Discover the benefits and drawbacks of implementing continuous integration and continuous delivery for FinTech companies

It’s no secret that to stay competitive, FinTech companies have to consistently support innovation. This includes following the best modern development practices. Continuous integration (CI) and continuous delivery (CD) are among the hottest trends in software development. But does the CI/CD approach suit large data-focused FinTech applications? Let’s find out what CI/CD has to offer financial services companies.

In this article, you’ll learn:

- What is continuous integration and continuous delivery

- The advantages of CI/CD for FinTech

- The disadvantages of CI/CD for FinTech

- The main problems that occur with continuous integration and continuous delivery

- Why DevOps is an unusual practice for FinTech

- Intellias’ experience implementing CI/CD for FinTech companies

What is CI/CD?

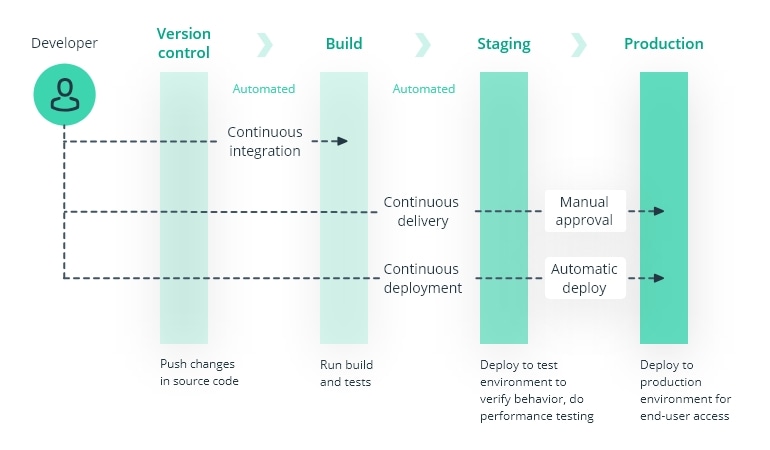

CI/CD stands for continuous integration and continuous delivery/deployment. Continuous integration means that developers frequently integrate their code into the main branch. Every change in the application first passes a number of automated tests and only then gets into the build. This helps to avoid integration hell and find problems in software early on.

What’s more important, continuous integration makes continuous delivery possible. CD is a set of practices that speed up the software life cycle. In other words, CD allows product releases to happen more frequently. CD pushes the build further to delivery environments. And just like CI, it’s a largely automated process that involves quantifiable risks. But continuous delivery doesn’t necessarily mean continuous deployment. Putting the release into the hands of users is still a manual process. By contrast, continuous deployment is fully automated. Essentially, every update to the build gets into production right away.

Let’s take a look at how continuous integration, delivery, and deployment differ. They each take place at different stages of product development.

Continuous integration, delivery, and deployment explained

The CI/CD benefits for Fintech

Now, let’s look at the CI/CD advantages for FinTech.

Faster time to market

The important business benefit of continuous integration and continuous delivery is the speeding up of he whole development process with FinTech developers. If you have to launch a FinTech application in a short time, CI/CD will be suitable. According to McKinsey, with CI/CD, companies can move code to live production in 15 days instead of 89 days on average.

Flexibility and responsiveness

The fact is that CI/CD allows not only weekly but even daily software releases. Continuous delivery in FinTech makes application updates faster. And this makes introducing new features easier. More importantly, with CI/CD, developers can fix issues rapidly. In case of application failure, traditional manual development isn’t an option for a FinTech company. Clearly, when an application needs a critical fix, delays aren’t acceptable in the financial industry. The solution lies in implementing a CI/CD pipeline that allows quick software delivery. This practice helps FinTech companies stay flexible and responsive, meaning more satisfied customers.

Increased productivity

Implementing CI/CD allows the development team to stay more productive. CI/CD in FinTech eliminates rework and wait time. Thanks to the automation of routine processes, software developers can focus on other more crucial tasks, such as ensuring code quality and security.

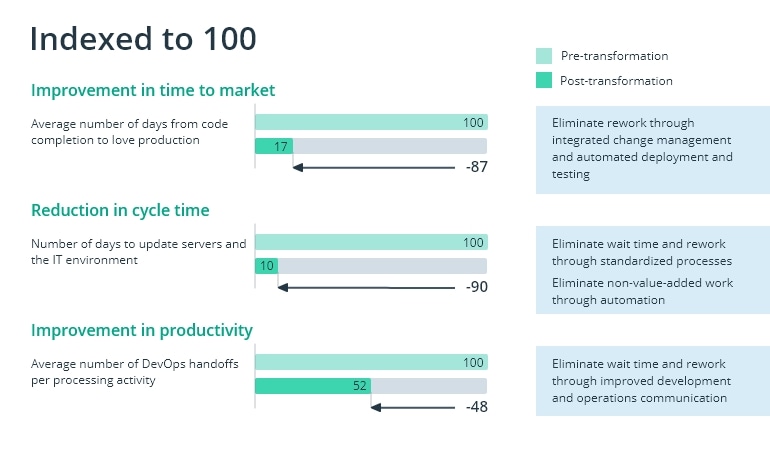

The adoption of DevOps helps companies shorten the software development cycle and time to market while improving productivity.

The value of adopting DevOps

Source: McKinsey Digital

Product quality

Another benefit of continuous integration in the FinTech industry is that it also reduces risks and failures. Since the development process is largely automated, it’s also more reliable. Errors are detected early in development and potential risks are calculated, making it easier for developers to control them. An error-free release is especially important for FinTech companies since they have a lot at stake. Even a small failure can cost millions of dollars and make customers question the reliability of your FinTech service.

