05 Mar Mobile World Congress in Barcelona: groundbreaking innovations

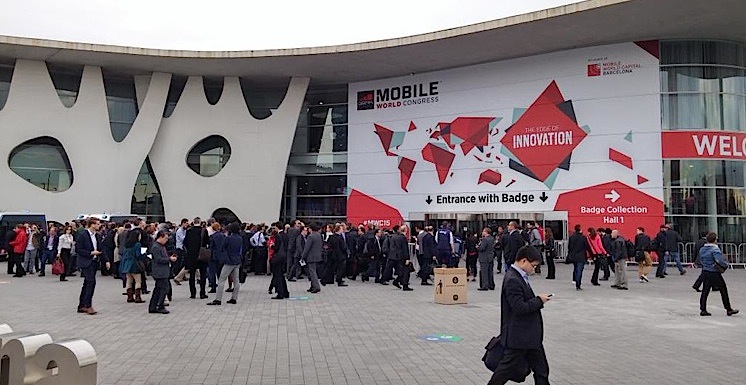

Biometrics, ultrasonic scanning, platforms that integrate mobile payments in apps and the battle between Android Pay (Google), Samsung Pay and Apple Pay for world reign. During the 7th Mobile World Congress (MWC) in Barcelona, we got a first taste of everything related to mobile innovations. Carlien Roodink of Holland FinTech was there; here’s her report.

This massive event in Barcelona provides all the spotlights for mobile companies to introduce their new flagship products. For example, Samsung took the stage to reveal their much anticipated Galaxy S6 and Galaxy S6 Edge. Other companies followed suit with their products. New designs, improved camera’s, higher resolution displays; visitors were bombarded with new features and better specs that should elevate user experience to a whole new level.

Biometrics

Many people were not only focused on the newest smartphones, but also on the latest trends like biometrics or mobile payments. Biometrics is the technology making the analysis and measurement of certain human distinctions possible, such as DNA, fingerprints, voice and iris recognition. This technology can be applied to mobile payments. Apple Pay introduced Touch ID, and many people are already using this fingerprint feature. ZTE, a large Chinese telecom company, debuted with the introduction of the world’s first smartphone equipped with iris recognition, a feature they call Eyeprint ID. It sounds promising, but it still needs some tweaking, as trendwatcher Vincent Everts found out in a video he made (in Dutch).

Ultrasonics

Then we have Quallcom, a relatively unknown player in this industry because they do not produce smartphones. They are in fact the world’s biggest developers of chip technology that well known players need for producing smartphones. They entered the stage with their innovation called Sense ID. This technology enables a smartphone to ultrasonically scan fingerprints. The advantage is that you do not need to touch the smartphone with your finger because it uses sound waves. An ultrasonic sensor is placed directly under the display to make this technology work.

Google’s solution for mobile payments

Of course Google dispatched their representatives too to showcase their tech. Sundar Pichai, the nr2 in command at Google, told a big audience that they are working on a new framework for processing mobile payments. It’s not a new app, but a platform that enables developers to integrate mobile payments in their apps. This mobile payment ecosystem runs on Android and is additive to Google Wallet. It uses NFC only, but we can expect support for biometrical features in the near future. Android Pay is Google’s attempt to compete with Samsung Pay and Apple Pay, although Pichai did not rule out some kind of synergy with Samsung Pay.

Samsung Pay and Apple Pay

Samsung officially introduced their Samsung Pay. Officially, because many people already knew about it. They bought LoopPay not long ago, a clear sign of what was about to be announced. Samsung combines NFC technology and LoopPay’s Magnetic Secure Transmission, a technology that uses a tiny magnetic field that mimics the magnetic stripe we all know and use on a daily basis. The advantage is that when you have your smartphone near a ticket machine, for example, your smartphone is automatically detected as a potential paying device.

Apple and Samsung already cooperate with MasterCard and VISA. Apple recently added American Express as a partner, so Apple now has the three biggest credit card companies on board. But who will win the mobile payment war? Apple, Samsung or Google? Vincent Everts searches for answers in his latest video.

Blogpost by Carlien Roodink, Partner Holland FinTech