A universal solution

On July 2, 16 European banks from 5 countries came out with the news that they will pave the way for a pan-European retail payment system, provisionally called the European Payments Initiative (EPI). With EPI, a long-cherished wish of the European Commission and the ECB is being fulfilled. Successive commissioners increasingly openly alluded to more decisiveness from the European financial sector to counterbalance the dominance of the American card schemes. Nevertheless, for a long time the banks hesitated about the need for a pan-European solution. Now, after long deliberation, a decision has been made. EPI must become a universal solution that will replace the still existing patchwork of domestic payment systems. A solution that competes in terms of user experience, innovative strength and costs with international schemes such as Mastercard, Visa and Paypal, and with the Big Tech giants, also referred to as GAFA (1) and BATX (2).

We interviewed Eric Tak, Global Head ING Payments Centre and member of the EPI steering committee.

But first some background.

Two products

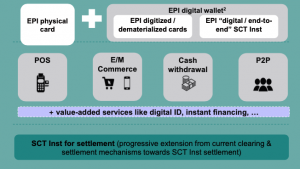

The initiators want to launch two products for the time being: a physical card and a digital wallet, with which digital card transactions can be made (compare Apple Pay) as well as end-to-end instant payments. With those two products, all types of retail transactions can be done: POS, e- and m-commerce, ATM withdrawals and P2P transactions. In a later phase, once SCT Inst is the standard infrastructure in Europe, value added services will also come into scope, such as digital ID and instant financing. Differentiation in different countries is possible.

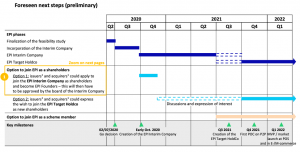

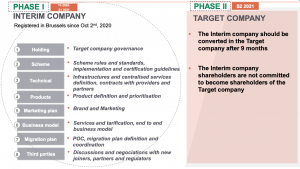

The ambition level is high: EPI must become nothing less than the new standard for retail payments in Europe, based on instant payments. The first EPI transactions must take place in the first quarter of 2022. To achieve this, a two-stage rocket has been launched: the foundation must be laid over the next 9 to 12 months by an Interim Company, based in Brussels, staffed on a secondment basis by approximately 40-50 experts from the participating banks and local schemes, supplemented by some externals. The Interim organisation has to deal with questions regarding the technical realisation, the road map for marketing, sales and product development, the detailing of the business model and the business case and everything else that is involved in setting up a full-fledged payment system. The target EPI Holding Company must be registered in the last quarter of 2021 to enable the launch in 2022.

Volume is at least as important as speed: an important part of the business case is based on network efficiencies: the more players join in, the greater the transaction volume, the lower the costs per transaction and the more room for innovation.

Best in class

For European consumers, EPI transactions must be “best in class”, or at least as easy, fast and secure as their international counterparts. In a recent interview, Narinda You, vice-president of the EPC (3), stated that the great benefit for consumers will be familiarity with the customer interface, regardless of the device or the type of payment. An EPI payment can be made with a card, a digital wallet or an online instant payment. Merchants mainly benefit from a standard solution that is accepted all over Europe, with immediate payment guarantee and high security, low prices and added value in the form of tooling (such as reconciliation, refund and chargeback, budgeting, stock management, data analytics and OTC management).

We spoke with Eric Tak, Global Head ING Payments Centre and member of the EPI steering committee.

Q: Have you been involved in the creation of EPI from the start, when it was still called PEPSI (4), and how did the contacts come about?

‘The initiative came initially from the CEOs of the major French banks. In high level meetings with the ECB and the European Commission, they came to the conclusion that the functionality of Carte Bancaire was lagging behind the international card schemes so much that it was time to take action. In the middle of last year they then started looking for a “coalition of the willing”, consisting of the 20 largest European banks that together represent about 65% of retail payments in euros. ING was approached in that consultation round. From that moment, June 2019, I have been actively involved as a steering group member.’

