Trading is rapidly gaining in popularity among young people. Since the interest rate on savings has been close to 0%, young people have started to look for other ways to build up capital. So it should come as no surprise that the development of trading apps such as BOTS appeals to this age group. And for us as a platform, that entails a responsibility.

Young people and trading

Talking about personal financial matters is becoming much less of a taboo these days. Whereas people used to be hesitant to share information such as the size of their income, we now see money being talked about more openly. And trading is becoming one of the top subjects to discuss.

The world of investment always seemed inaccessible; it was viewed as the prerogative of wealthy men in black suits. In other words, no place for the ordinary man to build up capital. Most banks were already offering managed trading but in most cases this came with high entry fees.

But a lot has changed in the past decade. Banks started to focus more on ‘the ordinary man’ by substantially decreasing the entry fees. This made managed trading increasingly accessible to everyone.

Also, in recent years, many new apps have been developed with the aim of simplifying managed trading. Do you have a smartphone and some spare cash? Spend five minutes and you can get started on your own managed trading pool. Applying gamification has greatly boosted the appearance and user-friendliness of trading apps. No wonder so many youngsters are getting into trading nowadays.

And for us as a platform, this entails an ever-increasing responsibility. After all, there are risks involved in trading.

Trading apps under criticism

Last month the FD (Het Financieele Dagblad, a Dutch daily financial newspaper) published a critical article about the trading app Robinhood. This app basically allows anyone to trade by themselves. It’s easy to use and you can get started within mere seconds.

Because share prices plummeted at the beginning of the coronavirus outbreak, many novice traders sensed an opportunity and started trading. This resulted in an additional 3 million users for Robinhood.

As a user of Robinhood, you trade entirely by yourself. You choose exactly what you want to buy and how much of it you want to buy. The app is very easy to use, so it barely takes any effort to buy or sell shares. “At first, it seemed like a smartphone game”, a user of the app commented.

And that’s exactly where the danger lies, according to the FD. Trading is not something you should start doing just like that. If you want to do it right, and actually build up capital, you need a great deal of knowledge, experience, and preferably a supercomputer as well.

The new trading

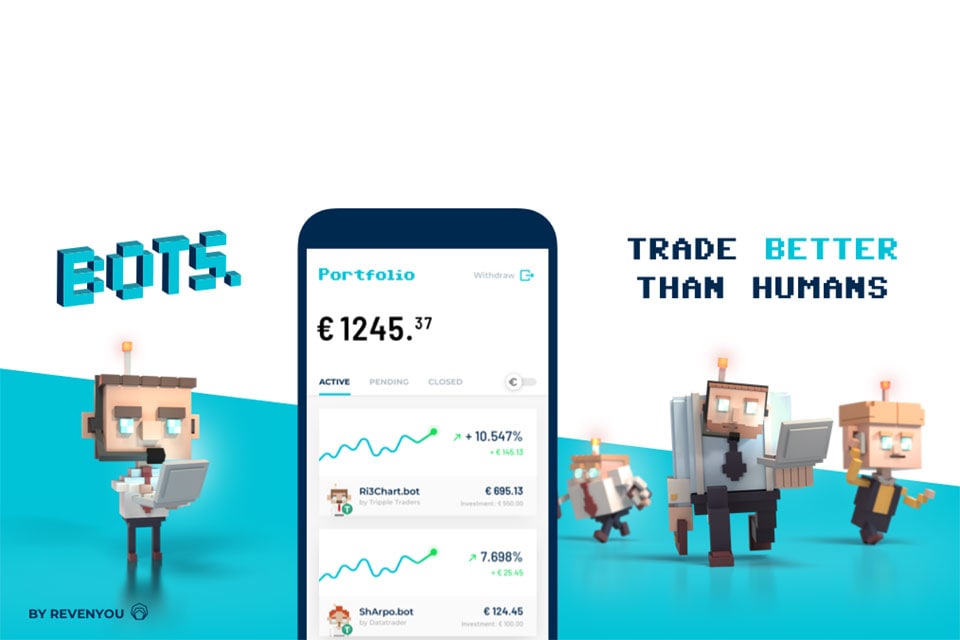

Trading with BOTS involves that supercomputer we just mentioned. It’s an open platform on which expert developers offer the use of their bots. These bots trade on behalf of the user, making decisions based on artificial intelligence, machine learning and algorithms. So essentially, bots are automated trading strategies.

Until now, algorithmic trading used to be accessible only to the world’s richest 3%, exactly the 3% who were already making enormous profits. The BOTS app was developed to make this trading method accessible to all.

Our app also uses elements of gamification . “This is mostly to make the app easier and more fun to use. Also, you don’t make trades yourself when using BOTS. The app trades on your behalf using algorithms,” said the founders of BOTS.

This means that everybody of all ages can start trading without requiring extensive knowledge. The bot already has all the experience you need. Users can choose their own risk level and the size of their stakes. Since a bot will never make unnecessary trades, the user won’t have to face unnecessary transaction costs.

“That is the new trading. We take into account user needs, the risks involved in trading, return on investment, and we provide a supercomputer. This is how we, as a platform, take the responsibility that comes with a young audience.”

Trading is for everyone

Everyone should be able to trade. And now they can. With BOTS. Together, we are committed to making the world of trading fairer and more transparent. Interested, but your question hasn’t been answered yet? Then please have a look at the FAQs on our site. Or contact us, we will be happy to explain it to you in person.

The BOTS app is now live

Download the BOTS app on your mobile phone today! For Android click here, for Apple click here. Find out more about BOTS by RevenYOU here.