The second quarter of 2020 has been a wild ride in the blockchain industry. Bitcoin saw a ~44% price increase and other digital assets have also seen a lot of price action this quarter. Overall this resulted in an increase of market capitalization of digital assets of USD 100 billion this quarter. The Bitcoin halving took place in May, if you want to read more about this we previously published about it in a blog post. Furthermore, the rise of stablecoins which we expanded on in the previous market update, has kept on-going relentlessly. Whereas last quarter we reported USDT, the biggest stablecoin, surpassing USD 6 billion in issued coins, it has currently surpassed USD 10 billion.

We are also seeing a great increase in deal in-flow on the venture side. This is mostly focused on decentralized finance, which has completely taken over the narrative in the industry. We will focus on what decentralized finance is and what it has to offer in terms of disintermediary, ownership, efficiency and effectiveness of financial processes below.

Decentralised Finance (DeFi) taking over the digital asset narrative

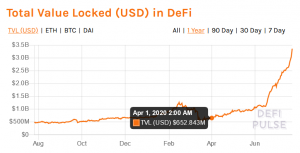

Decentralized Finance (DeFi) has certainly been one of the major trends in Q2 2020. Over USD 2 billion worth of various digital assets is currently locked inside a variety of DeFi protocols. At the start of Q2 this was ‘only’ USD ~650M, an impressive ~300% quarterly growth rate. So why has this happened this quarter? There are various potential explanations, but the most logical one is that it is a consequence of so-called “liquidity mining” and “yield farming”. What these concepts are and why they are relevant to DeFi will be explained below.

Let us start at the beginning. What is DeFi and what does it offer? Decentralized finance refers to all financial processes that happen in a decentralized way. This is enabled by blockchains (currently all the DeFi activity takes place on Ethereum) and the digital contracts that are executed on top of blockchains. It removes the need for intermediaries in finance such as investment/commercial banks, insurance companies, brokers and so forth. What this means is that a user is not dependent upon any other party in order to use a financial service. So for instance in the centralized finance world when taking out a loan you interact with an advisor and a bank in order to get access to a loan. In the DeFi world you’re interacting through a digital contract (also known as smart contract) instead of through an intermediary. A capital provider deposits their (digital) asset into a liquidity pool where it is pooled and awaits a borrower. The removal of intermediaries leads to more efficient and effective capital allocation which in turn leads to higher interest rates paid to lenders and lower interest rates paid by borrowers. For instance a capital provider in Compound, an interest rate protocol, can earn ~3% interest on his funds. While taking out a loan charges an interest of ~3,6%. The spread between the maker and taker interest rate is stored inside the Compound protocol, in a so-called reserve. Compound is just one example of a DeFi protocol. Currently live are Uniswap and Balancer, both exchanges, MakerDAO, a stablecoin issuance protocol, Aave, a lending protocol, Synthetix, a derivative protocol, bZx, a protocol that provides leverage. And these are just the protocols that are currently live and gained some traction, many more are in development or currently less well-known.

Recall the Compound reserve mentioned earlier? Currently that is just a warehouse of digital assets being stored. However what happens to these assets is determined through a governance process, through a so-called DAO. The term DAO brings us to the next part of all the DeFi activity. DAO stands for “decentralized autonomous organization” and while this construct has been around ever since 2016, it has started to gain broader traction with the introduction of DeFi. In a DAO tokens are used to vote on decision making. This is comparable to shareholders voting in a shareholder meeting. The more tokens (similar to shares) you hold, the more weight your vote gets. Currently DAO tokens are mostly used to alter various parameters inside DeFi systems, for example voting on what happens with the reserve inside Compound, setting the interest rates in MakerDAO or allowing various digital assets as collateral. These DAO tokens can be distributed in a variety of ways. One of which is through an investment, where assets are exchanged for governance tokens similar to any other investment. However another method also came into existence recently. This is the so-called liquidity mining.

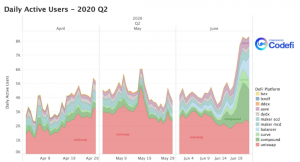

Liquidity mining refers to the process of rewarding capital providers, users that deposit digital assets into the liquidity pool mentioned earlier, with DAO tokens. In addition users that utilize the protocol to lend from the liquidity pool can also be rewarded DAO tokens. This is a form of “cashback”. The idea is innovative, but yet rather simple. By rewarding users on both the supply and demand side of the protocol with governance tokens you give them the power to make decisions regarding the protocol. This makes sense because these are the people that actually use it and would consequently be the best decision makers. The liquidity mining programs that protocols have rolled out have attracted a lot of users over the last few months, as is shown below.

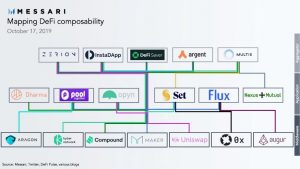

Because all these protocols are built on the same technology stack, a major advantage over centralized finance “data silos”, they are also composable. Consequently you can easily make them interact with each other. Rebuilding entirely new finance processes, like stacking lego bricks on top of each other. For instance a user can issue a stablecoin on MakerDAO, pool it in the liquidity pool in Compound, utilize the rewarded COMP governance token in a Balancer pool to gain access to the reward from Balancer. This reward can be used in another protocol again and so forth. The major advantage from this is that it stacks the various yields of these products. This process is called “yield farming” and can earn users up to 100% returns annually. Because the system is entirely permissionless users can get as creative as they want with financial constructs.

However there is one major annotation to be made, no yield comes without risks. And risks are also plentiful in an industry filled with innovation and novel products that aren’t like anything seen before. We currently identify a few major risks involved in DeFi. First is the risk of a digital contract bug and/or exploit. With contracts holding hundreds of millions worth of assets they become attractive targets for hackers. In addition, a buggy digital contract can freeze and it may become impossible to access the assets at all. Second is the risk that users themselves are in control. By eliminating the intermediary you also eliminate a measure of control in financial processes. There is no intermediary that you can hold accountable for mistakes. If a user accidentally loses funds they are lost. While in centralized finance systems the reversal of a transaction can be as easy as changing a cell in an excel sheet, this is not possible in decentralized finance. Thirdly is the composability we mentioned earlier, in the lego brick analogy, is a benefit but also a risk. Because the protocols are all stacked on top of each other by users, one of them breaking down can cause the entire stack to fail like a jenga tower falling apart.

All in all, DeFi has taken the digital asset industry by storm in the last quarter. However it is still at a very early stage and we predict massive growth in the foreseeable future. The advantages the DeFi stack offers over CeFi are too strong to ignore. While the fact that it is still in its nascent stage, which also brings on additional risk as mentioned above, we are of the opinion that the potential yields far outweigh the risks at this stage and are investing accordingly.

Read more about Maven 11 Capital here