Abstract

Prudent investors should be preparing for a potential market downturn in the next years as central banks attempt to walk back the aggressive monetary policies used in the last decade to help economies to recover from the great financial crisis of 2007-08.

Typical investment portfolios have large allocations to equities and therefore are positioned to suffer the most in case of a broad market recession.

Brickken empowers small investors by allowing them to diversify their portfolios optimally by enabling investing in different asset classes like real estate, art, infrastructure, intellectual property, etc. with as little as €100. This way, even the smallest portfolios (less than €10,000) can enjoy the benefits of full optimal diversification like institutional players or high net worth individuals.

These asset classes are uncorrelated to equity markets (i.e. the performance of one asset class has no influence in the performance of other asset class) and provide excellent diversification exposure to all investment portfolios.

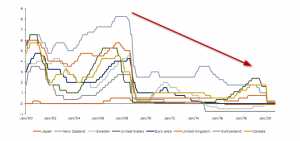

Central banks have undertaken the most aggressive monetary policy in history

The last decade in financial markets has been dominated by the recovery of the great financial crisis from 2007-2008. This recovery has been characterised by the most aggressive monetary policy experiment undertaken by central banks in history. Central banks have been continuously decreasing interest rates for the last ten years in a synchronised manner. Interest rates have dropped to close to zero percent across most developed countries. On top of lowering interest rates, central banks have been purchasing debt securities from governments and, in some cases, from corporations as well.

Figure 1: Global central banks interest rate evolution

This has translated in artificially high equity market prices. This is because low interest rates force investors to seek more attractive returns elsewhere combined with central banks support to corporations through the acquisition of their debt securities.

What does this mean to your savings?

In a very simplified way, the interest rate established by a central bank is the benchmark rate that retail banks (the ones you have your deposit accounts with) will use to establish the interest rate they will charge for the money your borrow, but also to establish the interest rate you will receive on your savings.

The lower the interest rate established by a central bank, the lower it is to borrow money, but also the lower the interests you will receive on your savings.

What is the problem with close to zero interest rates?

In principle, there should be no problems with close to zero interest rates. The problem appears when close to zero interest rates are kept perpetually and central banks are “trapped” in this environment because, as soon as they start increasing interest rates back to pre-crisis levels, the economy cannot handle it and collapses. This is exactly what is happening nowadays. Central banks attempted to normalise interest rates in 2016 and equity markets across the world suffered the worst contraction in years afterwards.

What happened to equity valuations during these period of low interest rates?

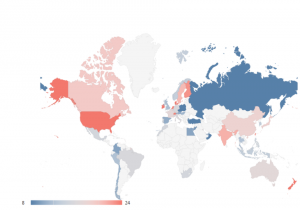

This exercise of reducing interest rates and keeping them low for longer, has translated in artificially high prices across most equity markets. The map below (Figure 2) displays current valuation measures in different regions using the well-known Shiller-CAPE measure. The Shiller-CAPE is a measure of current level of valuation based on a number of metrics (see research here). The highest the valuation, the lower the next 10-year returns in stock markets. The map clearly shows overvaluations in US equity markets and other markets like Ireland, Denmark, New Zealand, etc. Not surprisingly, the markets with least stretched valuation metrics are the least favoured ones in the most recent equity bull market: Russia, Greece, Poland, Spain, etc. Markets with Shiller-CAPE between 0 and 15 typically present a return of 8%-10%. Markets with a Shiller-CAPE above 20 present returns of 5% of lower, and even negative. According to this measure, a typical equity investment portfolio with major allocations to US markets could present an adjusted returns over the next 10 years close to zero, and potentially negative. This is the result of excessively inflated financial assets and overly optimistic earnings growth expectations by companies, among other factors.

Figure 2: Global market valuation (Shiller-CAPE); source: Star Capital

At current levels, equity markets are priced for perfection over the next years to come.

The key to avoid falling in a potential recession in financial markets is diversification. Diversification is a risk management strategy that involves investing in a mix of distinct asset types in an attempt at limiting exposure to any single asset class or risk. (In other words, “don’t put all the eggs in the same basket”). A portfolio constructed of well differentiated asset classes will, on average, generate higher long-term returns and reduce the risk of any individual investment. Also, diversification implies that an investor does not allocate excessive weight to any single asset class, or she will be excessively exposed to that particular asset class.

One of the problems with an optimal diversification is that it requires large amounts of capital. However, most small investors do not have large amounts of capital to invest, and some of the best asset classes to diversify away risks are inaccessible to them. For instance, investing in property demands large amounts of capital. A typical family that acquires a property spends around 30 years paying off the mortgage and, automatically, such property becomes the largest asset on their investment portfolio for the rest of their lives. This is extremely poor diversification! And this is why so many families suffered during the great financial crisis of 2007-08.

The right diversification strategy would involve having, for instance, similar capital allocations in equity, fixed income, property and other asset classes.

The problem is that today this is not possible to do! You cannot allocate a few thousand euros to a property. Either you buy the whole property or you don’t.

Brickken enables small investors to create well diversified portfolios

This is where Brickken comes in. Brickken’s platform allows for fractional ownership of properties and invest as little as €100 per property. Once you have invested in one property, you will receive your share of the property’s revenues depending on your ownership of the property. It is like investing in stocks, but in real assets. This is done through the process of tokenization, and by using blockchain as the underlying technology.

Now you can diversify your investment portfolio in the right way and avoid being excessively concentrated in equity markets or any other asset class. And vice versa, you don’t need to buy a house with your life’s savings as an investment and not invest in other interesting, and potentially more attractive, asset classes.

Conclusion

As we have seen, the reckless activity of central banks across the world during the last decade, have translated in excessively inflated equity markets that are priced for perfection and that expect central banks to keep their interest rates low. Should these expectations reverse, equity markets could suffer a strong recession that would destroy the savings of the investors that have not well diversified investment portfolios.

Brickken allows small investors to invest in asset classes that were not accessible to them before due to the large capital requirements needed to invest. Brickken’s platform will allow you to invest in real estate, art, intellectual property, infrastructure, and other asset classes with as little as €100.

Now you can create a well-diversified portfolio like the biggest institutional players and richest people in the world do, without needing millions in your bank account.