Learn how both lenders and their clients benefit from non-traditional credit scoring

In the US alone, 60 million adults are credit-invisible — that is, people with limited or no credit history. Traditional credit scores are not available for these credit-invisible individuals; they can’t prove their creditworthiness.

But now there is a way for such individuals to qualify for credit. Today, lenders can provide credit access to more consumers by using alternative credit data. Beyond that, using alternative credit data in credit risk modeling increases accuracy. How? Read further to find out more about the applications of alternative credit data.

In this article, you’ll learn:

- What is alternative credit data for credit scoring?

- Sources of alternative credit data

- How to get alternative credit data and adopt AI for credit scoring

- How alternative credit data can increase accuracy in credit scoring evaluation

What is alternative credit data?

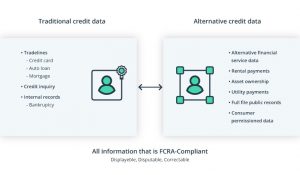

Alternative credit data is information obtained from non-traditional data sources that helps to evaluate a consumer’s creditworthiness. While “traditional data” refers to an individual’s credit report, alternative data for credit scoring covers non-credit information about insurance payments, utility payments, rental payments, public records, and property records. These data points can help lenders get a sense of an individual’s financial reliability. Even the consumer’s employment history can assist in credit scoring by substantiating the stability of a person’s financial situation.

The differences between traditional credit data and alternative credit data:

Source: Experian

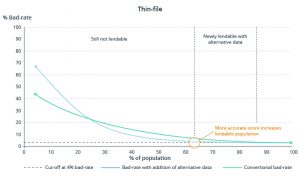

Alternative credit data may be supplemental for many consumers with extended portfolios and help build personal financial assistant apps. For those who have insufficient traditional credit data for credit scoring, however, alternative data may be the only way to get a loan. Today, lenders can offer their services to more clients by using alternative data to score thin-credit file consumers.

“Alternative data sources (such as property, tax, deed records, checking and debit account management, payday lending information, address stability and club subscriptions) have proven to accurately score more than 90% of applicants who otherwise would be returned as no-hit or thin-file by traditional models.”

Mike Mondelli, SVP of TransUnion Alternative Data Services

Sources of alternative credit data

Alternative data for credit scoring comes from various sources; digital footprints, full-file public records, and banking accounts are some examples. Sources and types of alternative credit data used in the evaluation depend upon the company that collects the information.

According to research by Oliver Wyman, a good alternative credit data source should have the following characteristics:

- Coverage. An alternative data source should have broad and consistent coverage.

- Specificity. The source should provide information specifically about the individual.

- Accuracy and timeliness. Alternative credit data must be accurate and current or frequently updated.

- Predictive power. The information from the source should be relevant to the behavior being predicted.

- Orthogonality. Ideally, alternative credit data should complement traditional credit bureau data.

- Regulatory compliance. Alternative credit data sources must comply with existing financial regulations.

How to collect alternative credit data for lending?

Much alternative credit data can be collected in a traditional manner: by asking consumers. Loan applicants can be required to give additional information about themselves. Lenders can ask consumers to grant them access to account information from banks, credit cards, investments, and mobile phones.

Getting assistance from various data aggregators is another way of collecting alternative credit data. Partnering with a vendor or using a data aggregation platform can help a credit bureau gain access to the needed information about its consumers. Using aggregation technology can make the loan process move along faster and more efficiently — for that reason, traditional lenders may choose to team up with FinTech providers.

How can alternative credit data increase accuracy in credit scoring evaluation?

Collecting alternative credit data is not enough. The data then needs to be processed. Scanning through a person’s transaction history is cumbersome. Modern lending companies use AI technologies and machine learning solutions to quickly gain insight from numerous datasets. An AI model can rapidly analyze copious amounts of alternative credit data, significantly reducing the processing time. More importantly, machine learning algorithms can identify patterns in unstructured data — patterns that will help evaluate a loan applicant’s consumer behavior and predict ability to repay the loan.

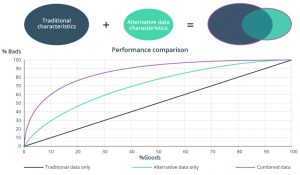

According to FICO’s research, alternative credit data captures less value than traditional data, and traditional characteristics, alone, present more insights into a consumer’s creditworthiness. However, using alternative credit data in credit risk modeling is the only way to help the credit-invisible consumer qualify for a loan. Combining the use of both traditional and alternative credit data sources will result in a more accurate model.

How combining traditional and alternative characteristics affects performance:

Source: FICO

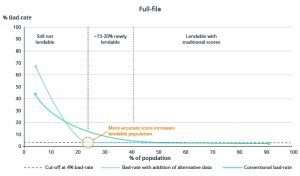

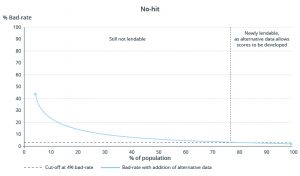

A more accurate alternative credit score affects all types of consumers. It helps separate lendable clients from risky ones — even for the full-file population — making it much easier to reduce lending risk with alternative credit data.

Depiction of lendable population with the addition of alternative data:

Source: Oliver Wyman Report

According to Experian, 65% of lenders say they already use some information beyond the traditional credit report to make lending decisions. Many of them use alternative credit data to develop credit scores; doing so can have many benefits. In cases where a person doesn’t have a credit profile or a credit history of at least six months, alternative credit data can provide predictive assistance where there is no historical data. With alternative credit data, lenders can increase the number of their consumers. Moreover, alternative credit data can help to build an accurate scoring process for all types of applicants. Using alternative data in credit risk modeling helps identify risky consumers.

To more accurately and efficiently work with copious amounts of information obtained from a variety of sources, companies should adopt AI technologies. Many FinTech lenders, such as Zestcash and Global Analytics, already do so. Machine learning algorithms reduce data evaluation time and give a full overview of a consumer’s creditworthiness.

Read the original article here. Find out more about Intellias here.