For the iconic year 2020, we are inspired by late tech giant Steve Jobs, who said “If you are working on something that you really care about, you don’t’ have to be pushed. The vision pulls you.”

We really care about fintech – and are pulled by the vision of a positive fintech future – where financial services are so efficient they blend perfectly into the background of our daily lives, nudging us only when we are making a decision that does not resonate with our financial goals, or providing us with business opportunities and savings. Behind that experience, a whole world of supercomputers, algorithms, robo-advisors and robots manage, maintain and adjust course on microseconds of notice to keep our financial infrastructure, risk profile and investment portfolios safe and profitable.

Getting to that place has been our passion project for the last 5 years – and whilst the financial industry is making great strides and developing at a rapid pace, our work is still in its early stages. 2020 marks a pivotal year not only for our ecosystem and our role in it, but also as a moment of reflection on what we, as people, have achieved in the first two decades of this new millennium – personally and professionally.

Over the last two decades, the internet exploded across the world, penetrating into nearly every aspect of our lives – crossing over the digital divide with the advent of the IoT – bringing what used to be a network of computers sharing information to literally trillions of items, spanning home appliances, medical equipment and commercial articles into the digital sphere. The same is true for the financial services industry. Checkbooks were replaced by online banking, which was replaced by app based banking, and we have seen how cash turned to cards, which turned to tokenized payments via a smartphone near a POS terminal – with fully biometric payments on the horizon for the near future.

These opportunities will keep on coming and take control over large parts of our live and economic activity, but we need to remain realistic: with new opportunities, also new challenges arise. Do people have sufficient access to essential resources. Are they aware of the choices they can – or have to make, and the risks associated with that, for example the use of their personal data. Are we educating people with sufficient awareness and skills to operate in this world, and support all associated economic activities? Are our rules and regulations still fit for purpose, when actors, activities and business models change so rapidly.

