Dutch start-up Finturi received approval from AFM and has launched a new way of invoice financing in the Dutch market. Finturi connects companies to financiers and helps them borrow money against invoices.

Finturi offers a platform for SMEs to finance invoices quickly, flexibly, and at the best interest rates in the market. Companies receive 80% of the invoice value as a loan within 24 hours. The level of the interest rate depends on the ‘Health Score’ calculated by the platform and amounts to 1-2% per 30 days. Finturi charges a flat fee of 0.65% per transaction for processing the loan.

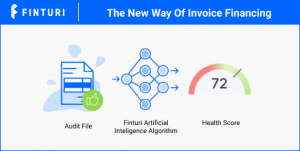

One of the reasons why Finturi can work so fast is because it uses artificial intelligence to calculate the financial health score of the business, based on the RGS tagged audit file provided. Thanks to RGS, financial data is now in one uniform format and this can be easily analyzed using Finturi’s artificial intelligence algorithm.

For getting a health score, the business must upload an audit file which meets the below conditions:

- An XAF file of version 3.2

- The XAF file should have RGS tags added

- An opening balance should be present

- Data must be available for one full calendar year

After this, within 30 minutes, businesses get their health score and thus know if they are eligible for receiving financing. Finturi aims to continuously optimize its health score algorithm in order to accommodate more formats of the audit file.

So far we have analyzed audit files with RGS tagging from multiple accountancy providers including Minox.

Please contact us for further information on [email protected]

Read the original article here