We’re settling in for the long haul—in our homes and in the long-term impact the coronavirus pandemic will have on business and communications. In this third issue of our weekly digest, we are beginning to see more data emerge to inform forecasting across financial services—providing some stable footing, but also sparking debate.

Media Snapshot

View from the Top

Now nearly a month in, depending on where you live, crucial economic data is coming in to help understand the severity of Covid-19 and, more importantly, inform forecasting. We have all seen last week’s record unemployment figures in the U.S., and the reversal of a decade of job growth.

So where is this headed? Vox rounded up estimates from leading economists who put forward some stark figures. Predicting the economic recovery is equally speculative, but there is thorough analysis in an op-ed in the Financial Times on the latest forecasts.

Banks

Capital and liquidity measures in place post-financial crisis have worked, but will continue to be stressed as banks are quickly evolving into “pass-through vehicles for governments whose key value is that they have the local reach to businesses and households.” Despite forecasting unprecedented levels of lending to households, small businesses and corporations in the coming months, most bank executives are taking a measured, but positive outlook, writes Euromoney.

This demand was seen immediately in the U.S. on Friday as Bank of America, one of the lenders responsible for administering the small business relief program, reported 85,000 applications for more than $22 billion. Politico has already reported on its rocky start.

The UK’s largest banks bowed to pressure this week from the Prudential Regulation Authority and suspended dividend payments, including HSBC. This angered Hong Kong retail investors, who own more than a third of shares and pushed the stock to a 10-year low. The South China Morning Post linked the reaction to Hongkongers’ wider frustration around city management.

For bank marketers and communications professionals, Covid-19 may be the catalyst that realizes not just digital transformation, but reshapes content marketing and customer engagement strategies, as per a discussion with The Financial Brand and executives from HSBC, Salesforce and KeyBank.

Fintech

Industry reports begin to roll out with differing opinions on the long-term impact to the fintech industry. Like any industry, the more entrenched firms with strong capital flows have a rosier outlook, but traditional businesses they have attempted to disrupt “will gain a competitive advantage over fintechs,” as people prefer stronger, established brands and are risk-averse.

Others argue the digital-first mastery of the fintechs will see much of the industry emerging from this period stronger than ever. Financial services advisory organization deVere group found the use of fintech apps had spiked 72% in Europe as more customers embrace digital banking and other forms of digitisation.

New solutions for today’s times are quickly emerging as well. Crowdfund Insider reported on a cooperative venture from Capital on Tap that aims to help businesses track and claim back funds lost to the outbreak.

Insurance

The battle over what is covered by personal and corporate insurance policies, and what is not, is heating up. Unsurprisingly, the insurance industry prepared for this, writes The Washington Post.

Broker Willis Re said that many reinsurers have introduced specific policy exclusions over losses linked to the Covid-19 outbreak as the industry moves to minimize its exposure to the growing economic crisis.

Meanwhile, Insurance Asia News reported that some Chinese insurers currently believe that their business won’t be seriously affected by the global pandemic this year. Luo Xi, chairman of insurance conglomerate China Taiping said that the outbreak will ultimately be good for the mainland insurance industry in China, accelerating the shift to insurance demand across the country.

Asset management

Private equity firm Apollo is mounting an argument to the Fed that it needs to expand its emergency lending under the Term Asset-Backed Securities Loan Facility to cover, primarily, loan obligations underpinned by residential and commercial mortgages. This would protect default on many collateralized loan obligations (CLOs) popular in private equity portfolios.

Ratings agencies S&P Global, Fitch and Moody’s are under fire for lowering ratings that many think were inflated leading up to the crisis. Lowering ratings ultimately impacts bond prices, but high-yield investors reversed course and have poured money into risky assets. Fitch also dinged asset managers last week, predicting a 30% decline in AUM.

Nomura Securities estimated that Japan’s Government Pension Investment Fund (GPIF), the largest pool of retirement savings in the world, suffered an ¥18 trillion ($166 billion) loss in Q1, thanks to its exposure to equity markets, the Nikkei Asian Review reported.

