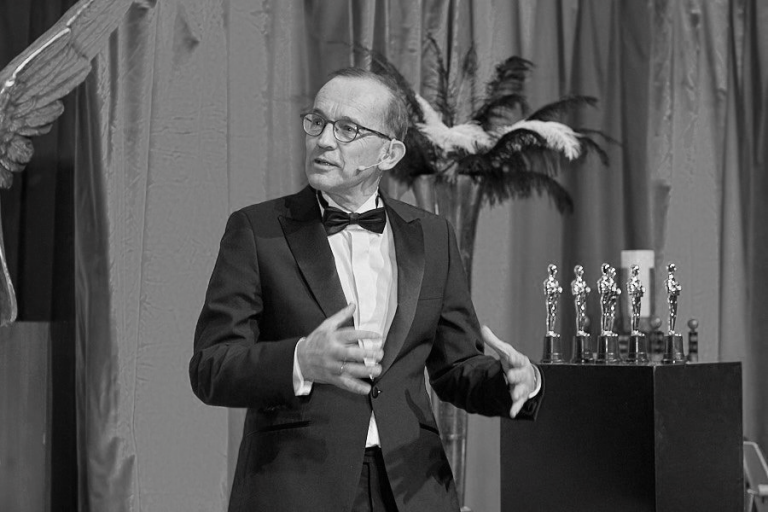

On February 11, the Dutch payment industry said goodbye to one of its most prominent players. Piet Mallekoote, since 2006 CEO of Currence and since 2011 of the Dutch Payments Association, is leaving the playing field in which he has personified the importance of collaboration for 17 years.

17 years of collaboration

After 25 years of employment at DNB, where he held various managerial positions, he was asked to join the board of Currence in 2004. That was during a turbulent period. Payments processor Interpay (now Equens Worldline) and its shareholders, the Dutch banks, were at odds with the retailers about the pricing of debit card transactions. The Dutch competition authority NMA imposed heavy fines for violation of competition rules.

One of the measures the banks took to settle the matter was the establishment of Currence. That company would from now on be the proud product owner of the collective Dutch payment products: PIN, Chipknip, Acceptgiro, Incasso and the new iDEAL, which was announced almost the same time. Currence became a licensor and focused on matters such as coordination, representation, professionalisation, recording of rules & regulations, standardisation and fraud prevention. Collaboration became the new leitmotiv in the Dutch payment landscape: in 2005 banks, retailers, the catering industry and the oil industry closed a Payment Services Covenant, and the “Stichting Bevorderen Efficient Betalen” (Foundation for the Promotion of Efficient Payments) was founded.

Only shortly after its establishment, the economic base of Currence was threatened by SEPA. The end of the magnetic stripe around 2010 marked the end of the PIN brand that disappeared from the Dutch debit cards. Maestro, until then used for cross-border payments, became the flag with which the new “pin” (with lowercase) was adorned. European alternatives, SEPA Credit Transfer and SEPA Direct Debit, were also being developed for the domestic products Overschrijving and Incasso. Because a form of governance and coordination was also required for the new international products, the Dutch Payments Association was founded in 2011. Piet Mallekoote became Managing Director and subsequently combined both functions.

Time for an interview

We interviewed Piet Mallekoote just before his farewell. What was it like to lead Currence and the Payments Association during those 17 exciting years? What is he most proud of and what were the main challenges? During the interview it appears that he does not like to put himself in the foreground. And his answers reveal, in addition to extensive knowledge, a fascination for economic theory. To our first question, how he experienced the hectic period surrounding the foundation of the Dutch Payments Association, he first takes a step back. Because in order to understand its role in the development of the Dutch payment industry, we must first discuss the importance of cooperation.

Limiting transaction costs

In 2011 you were asked to become CEO of the Dutch Payments Association in a period when everything changed with SEPA. How did you experience that period?

“It might be good to take a step back first. My role is mainly about collaboration. The importance of collaboration is often underestimated. Science suggests that transaction costs are of paramount importance in the economy. If you want to limit transaction costs, the only way to do that is together. This is not only the case in the payment system, but in all sectors of the economy. You can limit transaction costs, for example, by agreeing standards. For that to happen you need an organising institution, commonly called a “linking zone”, “platform” or “scheme”. This institution brings parties together to reach consensus and take decisions to limit transaction costs. In essence, that is what also happens in the payment system.