The CI/CD advantages and disadvantages for FinTech

But let’s be honest: no one is perfect, not even those hyping continuous integration and delivery. Let’s take a look at the cons of CI/CD for FinTech.

The cost of transition

Implementing continuous delivery in FinTech requires a lot of effort, time, and money. Changing the workflow, automating the testing process, and putting your repositories in Git are only some of the processes you’ll have to handle. The good news is that all of them can be dealt with. But beware: Transitioning your in-house development team to CI/CD will not come cheap.

Hard to maintain

On top of that, it’s not enough to just implement CI/CD practices; they require constant support. This can be hard for large financial organizations that offer diverse services. Such FinTech companies will have not one but several pipelines, some of which may even end at different delivery stages. This makes it difficult to compare the throughput and cycle times.

What are the problems with CI/CD for the financial industry?

Sadly, these drawbacks are not the only obstacles to successfully implementing CI/CD in FinTech. Legacy application architecture and the lack of a compatible development culture can stand in the way too.

Legacy architecture is a pain for many FinTech services. As soon as an application grows large enough, it can’t stay flexible or scale anymore. Unfortunately, implementing FinTech CI/CD won’t come easy in these cases. In fact, an application’s architecture can be a critical barrier in moving to CI/CD.

Lack of development culture is another challenge for continuous delivery in FinTech. Adopting CI/CD requires changes in the organizational culture of development teams. In other words, FinTech CI/CD won’t be successful if there’s no commitment to it. For instance, there can’t be any benefits of continuous integration if your developers forget to commit to the main branch frequently.

Why is DevOps an unusual practice for Fintech?

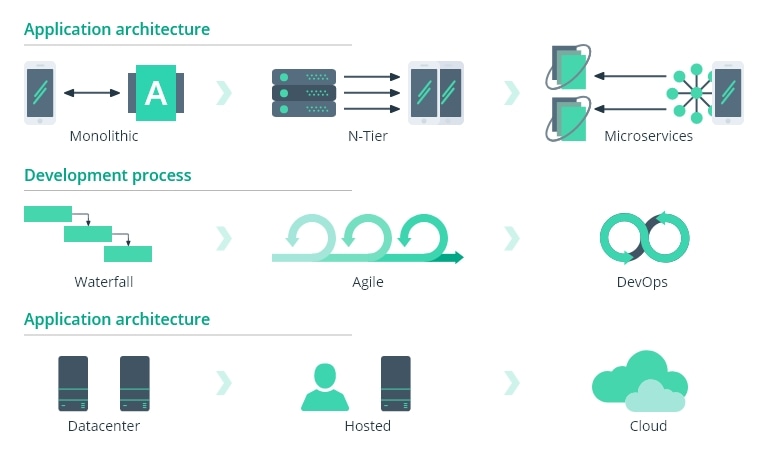

While continuous delivery focuses on the automation of software delivery, DevOps involves many other processes. Along with automation, it focuses on monitoring and cultural change in the organization.

DevOps is the latest step in the evolution of the development process for FinTech.

Source: A DevOps State of Mind: Continuous Security with Kubernetes

Currently, DevOps seriously lacks popularity in FinTech. Why?

It’s simple: DevOps requires companies to make broader, more systematic changes than implementing Agile. The transition to DevOps affects interactions among software development teams, IT operations staff, and business stakeholders. Naturally, many FinTech companies don’t want to take such a risk.

Moreover, the DevOps model doesn’t suit applications with a legacy technology stack. Among banking systems, 43% are still written in COBOL. Because of that, some mechanisms that support rapid development may not be successful. In this case, the traditional split of roles in the development process is more preferable.

Intellias experience in FinTech CI/CD implementation

Intellias has been using DevOps and cloud development services since they were first introduced in the mid-2000s. Take a look at how we’ve helped several FinTech companies benefit from modern software delivery practices.

- Intellias helped Germany’s leading online loan comparison platform to develop backend components. Having analyzed continuous delivery benefits we adopted a CD model and provided timely product shipment to meet our customer’s specific needs. Throughout the development process, we controlled defects during the build and integration sprint cycles. Thanks to CI/CD practices, we maintained superior code quality, optimized the development process, and ensured frequent product delivery.

- EveryMatrix, a B2B iGaming solutions provider, faced scalability and flexibility problems with its online service. Its platform’s monolithic architecture made continuous deployment, 24/7 availability, and adoption of new technology impossible. Now, Intellias is helping EveryMatrix move from their legacy platform to a new sports betting software platform. This migration process has CI/CD at its core. The result is a multi-component architecture that makes introducing new features quick and cost-efficient.

- Although DevOps isn’t popular with FinTech, in some cases you just can’t ignore it. For instance, one of our German customers needed to develop a platform for optimizing working capital. In this case, our DevOps engineer was responsible for infrastructure configuration and automation. Thanks to automated processes, we were able to quickly react to business ideas and client requests and deliver new features in time.

CI/CD is a modern standard for software delivery. But in the financial industry, CI/CD has its peculiarities. Yes, there are many benefits of using CI/CD for FinTech. It ensures high product quality and speeds up time to market. Also, the FinTech CI/CD pipeline increases a service’s flexibility and helps the development team stay productive. But you have to keep in mind that transitioning to continuous delivery in FinTech is complicated. It requires a lot of effort and involves some risks.

The main problems with CI/CD for the financial industry include legacy infrastructure and the lack of a suitable development culture. And because it’s risky, FinTech companies hesitate to implement DevOps practices in their organizations.

Author: Anna Oleksiuk

Read the original article here. Find out more about Intellias here.