For retailers, their employees, and consumers, holiday 2020 is going to be … well … it’s complicated.

Whether your customers celebrate the holidays by lighting a Chanukah menorah or diyas for Diwali, laying out a Kwanzaa Mkeka or rows of corn husks for Noche Buena tamales, hanging Christmas lights or just hanging at home hiding from a world suddenly invaded by fruitcake, eggnog, and ubiquitous, atonal carols, they are all looking for something during the holidays.

The trick, of course, is figuring out what “something” is. It’s easy to forget “consumers” are human beings, and human beings have their limits, and even during a pandemic, that still includes holiday season. So it comes as no surprise that COVID-weary consumers have rising expectations and will be less forgiving of retailers that fail to meet them.

Despite being one of the strangest years in memory, retail sales have remained remarkably stable and many categories have even trended up. This year, depending on which “experts” you listen to, holiday season—which either began on October 13 with Amazon Prime Day, or in November on Black Friday, or whenever, and extends until sometime in January—will be worth anywhere between one and four trillion dollars to retailers, roughly a quarter of which will be captured by e-commerce. Kearney Consumer Institute (KCI) research suggests that whatever those sales end up being, they will be split between “shoppers” and “buyers.”

Confusing “buying” and “shopping” threatens 2020 sales and long-term loyalty

This October, the KCI conducted its Shopper Experience Survey. The dominant theme emerging from the survey results was the clear dichotomy in consumers’ minds between buying and shopping.

In a normal year, we might define buying as the purely transactional, routine, and dispassionate acquisition of goods—common sentiment for our everyday purchases. Shopping is a more discretionary experience, characterized by high levels of emotion, a search for self-affirmation, and, often, an exercise in self-indulgence. But, thanks to the pandemic, emotions are running high among buyers and shoppers.

“I feel anxiety and fear when I have to shop … items I routinely purchase are always sold out or the store can’t get them.”

Buyers, previously forgiving during the throes of early lockdown, are now getting irrationally upset by delayed shipping times, service which does not immediately address their specific concern, labyrinthine return policies, out-of-stocks, or anything else that impedes their ability to easily, quickly, and efficiently get what they want whether that is a pear or a pair of socks.

Shoppers, on the other hand, start off as more emotional consumers. The combination of this inherent emotionality combined with holiday stress is bad enough, but when combined with additional COVID-related stress, it can become either a way to fulfill consumers’ wildest dreams or a recipe for total disaster.

emotionality combined with holiday stress is bad enough, but when combined with additional COVID-related stress, it can become either a way to fulfill consumers’ wildest dreams or a recipe for total disaster.

