In this global edition, BDO’s team of fintech experts presents some of the challenges facing fintech companies, advises on how to overcome them, and how to prepare to best grasp the future opportunities that await.

Covid-19’s effect on markets, the economy, industries and fintech companies leads to a mix of new opportunities and challenges. Increased financial digitisation and digital transformation are among new opportunities, while the general economic slowdown and changing funding and market dynamics lead to increased challenges.

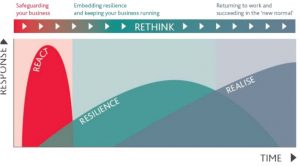

BDO’s RETHINK model assists companies overcome the short-term fallout of Covid-19 and prepare to grasp the opportunities that await on the other side.

Graph: BDO Global

Most fintech companies are still in – or just exiting - a REACT phase, working through the initial ramifications of Covid-19, safeguarding their business, and addressing immediate risk factors such as changes in cash flow. Companies and sub-industries will then move into a RESILIENCE phase, looking to build out risk mitigation and growth initiatives such as business continuity planning, permanent remote working strategies, and access to growth funding. Such initiatives play a pivotal part in being able to REALISE the opportunities that trends such as increased digital transformation and a push toward cashless transactions present for fintech companies across the globe.

Read the full report here