The fintech industry is rapidly evolving and disrupting traditional financial systems. In this article, we bring you the latest research insights to help you stay ahead of the curve and understand the future of financial technology. Enjoy researching!

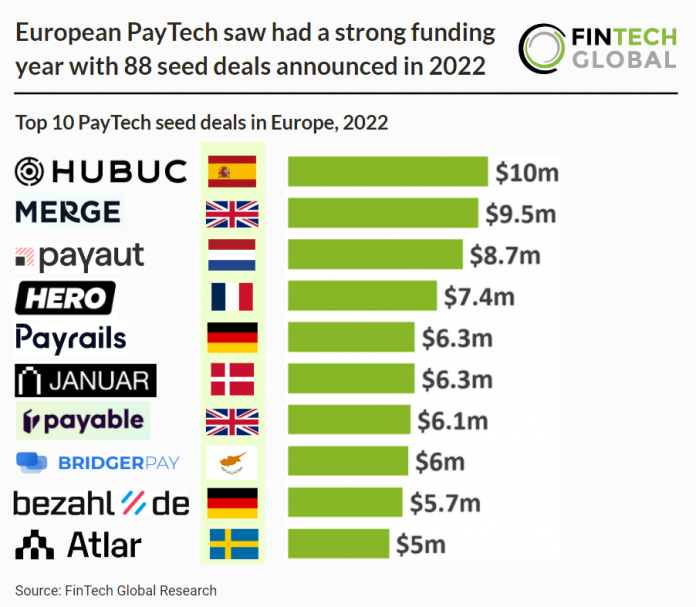

European PayTech saw had a strong funding year with 88 seed deals announced in 2022 (Global Fintech)

The PayTech sector was the third most active European FinTech subsector for seed deals in 2022. Only behind WealthTech and Blockchain & Crypto. European PayTech companies raised 88 seed deals in total during 2022, a 14.8% share of total European seed deals. The UK was the most active PayTech seed country in Europe with 27 deals, a 30% share of total European PayTech seed deals. France was the second most active with eight deals, a 9% share and Germany was third with eight deals. Read more

Cryptocurrency payment gateways – the interface to the fiat world (The Paypers)

The holy grail of financial transactions is removing as many intermediaries as possible and offering faster, cheaper, frictionless payments. Cryptocurrencies aim to solve these issues via cryptocurrency payment gateways. Nevertheless, we are still not there yet. Several factors have hindered crypto adoption for retail payments. Crypto payment gateways enable businesses to accept cryptocurrencies as a form of payment, in contrast to traditional ‘fiat’ currencies such as the USD, EUR, and others. These gateways can be ‘crypto to fiat’ and ‘crypto to crypto’. Cryptocurrency payment gateways are not mandatory or necessary to carry out digital currency transactions. Users can also utilise their wallets to accept cryptocurrency payments. Still, gateways offload merchants of the extra work of exchanging cryptocurrency in real-time and managing a wallet. Read more

Tink Finds 44% of Customers Would Swap Banks if it Would Help Save Amid Cost-of-Living Crisis (The Fintech Times)

As the cost of living crisis rages, new research from European open banking platform, Tink, paints a stark picture of financial realities in the UK. Findings from Tink reveal almost half (46 per cent) of people in the UK are ‘only just managing’, where they expect their income not to cover their essential spending in the future amid the cost-of-living crisis. A further one in four (23 per cent) are identified as ‘financially vulnerable’, with their current income already no longer covering their essential spending. This represents a total of 37 million Brits who are currently either experiencing or expecting to face financial distress, It highlights the critical role of banks to support people with their finances during these unprecedented times. The research set out to understand how those who are ‘only just managing’ are currently coping with the rising cost of living. It explores what many fear is around the corner as rising costs and the shrinking UK economy mean that their income will soon no longer cover their essential spending. The cost of living crisis already has many people resorting to extreme measures. A quarter (25 per cent) of those defined as ‘only just managing’ have sold possessions to make cash and 27 per cent have used their savings to cover living expenses. Read more

Understanding How the Pandemic Permanently Accelerated Fintech (Payments Journal)

Fintechs are flourishing in a post-pandemic world. Equity funding for fintech companies doubled last year, bringing the industry’s global market value to about $5 trillion. Meanwhile, data from Statista found that roughly 65% of the U.S. population uses digital banking services, up from around 61% in 2018. That means more than 16 million Americans have adopted digital banking services over the past five years. Mass mobile banking adoption suggests the financial future will be digital-first. Fintechs excel in this environment because digital applications developed on, by and for mobile devices usually provide a better user experience. Still, financial leaders must unpack how this trend will affect their bottom line. Understanding post-pandemic consumer behavior is the first step toward generating more meaningful, modern and holistic user experiences for fintechs, Big Tech, and traditional financial institutions (FIs). Read more

IBM’s 2023 Banking and Financial Market Report is Bullish on Cloud and AI (Fintech news Switzerland)

Stress to the world economy in 2022, arising from factors including geopolitical conflicts, supply chain disruptions and rising inflation, will impact the financial services landscape in 2023, forcing industry players to embrace digital business models and architectures, a new report by IBM says. The 2023 Global Outlook for Banking and Financial Markets report, released by the technology corporation last month, lays out the headwinds financial institutions should expect in 2023 and discusses how these organizations can improve financial performance amidst these challenging economic conditions. According to the report, increased macroeconomic tensions, spiking inflation and rising geopolitical risks are introducing economic headwinds which financial institutions will need to face in 2023. Read more

–

Do you have any news to share: please put feed@hollandfintech.com on your press list.

Curious to read and find out more from fintech? Then subscribe & read our full newsletters here. In order to see our other weekly highlights, check out the following links: analysis & opinion