In brief

- Accenture’s global Insurance Consumer Study provides a view of consumer preferences and trends in insurance.

- We suggest a fresh look at how to meet the needs of generational segments, who have differing views on technology-enabled insurance services.

- Insurers can also offer usage- and behavior-based insurance to better personalize and target offerings, meeting consumer demand for better value.

- It’s also time to re-evaluate the role of humans in insurers’ digital ecosystems, to restore trust and better engage consumers.

The future of insurance

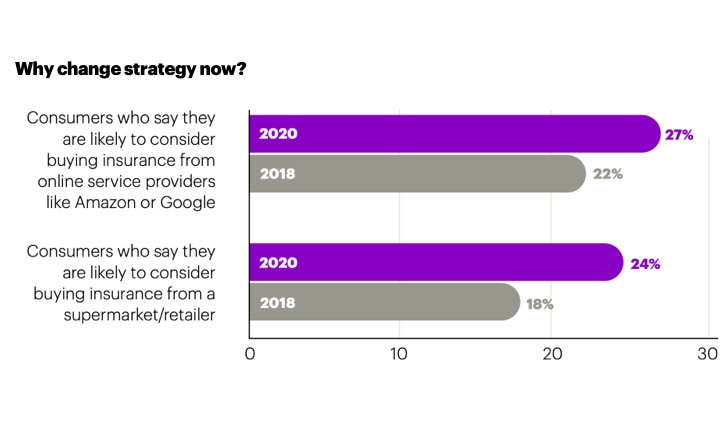

The future of insurance depends on exploring new models of doing business to ensure relevance. Business models that capitalize on the benefits technology can bring for insurers while meeting a changing set of consumer demands will help insurers not only to remain relevant, but to grow. A recent Accenture insurance survey of 47,810 respondents across 28 global markets points to three key areas where C-suite leaders can take action to address these insurance trends.

#1 Re-evaluate digital services with a generational lens

#1 Re-evaluate digital services with a generational lens #2 Personalize consumer offers

#2 Personalize consumer offersOffer usage- and behavior-based insurance to better personalize and target offerings, meeting consumer demand for better value.

#3 Restore trust with digital and human interaction

#3 Restore trust with digital and human interactionThe right human + machine mix restores consumer trust and better engages them.

Addressing generational consumer differences

Technology is a lifeline to increasingly digital insurance consumer segments. COVID-19 accelerated the transition to digital in 2020 across all demographic groups. However, clear differences in generational appetites for digital offers emerged.

Millennial and younger consumers, age 18-34 express greater interest in digital offerings that help them make safer, healthier, and more sustainable choices. Insurers will need to work with ecosystem partners to create and participate in digital platform offerings that help them succeed with this segment. From fitness devices that track and encourage healthier habits, to companies that offer coaching in nutrition or stress reduction, insurers have a wealth of partners to choose from to help their customers. And with a market value of $1.3 trillion in global health and wellness by 2024, ecosystem investments are well worth it.

This same demographic (age 18-34) values sustainability. Insurers are already well positioned on this with 71% of Millennial and younger consumers saying they see their insurers delivering on ethical and sustainable business practices. More than two-thirds (67%) say they want digital experiences that encourage sustainable travel and shopping practices.

Consumers age 55+ are slowly becoming more comfortable with digital insurer interactions. They show increasing preference for digital claims, with 71% saying they would like the internet chat/video insurance claim process to replace the traditional in-office claim process—an increase of 3%.

Approximately 7 out of 10 (69%) consumers would share significant data on their health, exercise and driving habits in exchange for lower prices from their insurers, an increase of 19% from two years ago.

Offering personalization per habits and usage

Consumers say they are more willing to offer personal data in exchange for more personalized pricing, offers, and discounts. They are increasingly demanding to be charged based on behavior and habits—and they’re willing to allow insurers to collect and use their data in exchange for that value. Consumers are being pragmatic and protective with their data, however. They say they will only share data for incentives; they show no increased willingness to share data without those incentives.

Approximately 7 out of 10 consumers (69%) would share significant data on their health, exercise and driving habits in exchange for lower prices from their insurers, an increase of 19% from two years ago. More consumers (66%) would also share significant data for personalized services to prevent injury and loss—up 54% from two years ago.

29%

of consumers who can drive expect to drive less in the long-term than they did before the pandemic.

In the auto insurance space, consumers look for personalized offers in the form of usage-based or “pay-as-you-drive” auto insurance. Twenty-nine percent of consumers who can drive expect to drive less in the long-term than they did before the pandemic. They will expect their rates and plans to reflect their new habits.

Consumers are being pragmatic and protective with their data. They say they will share data for better value; they show no increased willingness to share data without an incentive.

Trust and engagement in a human + machine world

Achieving the right balance between digital and human interaction matters more than ever. For example, while consumers are interacting more and more in the digital realm, particularly during COVID-19, they still view human touchpoints as more trustworthy than digital touchpoints when they are in need. Almost half (49%) say they place a lot of trust in a human advisor in an office when making an insurance claim, while only 12% say the same of automated service over phone/web/email, and just 7% say the same of a chatbot.

Training and skilling an insurance workforce that works well with digital tools will be essential for success. Insurance can be an emotionally complex business for consumers—they need the freedom to choose methods of interaction most comfortable for them.

Trust levels: Insurance customers are interacting more and more in the digital realm, particularly during COVID-19, but they still view human touchpoints as more trustworthy than digital touchpoints when they are in need.

- 49% of insurance consumers trust a human advisor when making a claim.

- 12% of insurance consumers trust an automated phone/web/email service when making a claim.

- 7% of insurance consumers trust a chatbot when making a claim.

What matters to your insurance customer?

There’s no doubt that the effects of technology are disruptive. But insurers can harness that disruption to better connect with consumers for positive business impact.

New models of doing business that capitalize on how technology helps insurers meet changing consumer demands are essential. Consider with your team how those models may be applied based on your existing book of business and unique market positioning.

By focusing on the areas our research highlights as important for insurers’ growth and relevance, you can lead your team into the future of insurance now.

We’re here to help.

Read the original research here. Find out more about Accenture here.