MyCardWallet is a B2B company helping businesses acquire relevant content about their own customers through their technology, which is offered in an intuitive and personal way via smartphone and digital wallet. What makes MyCardWallet interesting is that no API is required to employ its technology. We sat down with Fred Diepeveen, co-founder of MyCardWallet, to talk about what they do and why they do it.

The focus

MyCardWallet’s main focus is on the industries of insurance and finance. They currently aim to address market segments in Europe, and they are working on e-health solutions prioritising consumers’ point of view and a white label integrated mobile payment solution (pre- & after pay + loyalty with Android-based POS solutions).

Building customer intimacy

Fred explains that their wallet is a means to build customer intimacy via loyalty, payments, and personal communication.

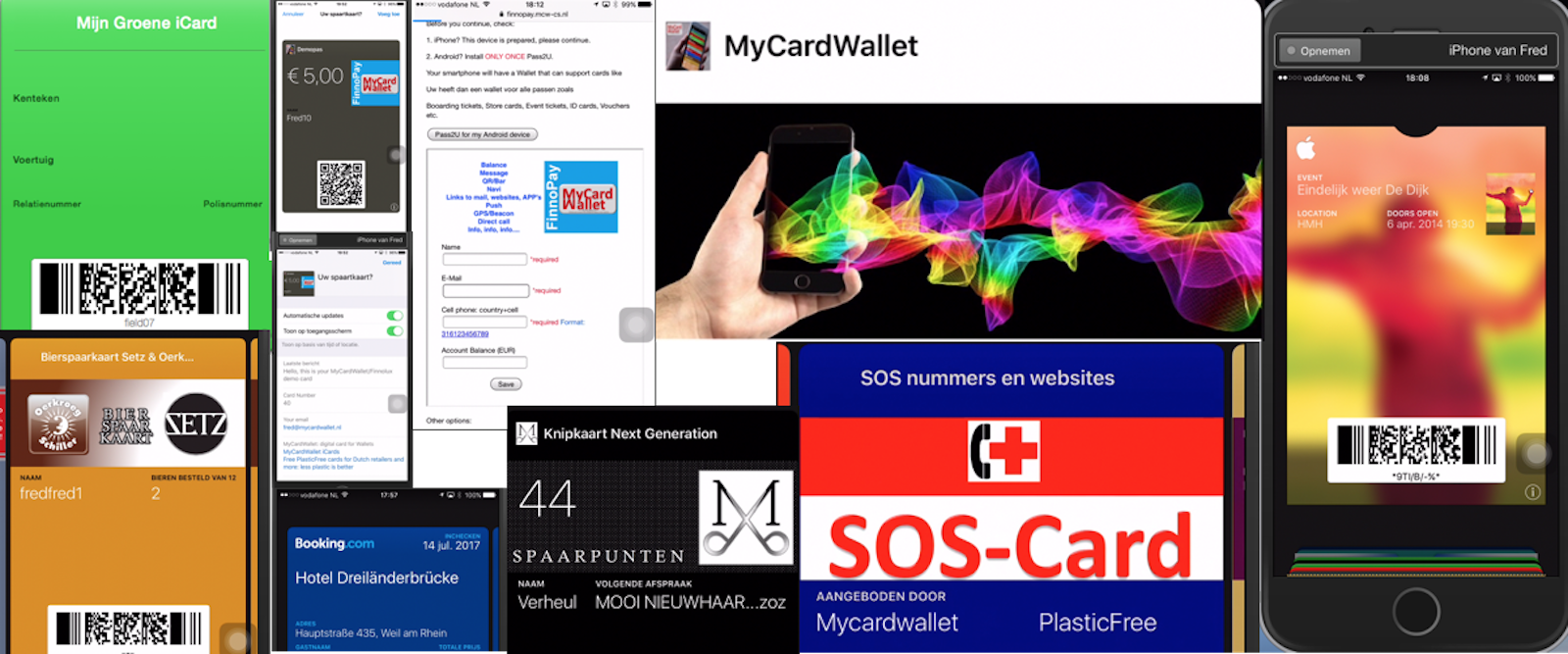

He finds it important to add that MyCardWallet is not a loyalty program, although a link can be established amongst loyalty, the clients of MyCardWallet, and the clients’ customers in terms of communication. To illustrate the process, Fred gives an example dating back to their first client, which was an insurance company. “We changed their paper document to a digital document available on smartphone,” he says. In that way, their client was able to easily reach its customers digitally 24/7. “What we do is a combination of communication and making your company visible via smart phones, and creating a basic portal for your services that your customers can use. We try to find the ways to enable those companies to use their content in such a way that changes the way of communicating”, he summarises. He goes on, “If you would like to target a specific group of people, this can also be arranged via our technology.” MyCardWallet’s current aim is to address market segments in the Europe. They are currently working on e-health solutions prioritizing consumers’ point of view and a white label integrated mobile payment solution. That is why they are interested in funding opportunities, and particularly in cooperating with banks willing to open their accounts, to interface with those accounts.

Increasing profits and cost reduction

The characteristics of MyCardWallet address Fred’s definition of what a feasible business is: personalised, specific, and timely. “By using our experience and knowledge on how business is done, we can help clients with reaching out to their customers. Companies that are using our technology and services see a real increase in their turnover”, he states. The company takes advantage of generic infrastructures to make small adjustments for each and every customer, which results in cost reduction and unburdening. The clients of MyCardWallet do not need to develop an app to employ the technology, as MyCardWallet solutions work on Apple and Android smartphones.

The Dutch fitch landscape

Fred’s thoughts on the Dutch fintech landscape vary. He finds it a pity that upon the intervention of large-size and traditional financial companies buying fintech start-ups, those start-ups do not seem to be following their initial and original ideas. He doesn’t think the future of the finance landscape is as free as it should be, as “it is a struggle to become an independent fintech start-up in the current market.” Further, he observes that large-size and traditional financial companies are making profit through asset management, hesitating to offer loans for start-ups, which is actually not helping society to get ahead, and slowing down the progresses of fintech.

By Asli Seven, Research Analyst