The New Network Overview

The fintech industry is expansive and seemingly diffuse, with each sector driven by constant innovation. Holland FinTech attempts to identify those relational elements once again in its upcoming Ecosystem Overview. The official release will take place during the Annual Member Summit on 30 January, 2020.

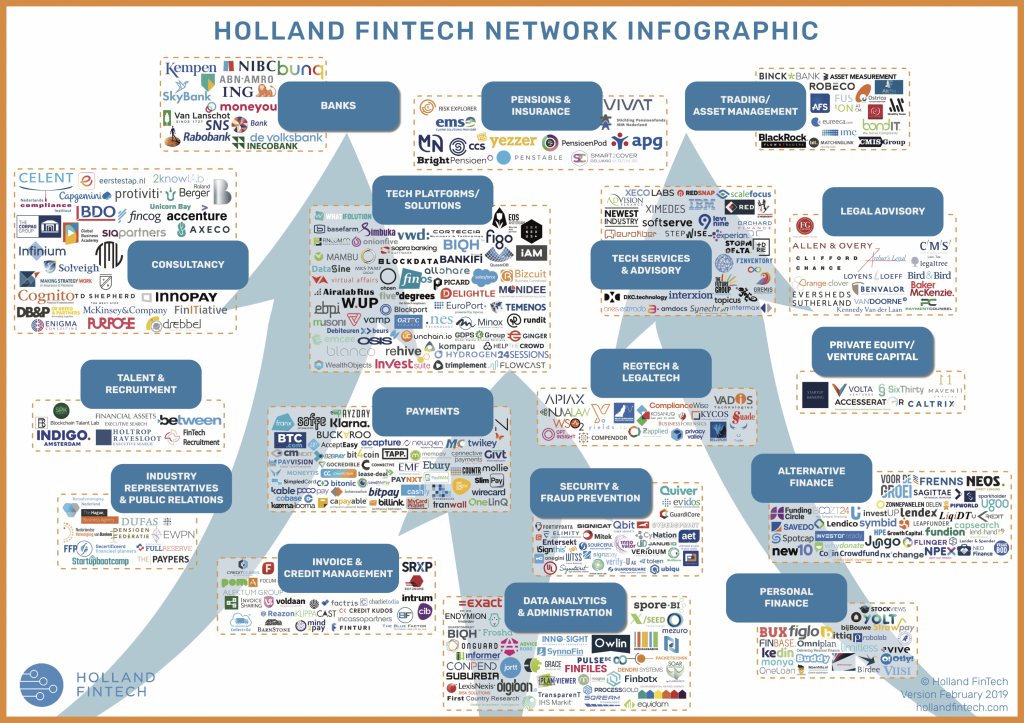

As building an inclusive fintech ecosystem is part of Holland FinTech’s mission, we went back to the drawing board to create a new ecosystem overview, rethinking how to demonstrate how innovation functions in the industry. Innovation leads to better and more personalised and accessible services and products for consumers and businesses alike, but what supports this innovation is cooperation to build better financial products and services together, with all the actors in the ecosystem.

The ecosystem overview shows how the different sectors within Holland FinTech’s 600-plus company-strong ecosystem relate to one another. It shows where banks, pensions, insurance companies, tech platforms, legal services, payments, data analysis companies, and more are positioned in the financial services value chain. This is an obvious attempt to simplify a complex reality, but it makes the dynamics in the value chain more tangible for outsiders.

Are you still in doubt why you should be included? Join our upcoming Fintech Insights to learn about what Holland FinTech can do for you!

Be included!

Ecosystem Sectors explained

The new Holland Fintech’s Ecosystem Overview will be divided to present major categories that play a crucial role in the financial services industry, depicting how innovation functions and drives forward each sector. You can find a brief explanation of different categories and their customers within the financial services below.

Alternative Finance

New financing methods beyond crowdfunding are a great addition for SME borrowers and consumers and make an appealing investment in the current low-interest rate environment.

Customers: Mainly SME companies.

Banks

Universal banks come in all shapes and sizes, and are generally most under pressure by regulation and fragmented competition, driving them to take the lead in innovation.

Customers: Retail clients and corporate clients.

Consultancy

Advisory services play an important role in spreading insights on innovation and supporting organization with their internal challenges as well as facilitating connections.

Customers: Mainly larger organisations.

Data Analytics & Administration

As the threshold of designing digital services declines, a broad range of solutions arise to facilitate streamlined or automated administration and analytics, saving tons of manual labour.

Customers: Mainly financial services providers of all sizes.

Industry Representatives & Public relations

The complex nature of the industry and its changes requires solid communication from and between key stakeholders like policy makers, regulators and customers.

Customers: Mainly financial services providers.

Legal Advisory

Law firms and legal services play an important role in helping regulated entities deal with new regulations, as well as the transition from paper-based agreements to the digital era.

Customers: Mainly larger organizations.

Payments

Facilitating seamless payments for companies is one of the drivers for the success of online commerce. These parties enable payments of all sorts, and increasingly help with online conversion.

Customers: Mainly companies selling online or in stores.

Invoice & Credit Management

Between transaction and payment exists a whole world of administration, risk assessment, fraud prevention and lending, enabling companies to facilitate their customers and get paid.

Customers: Mainly SME and corporate customers

Pensions & Insurance

Pensions and Insurance experience a different pressure from regulators and competition than banks, but they are exploring new ways to fulfill their role for consumers.

Customers: Mainly retail customers and employers.

Personal Finance

The increase in digital means and digital understanding with consumers, as well as enhanced connectedness of data, makes financial planning and advice more accessible than ever.

Customers: Mainly consumers.

Private Equity/Venture Capital

Investing in this growing industry makes an appealing investment and specialised investors enable necessary growth capital and a means to consolidate the market where appropriate.

Customers: Mainly institutional investors and mid-sized growth companies.

Regtech & Legaltech

Companies increasingly require technology to empower compliance through the use of data analytics and automated processes due to pressure from new regulation and legislation.

Customers: Mainly financial services companies.

Security & Fraud Prevention

Global connections have opened the way for cyber threats and fraud. Besides co-operation between stakeholders, technology solutions help keep the industry and customers safe.

Customers: Mostly financial services companies.

Tech Platforms/Solutions

Underpinning the connectedness and data infrastructure of the industry, many solutions, platforms and technology providers are laying the foundation behind the scenes.

Customers: All digital and financial organisations.

Tech Services & Advisory

Supporting the implementation of external solutions and supporting internal development and maintenance, is a legion of service providers, crucial to connect technology and financial services.

Customers: mostly larger financial services providers

Trading/Asset management

Increased complexity of administration, regulations, and demand by customers have sparked a large number of solutions for investments, asset management, and capital markets.

Customers: Mainly institutional investors or retail investors.

A Growing Ecosystem

Infographics over the years