For this week’s research article, we dive into new insights on fintech overview, digital payments and crypto. Enjoy researching!

Cold hard (digital) cash: The economics of central bank digital currency (CEPR)

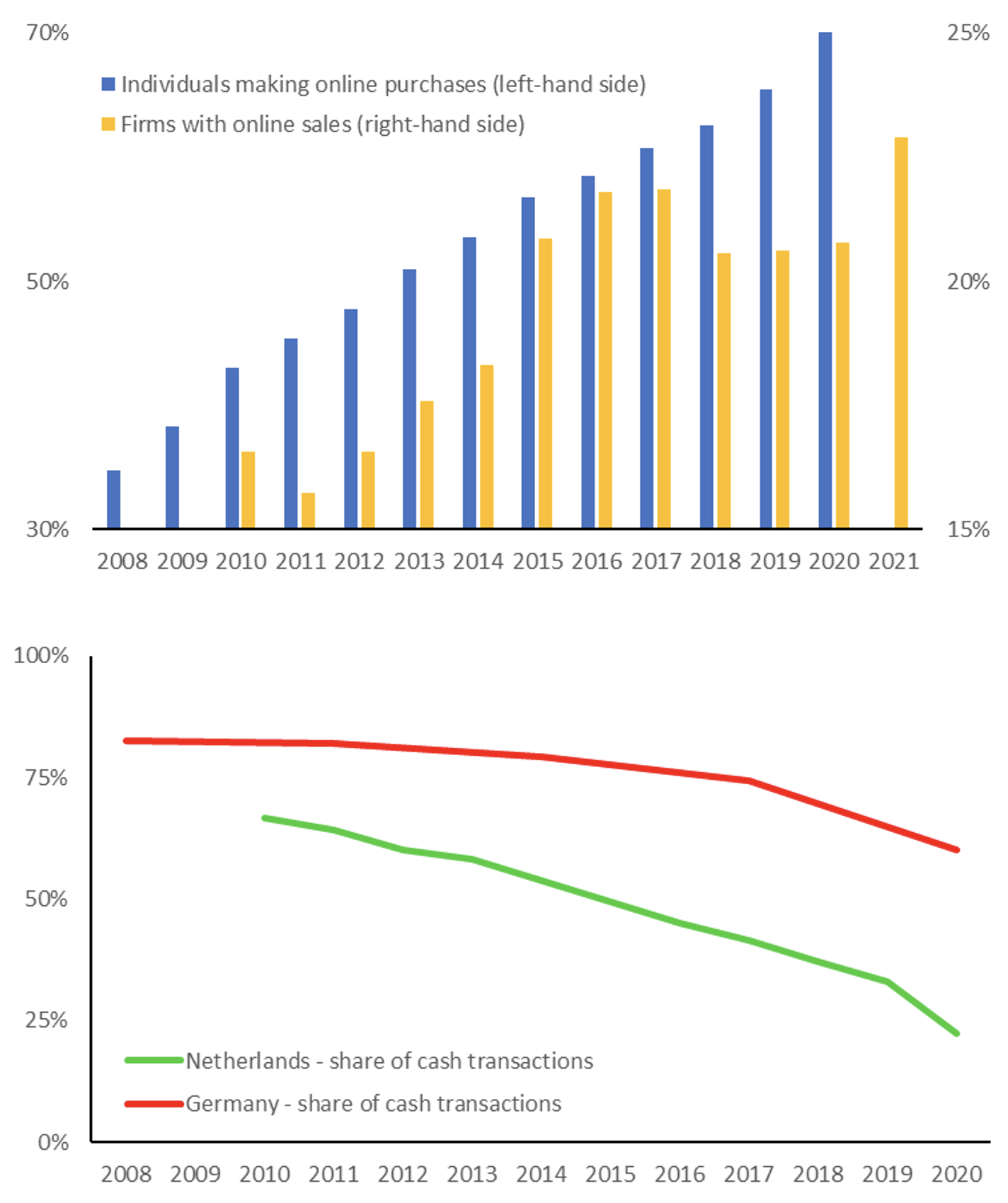

Central banks around the world are exploring the case for central bank digital currency (CBDC) – essentially a digital version of cash (Nielpelt 2021). In a new paper (Ahnert et al. 2022a), we provide an overview of the economics of CBDC. The rise of digital platforms as a dominant business model of the information age is challenging the central role of banks in the payment system. Large technology firms and financial startups are bundling payments with digital services, such as online marketplaces, messaging apps and financial services (for example lending and insurance). While banks continue to provide the underlying payment rails for these solutions, they are losing access to the customer interface. Further disruption is potentially looming on the horizon, caused by rapidly developing and complex payment innovations. This includes distributed ledger technology, which provides the basis for ‘stablecoins’ (crypto-assets designed to maintain a stable value) that could be used as means of payment. Read more

Kaspersky Research Indicates Alarming Rise in Malicious Cryptomining Programmes (The Fintech Times)

