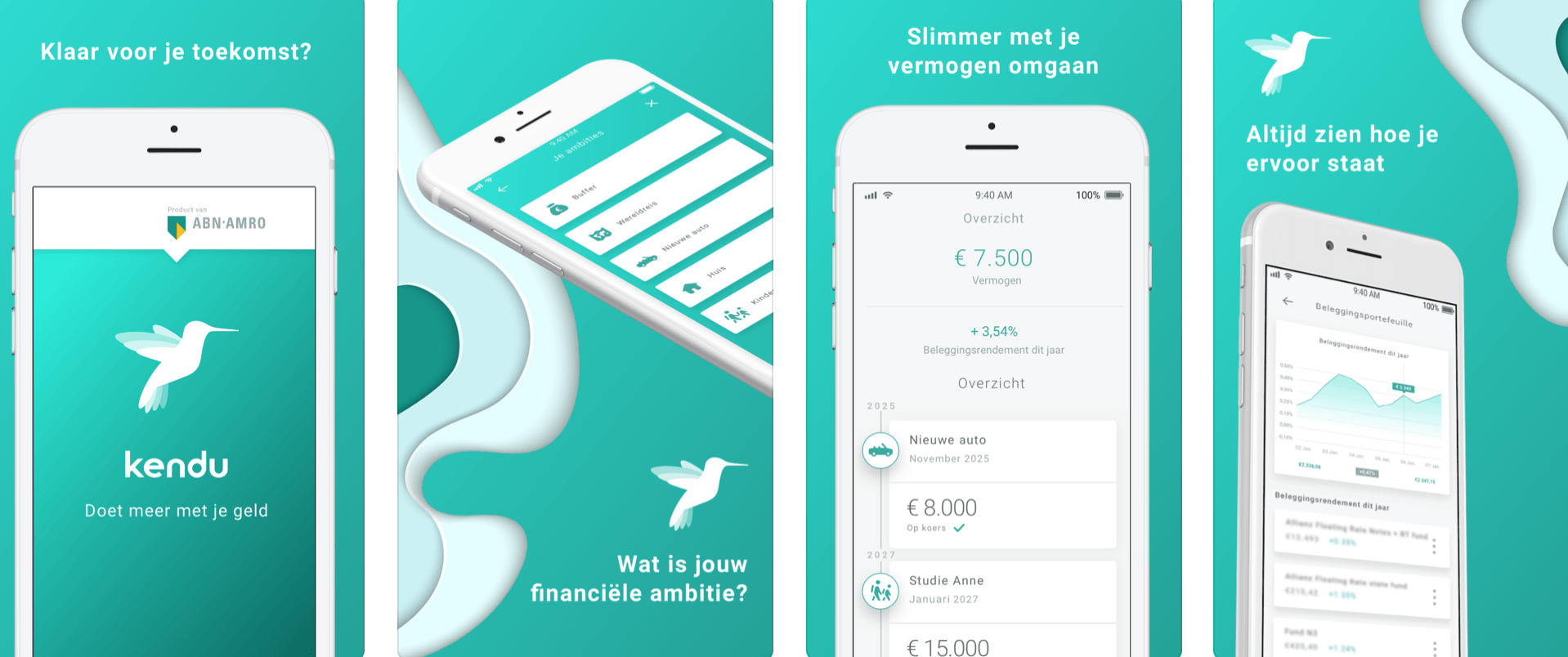

The Dutch bank took to fighting the idea that wealth management only brings value for wealthy individuals who can invest large sums of money, with their launch of Kendu last week. The app allows people to begin investing for EUR 50. Using a personal risk score, professionals invest a client-determined figure. Both ABN customers and non-customers can use the app.

The app is free and for the time being only available for iOS users. Android availability will come later in the year.

Frank Verkerk, chief digital officer at ABN AMRO, explains Kendu as the following:

“Kendu tries to give insight into what is required for you to meet your [financial] ambitions. For example, you want to be able to pay for you children’s educations in 15 years. Based on your risk score, Kendu makes an estimate on how much you will need to invest on a monthly basis to reach this financial goal. Kendu keeps track if you are on course to meet your goals and if you’re not on track, it will show you how you can get back on.”

Risk profiles are determined by the app taking prospective users through a digital intake processes, where users are asked about their preferences and wishes.