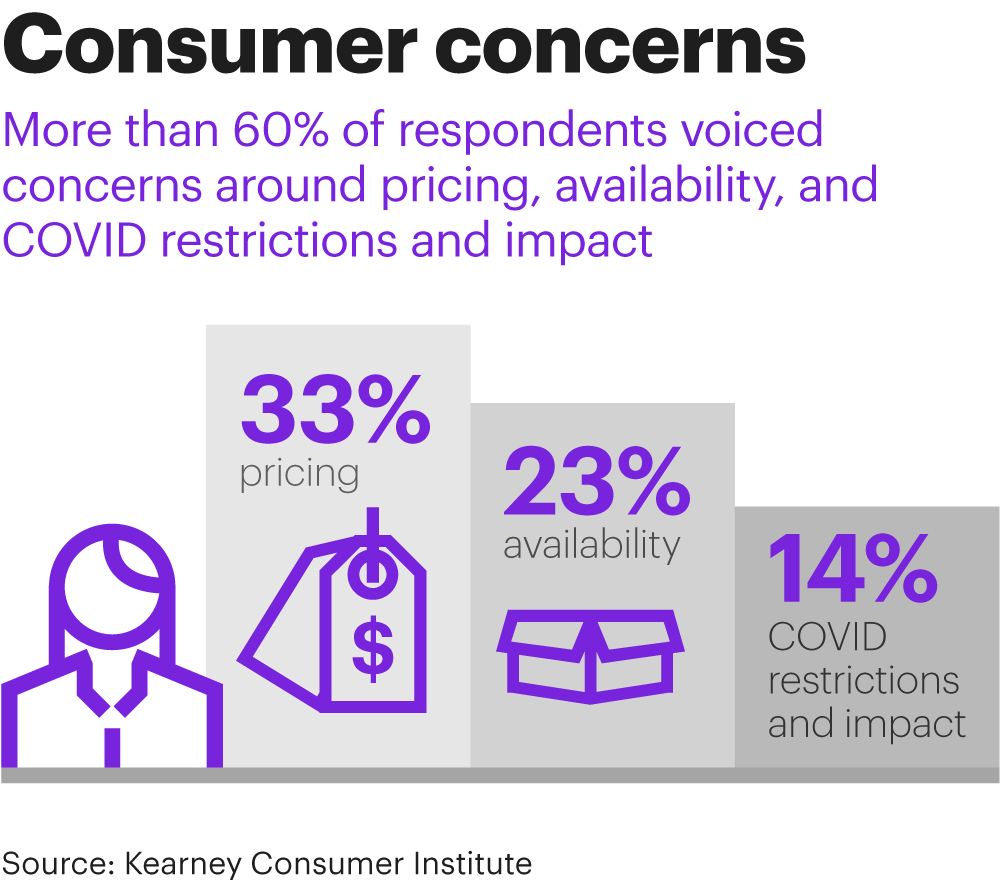

This year’s survey found more than 60 percent of respondents voicing concerns around pricing (mentioned by 33 percent of respondents), availability (23 percent), and COVID restrictions and impact (14 percent), reinforcing what most of us have experienced as consumers ourselves.

“The price of everything has gotten so high that I can’t afford to buy the things I bought before.”

KCI found respondents focused on a number of price-related issues. Looking at both the qualitative and quantitative responses, we were struck that what consumers were responding to wasn’t price as much as price perception. While this is no doubt always true, pandemic shopping has made the distinction between pricing and price perception even more crucial.

On a qualitative level, 24 percent of respondents said they perceived retailers might be raising their price or price gouging, but these seemingly dispassionate responses concealed a much more nuanced truth.

For example, respondents seemed to focus on total ring size, so consumers who, say, had routinely gone to the supermarket three times a week pre-COVID, and spent an average of $100 per visit, may feel “gouged” when they go to the store once a week and spend $300. Now add the fact that holiday meal bills tend to run higher in the normal course of events and—while maybe no one price has changed and their total spend hasn’t increased—their perception can be that retailers are trying to profit from the pandemic.

Some retailers, such as Best Buy, are offering reduced online holiday pricing in an attempt to reduce the in-store crowding many have come to associate with the holidays. Others are cutting out “door-buster” sales for the same reason. While these are laudable approaches aimed at protecting both customers and employees, they may reinforce the impressions—in some consumers’ minds at least—that the prices they are paying in brick-and-mortar retail are artificially inflated.

The customer may always be right, but retailers’ responses to them don’t come with the same guarantee. Failing to recognize this discrete set of consumer attitudes or, even worse, responding to one as though it were the other, can cost valuable holiday sales and erode long-term shopper loyalty.

Holiday inventories were, in most cases, purchased months ago, but there is still plenty of time for retailers to get themselves in position to maximize holiday sales. We are going to focus on a few crucial areas. It’s important that retailers address all of these, especially given the size of the holiday prize.

Putting the “happy” back into “happy holidays”

First, make sure all your technologies and systems—across channels—are running as seamlessly and efficiently as possible. Our rule of thumb is to be “ruthless” in your approach to technologies—in the sense technologists use the term. Determine what your core consumer value proposition is, and then automate as many activities as you can that don’t directly reinforce your position.

When it comes to selection, buyers and shoppers exhibit markedly different behaviors. Buyers hate it when the brands they regularly purchase aren’t available and easy to access in the most efficient manner possible.

Shoppers, on the other hand, want to … well … shop.

They love seeing the newest forms of technology, the latest fashions, or the hottest holiday food trends. They are willing to spend much more time browsing as long as that time is offset by high service level and a stimulating shopping experience. In brick-and-mortar stores this can look like everything from the ability to “treasure hunt” for surprising products and deals to virtual reality that amazes them. Online, this looks like website design and navigation that encourages browsing and product discovery.

