By Matthijs Ballintijn - JanusID

While the number of products consumers can apply for online is growing, accounts that can be opened through a 100% digital experience are still the minority. Moreover, in a physical business environment, transactions often take place between people at a distance: people that cannot meet in person or have never met in person. How can businesses be certain that the people they are dealing with are who they claim to be? Knowing this is key and a part of businesses’ KYC requirements.

Verifying that remote applicants or clients are who they say they are is one of the main challenges for businesses to reach their digital transformation goals. And with the number of data breaches rising across a multitude of industries, it’s not getting any easier. An increasing number of providers offer ID verification solutions as a service to solve this problem. The ID verification function is complex and highly specialized. It’s a logical step for businesses and institutions to outsource it to providers with the necessary knowledge, scale and security to accomplish sensitive transactions quickly, safely, and efficiently.

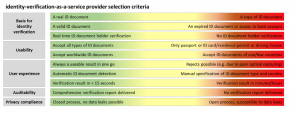

The starting point for most of these providers is a government issued ID document like a passport or an ID card. However, that is where the similarity ends. Verification of identities and providing personal data is offered at various levels of usability, user experience, auditability and privacy compliance. So how can businesses select an identity-verification-as-a-service provider? What are the aspects to be considered? The below table may be helpful in making a decision.

Outsourcing identity verification to a specialized provider allows for focus on core competencies. Carefully selecting the right provider helps businesses in their digital transformation journey. Onboarding, KYC and related processes can be further automated and sped up. Validating the ID document as well as its holder in real time provides instant certainty on whom businesses are dealing with, and therefore reduces their risk profiles. And selecting an identity verification provider that has built its processes with privacy at the core lowers GDPR compliance risks.

Sending copies of ID documents via post should be abandoned. It served its purpose in the pre-digital age. Apart from the high fraud risk, with identity theft on the rise, companies do not want to expose their clients to the data leakage that comes along with this practice. However, even in today’s digital age, people should still refrain from sending ID documents via email or social media apps, because these means are extremely unsafe.

When done right, identity verification leads to more efficiency, running a better business and a reduction of operational costs. It starts with making the right decision for a provider.