In addition, the payment system, unlike the mortgage market, for example, is a two-sided market. With a payer and a receiver, and the two banks, the issuer and the acquirer, that handle the payment on their behalf. Those parties have partly conflicting interests in the transaction. The only way to reduce the overall costs in that situation, and to create the conditions for innovation, is cooperation. That is how you should look at the role of Currence, as scheme and product owner, and of the Payments Association as facilitator. Also towards the many stakeholders of the payment ecosystem, because in this two-sided market the representatives of consumers and retailers, politics, the media, etc. influence the outcomes. The importance of this has only grown over the past decade because the number of stakeholders in the payment chain has increased significantly. Since these must all be connected to each other, an organised collaboration is very important to save costs.

During my time at Currence and the Payments Association, a lot of attention was paid to organising this properly.”

SEPA Cards

In the context of SEPA Cards at the end of the first decade, the PIN brand was exchanged for Maestro. Did your relationship with the banks change as a result?

“When it became clear that the banks were individually going to opt for Maestro as the new debit card scheme, I found that in itself a bit sore. Meeting the request from the banks to help manage the migration to Maestro initially felt a bit awkward. After all, the responsibility for hundreds of millions of transactions, and the tasks associated with them, shifted to a foreign scheme. Currence was more or less sacrificed and at the same time asked to cooperate generously in the transition. Nevertheless I thought: let’s do that anyway. After all, it was an exciting assignment to coordinate the technical migration to EMV and to persuade the merchants. Their mistrust had to be removed, we had to prevent a dip in the growth in the number of debit card payments at the point of sale.”

As a new player, the Dutch Payments Association took over tasks from Currence, the NVB and the banks and started to play an important role in the “Maatschappelijk Overleg Betalingsverkeer” (MOB, Social Forum on Payments). Was it clear to everyone who was doing what in that first period?

“Currence had already played a role in the creation of the Payment Services Covenant and the “Stichting Bevorderen Efficient Betalen” in 2005. Much of our work had already been devoted to promoting debit card transactions, for example for low value payments, with the successful “Klein bedrag? Pinnen mag!?” campaign. Currence played a coordinating role in reducing fraud and increasing security in the payment system. In short, the role that I was going to play as CEO of the Dutch Payments Association partly overlapped with my role as CEO of Currence. Occasionally I did have to explain which hat I was wearing, that of scheme (Currence) or facilitator (Payments Association). I have always been critical of myself to properly separate these roles.”

Did that go well from the outset, and have there been other options on the table to organise the “linking zone”?

“In 2009, the banks started an investigation to look at the future design of the payment system. Ultimately, an association turned out to be the best option to join forces. I remember that at the time the option was also on the table to transfer all coordinating responsibilities to the Dutch Banking Association (NVB). However, there were drawbacks to this. The NVB is an interest group for banks, payment institutions would not fit in. Moreover, the NVB has such a wide range of files at hand: mortgages, savings, securities. There was a need for a separate entity in which all knowledge and expertise in the field of the product features and the infrastructure of Payments, let’s say the utility functions, was housed.

In January 2012 we started the Payments Association. Initially, this did not go entirely well because some responsibilities remained with the NVB and Currence, particularly in the field of security and strategy. In practice, this meant that the Advisory Council of the Payments Association, and the Payments Committee of the NVB, partly met on the same subjects. It was sometimes completely unclear to the outside world for which subjects they had to be at the Payments Association, the NVB or Currence. At the end of 2013, we therefore decided shift completely. Gijs (Boudewijn) and his team came over to the Payments Association and since then the association has been the only party coordinating the utility functions in the payment system.

Payments are what you call “sticky business”, you are not the only one who has been involved in that profession for a long time.

“I have indeed been in it for a long time, and that in itself is not for me, but the dynamics in the payments system means that every day is different. Never a dull moment.”

You started this interview advocating collaboration with the aim of lowering transaction costs. At the same time, people often complain about the slow pace of the decision-making process, double agendas, etc. Your role was to provide the interbank cooperation with a dash of Haarlem oil, as they say in Dutch.

“Banks have different strategies and visions, and that makes it difficult indeed. If an individual bank develops a product, it can proceed faster, but to achieve sufficient scale and reach, you have to make collective agreements quickly. Sometimes this was difficult, such as with the Payments 2.0 program, which ultimately failed because not everyone agreed. Incidentally, eMandates and iDIN have emerged as separate products from that program.

In some cases, such as at the start of Instant Payments, it was necessary to get to the bottom of differences of opinion before an agreement could be reached. Our role was always to facilitate and bring the parties together. I think that role came into its own particularly well in all forms of legislation and regulations that come our way from the broader ecosystem. How do we react to new European rules such as the Payment Accounts Directive (PAD) and the renewed Payment Services Directive (PSD2)? The only possibility to do this jointly if you have properly organised the collaboration. The idea being that you incur costs in advance that you generally earn back in the longer term.”

After the initial period around 2005, the Dutch payment landscape entered calmer waters.