Q: It sounds like a lot of work.

‘I am not exaggerating when I say that I have spent half of my time on EPI recently. To give an example: the steering group met every week. I expect that frequency will now decrease, because the Interim Company started on October 2. The steering group will now switch to a Consultative Body, a kind of Sounding Board group with players from various user groups, which is more remote from the Board.’

Q: Has the covid-19 crisis led to a delay in the process?

‘As I said, the drive came from the CEOs of the French banks. The big advantage of that was that EPI is a top priority for them, and not one of the many projects that are being reconsidered because of the crisis. The French are clearly the driving force behind the start of EPI, but the other five countries are cooperating enthusiastically. The business rationale is also abundantly clear to us, because we are active in several European countries and therefore have to deal with several domestic schemes.’

Q: What does the structure of EPI look like now and in the final situation?

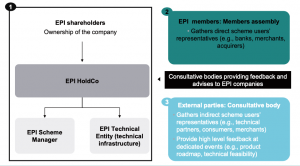

‘In short, there is a Holding Company, the EPI HoldCo, which manages two underlying companies on behalf of, as expected, 25-30 shareholders: the EPI Scheme Manager, responsible for the scheme rules & regulations, and the EPI Technical Entity, responsible for the technical infrastructure. These companies are advised by (external) stakeholders in a Consultative Body, which is regularly consulted on substantive matters. Initially, the path is cleared by the Interim Company. We are now working hard to fill in the staffing. For example, a CEO will be appointed soon (5).

At the end of next year, the Interim Company must hand over the baton to the Target Company. The affiliated licensees will therefore unite in a Members Assembly that advises the Board.’

Q: One of the motives of EPI is that with the intended scale and synergy, innovations are possible that are currently beyond the reach of domestic schemes. There is an annual innovation budget of € 75M. But what about a country like the Netherlands, where it was decided at the time to replace the PIN scheme with Maestro and V Pay in the context of SEPA Cards? Do you think that innovations can be accelerated by means of EPI, also for banks that no longer have domestic schemes?

‘Opportunities for innovation are certainly an important part of the business case. It is true that the Netherlands switched to International Card schemes (Mastercard/Visa) more than 10 years ago, which reduces the urgency of switching to a third scheme on the cards side. But remember that ING is active throughout Europe. All these different payment methods, with their own rules and infrastructures, make the payment landscape more inefficient and therefore more expensive than necessary.’

Q: Does that mean the end of iDeal as more or less the last remaining domestic scheme in the Netherlands?

‘iDeal has performed extremely well all these years, with a consistently high market share, partly due to Tikkie and the payment requests. But in the longer term, we will not remain the proverbial Gaul village where iDeal can survive in the power game. We want to offer our Dutch customers products that work throughout Europe. The idea is that customers will keep at least the same functionality and ease of use, but with a broader reach.’

Q: How long do you think this will take?

‘Nobody wants to part with their domestic brands, but we all know that it’s not really smart to keep several products alive with the same function for a long time. If EPI becomes the hoped-for success, I expect iDeal to disappear within 3 to 4 years, with branding likely going through a transition phase, “iDeal powered by EPI” or something similar.’

Q: EPI’s innovation budget is modest compared to that of the international card schemes, which invest billions in open banking. Consider the $ 5.3 billion acquisition of Plaid by Visa. How do the banks think they can compete?

‘Firstly, it is evident that the innovative power of EPI will be greater than what all those local schemes can now achieve independently. In addition, if you look at the innovations that the international card schemes have launched in the European market over the past 10 years, you have to conclude that there have not been so many that an EPI could not match. And they have not all been equally successful. In part because Mastercard and Visa are ultimately American companies whose product development focuses primarily on the American market, which is quite different from the European one. Think of the much higher interchange fees, but also of the rather rickety cashless products. Americans pay for their gas, water and electricity with their credit card, where we do this with a much more efficient direct debit. It is true that Mastercard and Visa have much deeper pockets than EPI will ever have. But on the other hand, EPI is focused on European consumers and merchants.