JPMorgan will spend almost $1 billion to buy out its minority partner in China International Fund Management, the FT reported, to take advantage of reforms that came into force last week in mainland China, removing restrictions on foreign companies having full control of local asset management operations. China’s asset management market is forecast to grow from US $5.3 trillion to $9 trillion by 2023.

Technology

The Economist looks at the role the crisis is playing in stimulating a further welcome shakeout in tech unicorn valuations, after a difficult year with pulled IPOs and poor secondary market performance—suggesting that having SoftBank as an investor has now become something of a black mark for tech firms.

Amazon is pledging to both protect warehouse workers—some of whom went on strike last week for better conditions—and provide more masks to hospitals. Facebook is pivoting to features designed to help users and small businesses impacted by the lockdown and launched a WhatsApp fact-checking service to guard against forwards of questionable reliability. Google used location data to emphasize just how much behavior has changed during the pandemic. Meanwhile life inside booming video chat provider Zoom is challenging.

Major consumer and business brands have traditionally been hesitant for advertising to appear next to controversial or upsetting news, such as stories around war and death. Now that some publications are almost exclusively publishing pieces that tie into the outbreak, a Business Insider op-ed argues that brands need to adapt a revised approach.

Advertising executive Steve Cohen implores companies to “Please immediately instruct your brand and agency teams to update your programmatic and all other media buying to enable advertising surrounded by topics you would have previously avoided, including ‘crisis,” ‘COVID-19, ‘coronavirus,’ etc. The faster you do this, the more lives you will save.” A Wall Street Journal report cited information from Integral Ad Inc. showing that coronavirus is now the most common blocked term for brands—overtaking “Trump”—impacting news and related lifestyle content and causing a huge problem for digital news publishers.

Story and Engagement Tracker

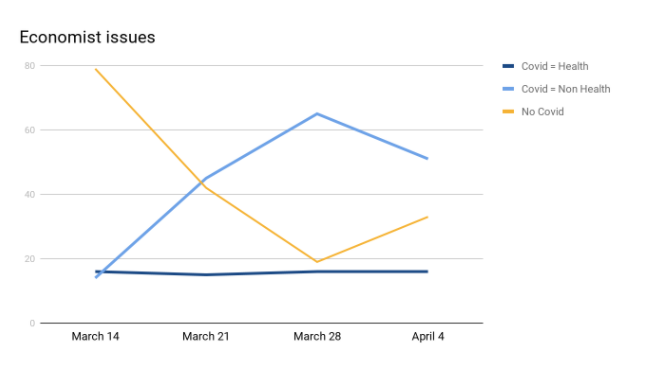

Our vice chairman Andrew Marshall is reading The Economist cover to cover every week to keep a running tally of how many stories mention the pandemic. Here are the last four issues:

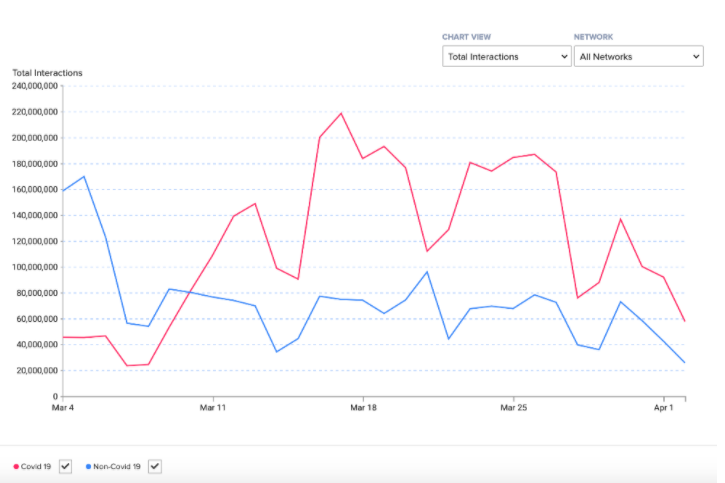

How are people engaging with Covid-19 content online? Newswhip, a news-engagement tracking platform Cognito partners with, has charted social engagement on Covid v. non-Covid media coverage, across all leading platforms. Covid-oriented coverage gets the majority of engagement, with days as high as 70%.

Source: Newswhip

Read the original article here