecosystem globally. The report states that, as of end-Sept 2021, the Indian FinTech sector has received over $23.7 bn of funding, giving rise to 10 Unicorns like Razorpay, CRED, Pinelabs, Policybazar; 170 minicorns, and 52 soonicorns. India’s FinTech market is estimated to be $31 bn in 2021, covering all subsegments like Digital Payments, Digital Lending, Insurance, Investment Tech, Neo Banking, and Banking Infrastructure. Between 2016 and 2021, total funding to the FinTech sector in India increased at a CAGR of 14.81%. The report also states that, during the same period, over 25% of all start-up funding in India was directed towards FinTechs. Read more.

India’s fintech landscape: Paving the way for financial wellbeing (The Times of India)

The BFSI sector in India has always been bold and willing to adapt to change, specifically with respect to the rapid digital transformation witnessed across sectors. The shift from offline to online in everything imaginable has changed the lives of everyone across the spectrum and the Fintech ecosystem in India, with its sophisticated technology has come a long way in bringing the unbanked population under the formal banking system. This is further aided by industry players and regulators who are making great strides in fostering financial inclusion in the country. Read more.

—

Do you have any news to share: please put feed@hollandfintech.com on your press list.

Curious to read and find out more from fintech? Then subscribe & read our full newsletters here.

In order to see our other weekly highlights, check out the following links: analysis & opinion.