by Joan McGowan , Senior Industry Research Analyst at Celent

Robotic process automation is a crunch technology that is relatively easy and quick to implement and promises a strong ROI, but a recent string of failed RPA projects has us all resetting our expectations. Launches and pilot projects have become stuck for several reasons — all of which can be avoided. It starts with the misuse of the word “process,” in robotic process automation. Robots are purposely designed to automate tasks, not to fix end-to-end business processes. RPA, placed on top of robust and streamlined processes, will be transformational.

RPA mimics human behavior that is repetitive and doesn’t require knowledge, understanding, or insights. Codified rules instruct the computer or software to perform human tasks within a process. It does this by either recording what humans do or using codified scripts that are straightforward to construct such as tapping and swiping through an app, copying and pasting content, screen scraping, opening emails and attachments, carrying out checklists, vetting contracts, moving files and folders, or reconciling processes.

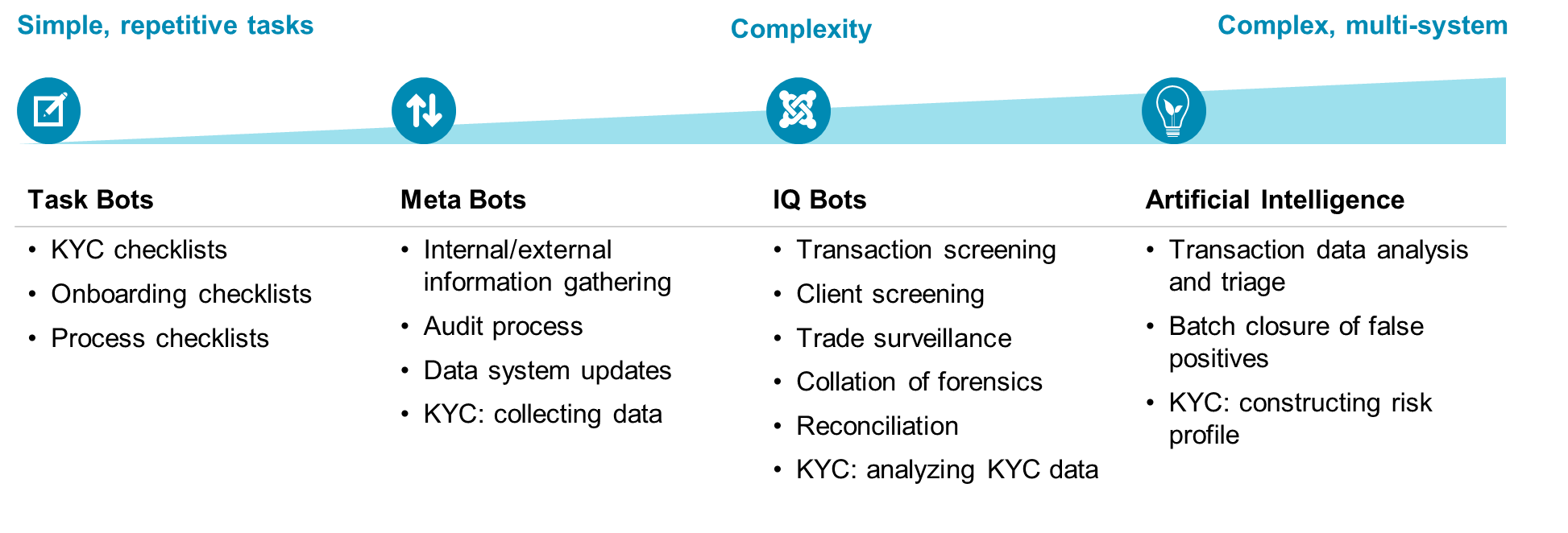

RPA layers on top of systems and directly integrates into existing infrastructure, without the need for invasive actions to underlying systems. It doesn’t touch the business logic of the system or the data access layer. Augmenting RPA with smart algorithms, machine learning, and large datasets will increase the complexity of tasks that can be undertaken. The table shows examples of high-impact RPA use cases from the world of financial crime and compliance that can be repurposed across other types of manual operational processes.

RPA Use Cases That Vary In Complexity Across Financial Crime Compliance

So, where are firms going wrong?

1. Lack of strategy: The most common pitfall is lack of strategy, governance, and planning. Firms need to set a clear vision, governance, and performance objectives when using RPA solutions to scale up their operations. Initiatives need to be business-led with a well understood end state. You must involve stakeholders from IT, business, support, compliance, and HR to ensure strategic alignment across the organization.

2. Limitations of RPA: Robots mimic human behavior in a static way; they lack a human’s ability to adapt to change. If robots are added to systems that will be changing over time, there will be an impact on the speed with which change can be delivered and the cost of that change. If the system is broken, the robot will accelerate the problem. RPA should not be used in isolation; it is a tool in a toolbox. Alone, it will not modernize a firm’s processes.

Moreover, RPA is not always the answer. It leverages human-to-machine processes, making humans faster, but perhaps not as fast or efficient as the web services system-to-system method or deploying a well thought out and controlled API.

3. Operational risks: There is a bias that says robots will never be wrong and they may get it right more frequently than humans because the time between reading and writing is much smaller. But, unlike a human, a robot does not know instinctively when something goes wrong and will not stop to ask questions. There will be bugs that go unnoticed and that can compound into operational failures. It is essential to have checks and balances with human oversight in place.

4. Enhanced cyberthreat vectors: Out-of-control robots can lead to invasive touch points, security concerns, and operational failures. RPA that is not well controlled will open the door to unauthorized, automated changes that go undetected. Robots are not designed with built-in ID authentication, and ease of access to software code poses a risk of noncompliance, data, privacy, and nefarious threats. Adding the necessary security and access privileges will increase costs and may hamper the light touch and efficiency of the robot. And, because of the high processing capability of RPA, nefarious actions will have a greater chance of being processed before the threat is mitigated.

5. Employee resistance: Employees’ resistance to being replaced by robots is a legitimate concern. The best way to view RPA is as a “helper.” Its value is in automating the repetitive, everyday tasks and allowing staff to focus on higher value and more interesting work.

The future calls for humans to work in a collaborative ecosystem; in some cases most of the processes are well defined, well understood, and can be automated. In many others, processes are considerably messier. Firms must recognize and mitigate the above issues at the start. If approached incorrectly, RPA will perpetuate your current operational challenges.

Celent is a research, advisory, and consulting firm focusing on financial services technology, and is a part of the Oliver Wynman Group.