In the longer term, it’s good news for Mastercard and Visa that a third scheme will be introduced with EPI. After all, it strengthens their position in all the antitrust investigations and complaints about a duopoly, and lso triggers them to continue to innovate. There is plenty of room in this market for more than two players.’

Q: Will EPI also contribute to more lofty European ideals?

‘The primary goal of EPI is to standardise payments in Europe and make them more efficient and therefore cheaper. With a system that runs on SCT Inst rails instead of more expensive Cards rails, you ultimately achieve that no higher prices for payment packages and acquiring fees have to be passed on to citizens and companies.

In addition to efficiency, EPI will contribute to a greater intrinsic security of payment transactions. In that respect, there is also an important difference between Europe and America. In America, despite EMV, it is still possible to confirm a card transaction with a signature instead of a pin code. This results in more fraud, but the related costs are more than offset by the higher interchange fee for the card issuers. This is different in the European market. We believe security is essential for the confidence people have in the payment product. Another example: although cash should remain available as legal tender, we believe it is in everyone’s interest to increase the share of electronic payments. The fewer ATMs, the less robberies and ram-raiding.’

Q: Is EPI looking for cooperation with Big Tech companies or international card schemes?

‘At the moment, we intend to use European infrastructures as much as possible, with the data remaining in Europe. We want to prevent the payment system from suddenly breaking down when the American president makes a turn to the left or right. Initially, EPI will still use the contactless kernel from Mastercard or Visa, which is already in all terminals. The idea is that within five years we will have an agnostic kernel rolled out across Europe.

We can become a member of EMVCo or the PCI Standards Committee ourselves, so that we can participate in this and adapt to those standards, but we will avoid any dependence on the Big Tech companies for the operation of the system. This does not exclude the possibility that we cannot also have the EPI cards work via Google Pay or Apple Pay.’

Q: The European Commission has applied pressure to take this initiative. EPI is in line with the new EU policy to stimulate European giants in many areas, such as microprocessors and batteries for EVs. Will the involvement with EPI remain the same now that the Interim Company has been founded?

‘The idea of European sovereignty is of course important to the European Commission. Consider the time President Obama ordered that no payments with Mastercard or Visa were allowed to Wikileaks. It may well be that we in Europe want to decide for ourselves who may or may not be paid.

This is an important project for the European Commission and so contacts remain intensive. The DG COMP monitors whether EPI adheres to the competition rules, whether the market is not shielded from players outside Europe and how a subject such as interchange is dealt with. DG FISMA is helping by speeding up the roll-out of Instant Payments in countries that are not yet ready to do so. So that by the end of next year, the basic infrastructure will also be available in the smaller countries to run EPI. That is one of the key points in the recently published Retail Payments Strategy.’

Q: How are the other Dutch banks involved in EPI?

‘At the moment, the other banks are involved through the Dutch Payments Association. It is important for ING that the other banks are also planning to become licensees of the EPI scheme by the end of 2021. It makes sense that there are all kinds of conditions attached to this: the efficiency and cost level that we have achieved in the Dutch market must not suffer. But without this explicitly stated benevolence, ING would not participate in the follow-up phase. For most Dutch banks, the greater reach of iDeal is a more important argument for participation than the replacement of their Maestro and VPay card base, which will logically be more organic.’

Q: What are the advantages for banks or other players to join as a shareholder in the EPI Interim Company before 2021?

‘Until December 2 this year, issuers, acquirers and other players in the payments value chain can still participate in the Interim Company. After that, you can also join the Target Company as a shareholder, but the greater financial risk for the Founding Members will in due course translate into more rights, such as a Board seat, golden shares, etc.’

