In today’s data economy in which everything has become a transaction, future relevance for banks is no longer based on payments alone. To help senior executives of banks to start leveraging their Open Banking capabilities in this context, we recommend three must-do actions to holistically address the components of a digital trust infrastructure (digital identity, consent management, payments and data sharing). These actions will enable banks to build much-needed customer relevance, credibility and trust in the digital transaction era.

Payments has historically been an important anchor product for full-service banks to create customer relevance. However, the introduction of PSD2 has brought with it a real threat of increased pressure on that relevance from third parties who succeed in introducing new, value-added products and services. PSD2 has also required banks to develop new technological and operational capabilities (e.g. digital identification, authentication, API infrastructure, developer platforms, support, etc.) and enhance existing ones that can be leveraged in pursuit of new business models in the Open Banking domain.

It is only natural that many banks are initially focusing on their payments strategy and roadmap. They are keen to better understand how the foreseen payment products under the European Payments Initiative (EPI) fit with existing payment solutions and the possible implications of related developments such as payment initiation services under PSD2, Request to Pay and other value-added payment functionalities enabled through Open Banking. Nevertheless, we are keen to remind banks that the newly acquired capabilities can also be used to gain new relevance in an open data economy in which customers are in control of what data is shared from which sources and for which purposes.

Regulatory reforms such as PSD2, Open Banking and GDPR as well as developments such as the EU Data Strategy and the digital finance strategy are democratising access to data assets across the whole economy. In a changing world in which data is emerging as the new global currency and digital transactions are at the heart of everything we do, customers are becoming more aware of the value of their data assets; they want to leverage their data beyond the platforms and organisations that store it in order to tip the ‘data-benefit balance’ back in their own favour. This is driving customer demand for increased transparency and control over their data assets – a concept that is also known as ‘data sovereignty’.

In our previous article we shared our perspective on the future role of banks as data custodians and the underlying beliefs that bank executives should embrace in order to initiate their sustainable transformation. Banks embracing these beliefs have recognised that putting customers in control of not only their money but also their data is strategically and commercially imperative for future relevance.

THREE ACTIONS TO TAKE RIGHT NOW

To define a solid strategic roadmap that will guide their bank’s digital transformation, executives need to initiate these three actions:

1. Shape the strategy and aim the role

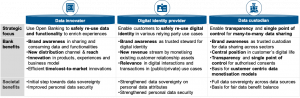

At the heart of the digital trust infrastructure, there are various transaction-based business models and related disruptive growth opportunities that offer significant monetisation options for banks. Three roles in particular will enable banks to secure relevance in the data economy (see Figure 1).

Firstly, banks need to firmly position themselves as a data innovator. This relates closely to banks’ strategic Open Banking initiatives (beyond regulatory compliance, e.g. PSD2, CDR) and focuses on enabling and educating their customers to safely re-use data and functionality in other environments. This entails banks opening up their APIs so that their services and products can be embedded in other platforms (‘banking as a service’) and making use of other APIs to enrich their own digital channels, products and services (‘banking as a platform’). This initial step is necessary to lay an effective foundation for new partnerships and business models, and banks must get this step right in order to pave the way for data sovereignty for their customers.

In addition, banks need to focus on positioning themselves as a digital identity provider. By enabling customers to re-use their existing digital identities in relevant relying-party use cases, banks leverage their KYC assets and SCA solutions effectively to shape new revenue streams and increase brand awareness and visibility. With this, banks empower their customers to exercise a concrete form of data sovereignty while also counteracting Big Tech moves in the digital identity space. Banks can actually explore digital identity-related business opportunities in parallel with the first step of becoming a data innovator. Several leading banks are already exploring API-enabled identity services as part of their Open Banking strategy (e.g. CapitalOne, Deutsche Bank).

Besides these two steps, banks can evolve towards becoming a data custodian, leveraging the trusted position it creates by engaging in Open Banking and digital identity. For more insights, see our previous article.

For bank executives, the focus should be on developing a solid understanding of these different roles and the propositions already offered by other players. Based on this, they need to define a common understanding of the vision and strategy which is complemented by inspirational use cases and high-level benefit cases. This should then be used to inform decision-making about the bank’s preferred role.

2. Select business opportunities & partners

Next, executives need to identify the most viable business opportunities within their bank’s preferred role. This entails developing more detailed value cases to prioritise opportunities worthy of further pursuit. Potential partnerships need to be identified to enable and/or accelerate the realisation of each selected opportunity.

3. Define must-win battles & roadmap

For the prioritised business opportunities, the subsequent task for executives is to identify, assess and prioritise key must-win battles and capabilities to prepare for successful execution. Besides this, a clear roadmap needs to be defined that outlines key activities and milestones for execution of the strategy and prioritised opportunities.

SUCCESSFUL PARTICIPATION

Executives at any bank wishing to participate successfully in the data economy will need to perform a review of their strategy and business model as well as their technological and operational capabilities. This starts with developing a solid understanding of how the data economy is evolving, their own vision, strategy and role within the digital trust infrastructure, and the necessary partnerships to enable or accelerate the execution of their strategy. To discuss how these three must-do actions can help your bank to achieve relevance in the data economy, feel free to contact Mounaim Cortet for no-obligation advice.

Read the original post here. Find out more about Innopay here.