According to the latest Kaspersky research, 2022 has experienced a sharp increase in the number of new modifications to malicious mining programmes. So far this year, 215,843 new miners have appeared and have taken over computers. Remaining hidden for months, cybercriminals use the processing power of the victim’s computer to mine cryptocurrency, with an income reaching up to $40,500 (2 BTC) per month. The research indicates that Q3 ’22 saw a sharp increase in crypto miner variants; a 230 per cent increase from Q3 ’21’s 46,097 figure. The research recognises crypto mining as a profitable venture; especially if used maliciously. Cybercriminals don’t pay for equipment or for electricity, both being rather costly in 2022. Read more

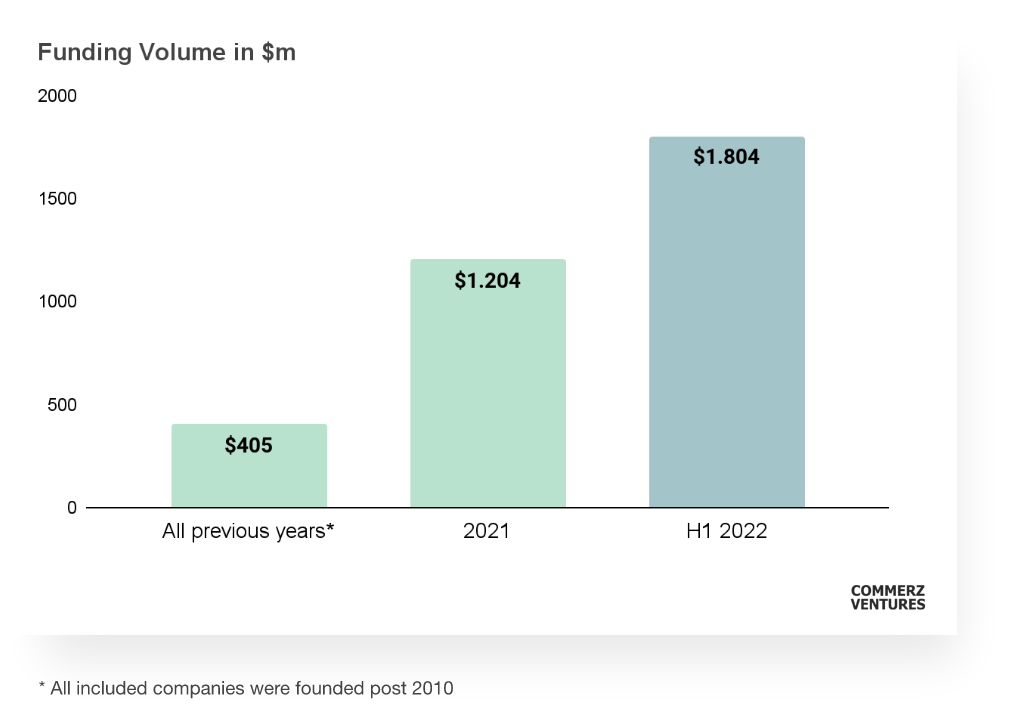

Climate Fintech Funding Soars, Totaling US$1.8B in H1 2022 (Fintechnews Switzerland)

CommerzVentures, the corporate venture capital (CVC) arm of Commerzbank in Germany, has released its latest report on climate fintech, sharing findings of an analysis of 528 climate fintech startups across Europe and the US with scalable business models to provide an overview of the sector’s growth across geographies, sub-sectors and funding stages. The Climate Fintech H1 2022 Update, released in October, points out to a fast-evolving climate fintech ecosystem that’s marked with increasing maturity, soaring VC funding activity, and the rise of new, exciting sub-sectors like natural capital accounting and decentralized finance/climate (DeFi x climate). H1 2022 was a record-breaking period for climate fintech funding, data from the report show, with total funding raised amounting to US$1.8 billion. The sum represents already 1.5 times what was secured by climate fintech companies during the whole year 2021, the report notes, and underscores the “extraordinary momentum of the space”, especially considering this year’s downturn in fintech funding. Read more

89% of Retailers Plan to Expand Sustainable Shopping Offerings: Barclaycard Payments (The Fintech Times)

Barclaycard Payments has revealed new research, showing that retailers are introducing more sustainable ways to buy and sell products and services. Such moves appear to come following pressure from consumers to be more environmentally conscious. Retailers also try to differentiate themselves from competitors as consumers look to reduce their spending as the cost of living continues to rise. Barclaycard commissioned a survey, conducted by Opinium, of 400 retailers between 6 and 11 October 2022. Those surveyed comprised senior decision-makers across SME and corporate retailers across the UK. The research appears to show that retailers are following consumers in taking the climate into account. Around seven in 10 (71 per cent) of the businesses surveyed now offer recycling, renting, reusing or reselling shopping options. It was also found that over a third (36 per cent) have introduced more sustainable ways to shop in the last 12 months. The results suggest that ‘green’ options have become much more of a priority for businesses in the last year. Read more

–

Do you have any news to share: please put [email protected] on your press list.

Curious to read and find out more from fintech? Then subscribe & read our full newsletters here. In order to see our other weekly highlights, check out the following links: analysis & opinion