Q: The 5 countries currently involved in EPI are Germany, France, Spain, the Netherlands and Belgium. It is striking that - in addition to Italian - no English banks are participating for the time being. Is this because they have not been approached because of the UK’s status as a non-member state?

‘It has been decided to limit ourselves in phase 1 to euro countries. From Italy, Unicredit has meanwhile been involved, but it is true that the Italian banks’ priorities were different, especially after the country was so hit by covid-19. We are currently talking to, for example, a number of Spanish and Portuguese banks whether and when they would like to join. Meanwhile, the Governing Council of the ECB and the central banks are encouraging banks to get involved.’

Q: How does EPI want to realise international payments outside Europe?

‘We expect that EPI can be used to pay anywhere in Europe, but the EPI cards will initially remain co-branded with Mastercard or Visa, so that you can continue to pay and withdraw money with your EPI card outside of Europe.’

Q: The proposition promises an easy transition for both consumers and merchants. Do you expect that the various parties in the payment chain(s), such as issuers, acquirers, terminal suppliers and PSPs, will all benefit from EPI? Are there other players who need to be persuaded to make the necessary investments to become EPI certified and migrate volumes? What is the business case for, for example, PSPs?

‘Certainly for the national card schemes, a new AID (6) will be introduced and they will switch schemes on a certain date. On the cards side, the adjustments are also limited and can be resolved by means of software downloads. On the e-commerce side, there will need to be enough PSPs willing to support the product from the start. This will probably work if sufficient numbers of consumers are enabled.’

Q: For the time being, the focus seems to be very much on the back end: instant payments and APIs to the banks. But will EPI also become disruptive, in the sense that there is a fundamentally different UX (for consumers and / or merchants)?

‘I think the motto is “first migrate - then upgrade”. In order not to lose customers in the transition, the first thing is: same UX, broader reach - in the next phase, the richer or better experiences will follow.’

Q: In pan-European initiatives like this, many different players from different cultures must find and understand each other, avoid irritation, agree on ambition levels, etc. Different national values can be a complicating factor in this. How do you deal with that? Is there explicit attention in the project organisation for potential misunderstandings as a result of cultural sensitivities, is this risk recognised?

‘That risk is actually not that bad. Most players at the table already know each other from the EPC or other international partnerships.

There are, however, major differences between European countries in what people are used to. The French cannot imagine people making a payment without the option of a chargeback, which also involves sharing something as confidential as an account number with the merchant. For the Dutch, on the other hand, it has been completely normal for years to conduct e-commerce transactions through iDeal, with SEPA as the underlying infrastructure, without chargeback. Germany is mainly Direct Debit oriented, with ELV in the stores. And PayDirect is also based on a Direct Debit.’

Q: Isn’t that where the biggest risks for EPI lie?

‘Indeed. Roughly speaking, I see two risks. The first is that we will eventually agree on all these points within EPI, but that it will take far too long, because each country wants to see its own local characteristics reflected in the new scheme. The second risk is the opposite: that we reach a compromise on the lowest common denominator, which means that we all agree, but which results in a Frankenstein-like product that insufficiently meets the customer’s needs.

I have the impression that all members are well aware of those risks.’

Q: For the time being, the focus seems to be very much on the back end: instant payments and APIs to the banks. But will EPI also become disruptive, in the sense that there is a fundamentally different UX (for consumers and / or merchants)?

‘I think the motto is “first migrate - then upgrade”. In order not to lose customers in the transition, the first thing is: same UX, broader reach - in the next phase, the richer or better experiences will follow. The aim is to bring value added services currently proposed by neo-banks and fintechs.’

- Google, Amazon, Facebook, Apple

- Baidu, Alibaba, Tencent, Xiaomi

- European Payments Council

- Pan-European Payment System Initiative

(5) On November 25, EPI announced the appointment of Martina Weimert as CEO of the Interim Company and Dr. Joachim Schmalzl as chairman of the board.

(6) Application Identifier

Read the original article here. Find out more about Connective Payments here.