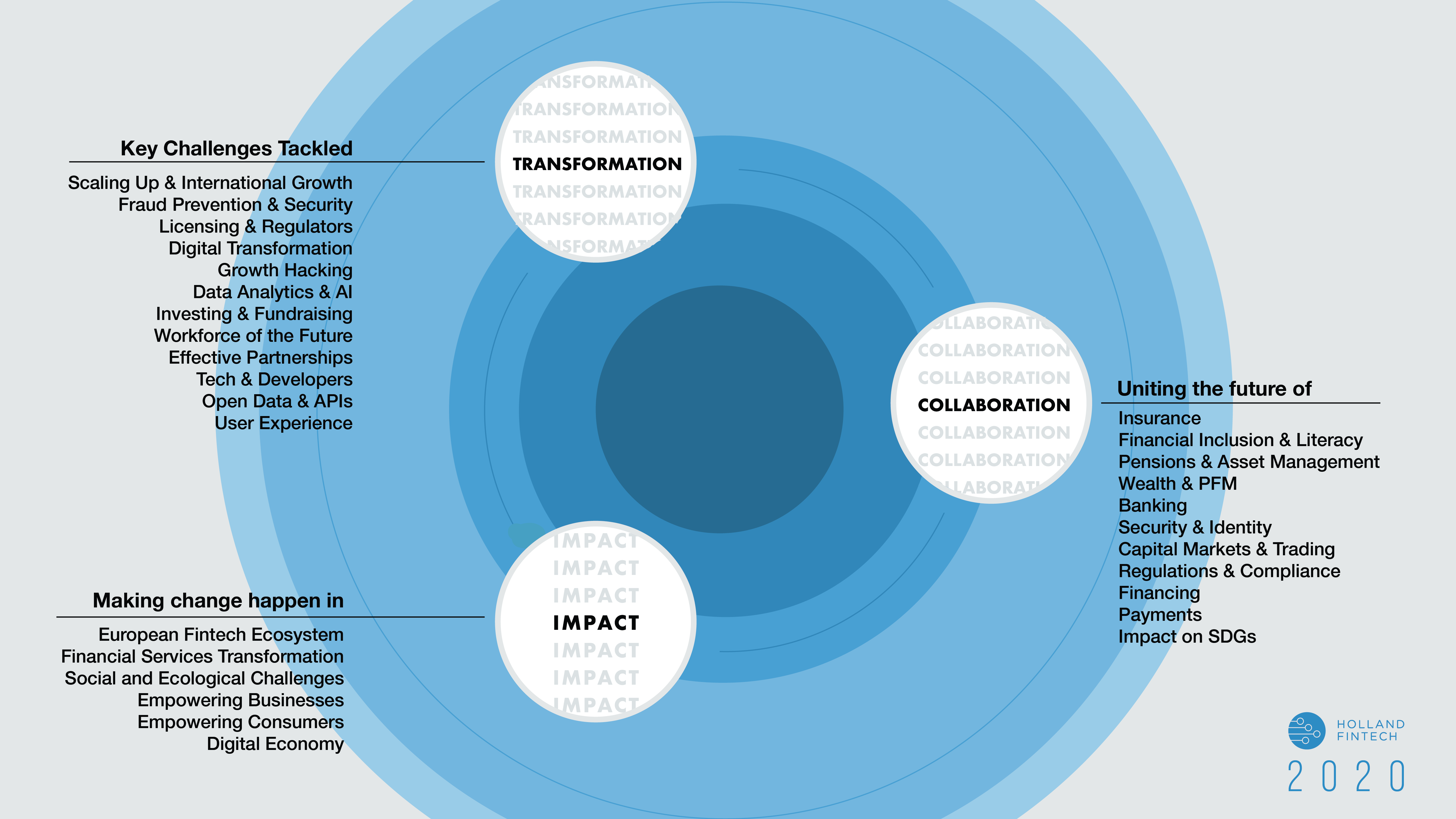

Holland fintech has as its core mandate to unite organisations and people in collaboration, transformation and ultimately positive impact. Our more than 500 members use our knowledge network and program towards a more connected, efficient, self-sustaining financial technology ecosystem – leveraging on emerging technologies, shifting societal expectations and capitalizing on refreshed political interest in the future of our financial systems. We work with all stakeholders to help discover the next steps in the evolution of the ecosystem and join forces to drive a positive change.

So when we look ahead – we must plot our course with lessons learned from the last 20 years and a healthy optimism for what could be. We believe that many sector areas are on the cusp of a digital revolution and that digitalization, its opportunities and challenges will be a key driver in the international fintech agenda for 2020. This year, we will shape three working groups, to steer our program around the key objectives: collaboration, transformation and impact. Collaboration covers the scope of fintech and financial services, to guide everyone towards potential co-operation per subject, while transformation aims to educate and share knowledge to overcome some of the key growth barriers like capital, talent and internationalization. On the agenda of Impact, you will find our focus on society and industry overarching efforts like:

Compliance and Regtech – with a strong focus on the interaction between policy makers, regulators and market participants, finding ways to reduce compliance burdens with shared data and services for AML/KYC and sanctions, and new smart and real-time assessment and reporting tools, that make regulatory compliance easy.

Cybersecurity & Fraud – Digital Self-defense is a key skill for 2020 – the ability to both identify and respond to digital threats in a timely manner - in particular for people within the financial industry. The weakest link determines the strength of financial services ecosystem and hence knowledge sharing is essential to safeguard financial services and society as it relies on it.

Governance of Data (aka money) – Privacy, data sharing, new business models, data security and decentralized ledgers key pieces of new initiatives to guard and regain control over personal data. Europe intends to lead the quest to rebuild the digital ecosystem with the user in control, and financial services is at the heart of solutions to get there.

Financial Health –Financial Inclusion has found its new home in developed markets in the shape of financial health. More than ever, the focus on sound financial decision making and planning will rely leveraging predictive and behavioral economics, making bespoke financial advice available to masses to improve financial well-being.

Please see our vision image and use it as a boiler plate for your own ideas – be sure to let us know what they are! We are looking forward to making 2020 an unforgettable year with you.

Not yet a member of the holland Fintech platform? Join here and benefit from everything our 2020 program has to offer!