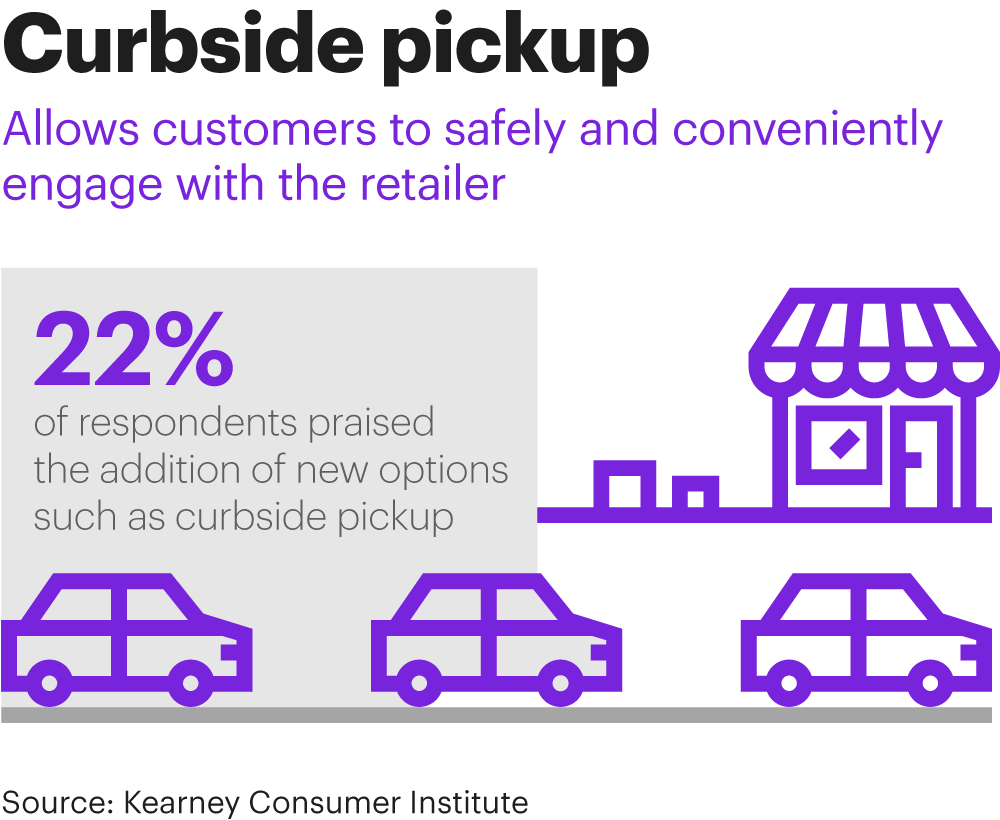

Service is perhaps the most crucial area. Most of us would concede COVID-related lifestyle changes have left our nerves a little worse for wear and our emotions sometimes too raw for comfort. Fourteen percent of survey respondents reported being disappointed in retailers on a variety of service-related levels. Conversely, 22 percent of respondents praised the addition of new options such as curbside pickup, which allows them to safely and conveniently engage with the retailer.

our nerves a little worse for wear and our emotions sometimes too raw for comfort. Fourteen percent of survey respondents reported being disappointed in retailers on a variety of service-related levels. Conversely, 22 percent of respondents praised the addition of new options such as curbside pickup, which allows them to safely and conveniently engage with the retailer.

Buyers are looking to retailers for higher-than-ever levels of professional competence and executional efficiency. Shoppers are hoping for in-person customized service that affirms them as individuals. For both groups, respect is the bottom line.

Bringing profits home for the holidays

It is never too late to begin retraining your sales force to address changing consumer definitions of—and demands for—service. If your clientele are primarily “buyers,” make sure everyone involved in ordering, fulfillment, and returns understands what your customers want: efficiency, seamless transactions, prompt shipment, and polite and rapid resolution of returns.

“Online retailers have offered exceptionally wonderful customer service lately, with issues being resolved efficiently in a friendly manner.”

If the majority of your customers are “shoppers,” reinforce the importance of high-quality, personable, and respect-based service. Consider personal concierges and flexible return policies.

Reevaluating these core areas—technology, selection, price, and service—won’t guarantee you’ll have the greatest holiday season in your history, but ignoring them will guarantee you won’t be getting even your fair share of what promises to be record holiday sales.

Authors: Greg Portell, Partner & Katie Thomas, Lead, Kearney Consumer Institute

Read the original article here.