“I think it is important to report on this that because of the diverging interests in the payments industry, emotions can sometimes run high. Keeping calm and monitoring is such a factor at the back that you cannot see, but when properly implemented it encourages more cooperation. That is a very relevant role for Currence and the Payments Association. Without saying so explicitly about myself, it worked out well.”

“Working together to (re)act on European regulations is only possible if you have organised the cooperation well.”

PSD2 and Open Banking

You mentioned PSD2 as an example. Compared to the UK, where Open Banking was tackled energetically from the outset by establishing a separate Open Banking authority, the Dutch banks have apparently approached PSD2 more as a compliance project. As a result, various technical solutions have been developed for API calls in practice. Leading to high transaction costs: every new entrant who obtains a PSD2 license will have to define its own API call for each bank. Time-consuming and expensive, and therefore an obstacle to innovation, which is what it was all about. Wasn’t there an opportunity for the Dutch Payments Association to define detailed technical standards for PSD2 messages, just like in the UK and New Zealand?

“That was discussed at length at the time, because it made good sense to define one collective API. However, the banks refused, for a variety of reasons, and in my opinion not all equally convincing. Ultimately, we ensured that the banks at least applied the Berlin Group’s Access to Account (XS2A) Framework, albeit each in its own way.

In the UK, the cooperation is more or less legally enforced, which means they have made more progress with Open Banking. On the other hand, England lags far behind the Netherlands in terms of functionalities and customer journeys for consumers. Here we have iDEAL and there seems to be less need for PSD2 for the time being. Consumers also indicate that they are not too keen to share their payment data with third parties, but that may be a matter of time. So yes, the UK is ahead with PSD2, but it is all still very early to be able to predict how PSD2 and Open Banking will develop in the future.”

iDEAL

Currence and the banks have announced a major overhaul of iDEAL under the name iDEAL 2.0. Is the PSD2 rails going to play an important infrastructural role in this?

“As the product owner of iDEAL, we certainly have to take into account parties that wish to use the PSD2 (PIS) rails. In that context, it is also exciting for iDEAL what is happening in Europe with the new SEPA Request to Pay (SRTP) functionality. Incidentally, the PSD2 rails are already being used in the iDEAL Scheduling pilot.”

What do you consider Currence’s greatest successes?

“I consider “pinnen” to be a great success, in the broad sense of the word, so debit card payments, separate from the PIN product. All the work that we have put into stimulating debit card payments together with the retailers has paid off: the point-of-sale payment system has become much, much more efficient in those 17 years. And of course iDEAL. That is without a doubt a very successful product. In 2020 we had almost a billion transactions.”

Looking at the growth curve of iDEAL, you can see that it took a few years to take off. In the first eight years, the number of transactions grew to 143 million in 2013, while 890 million was reached in 2020. During the first years, did you ever doubt whether iDEAL would skyrocket?

“In the early years we did worry about the transaction numbers. But iDEAL was really a popular product: it was supported from the outset by the home shopping industry and the Consumers’ Association also demanded a safe online payment product. The growth of iDEAL kept pace with the development of e-commerce, which of course went very fast at one point. In addition, PSPs entered the market, adding iDEAL to their range and applying it more widely outside of e-commerce for services such as invoicing and ticketing. PSPs were adding iDEAL to foreign web shops selling goods to Dutch customers. All these developments together have led us to consider annual growth rates of 30% and more to be normal. The expected flattening the curve did not materialise. And 2020 was of course, partly as a result of the lockdowns, an exceptional year for iDEAL, with 35% growth. Convenience and confidence are crucial factors in that success.”

“We expected the growth of iDEAL to level off at some point, but it went on and on: about 30% more every year.”

One of the initiators of EPI, Eric Tak, told us a few months ago that he expected iDEAL to be phased out in 3, 4 years and replaced by a new EPI product. How should we reconcile this with the announced investments in iDEAL 2.0? Could iDEAL form the basis of the online payment solution that is being considered in the context of the EPI?

“Eric may be a bit ahead of the facts, but it could well be that the scenario he sketches is indeed the reality. At the same time, we hope with all efforts in iDEAL 2.0 to have a chance to work with EPI. IDEAL is by far the largest European online payments product. If EPI were to embrace iDEAL, they would have a billion transactions in one fell swoop. No other European product for online payment comes close to this. And with the new infrastructure and new customer journeys, iDEAL is a wonderful party to work with.”

Will national sentiments still play a role in this? For example, how do French banks view iDEAL?

“Those sentiments are certainly there. When I spoke at international conferences, everyone thought iDEAL was great. But when I tried to get foreign issuers interested, the “not invented here” syndrome often surfaced. If you keep looking at sentiments, I don’t think you will get much further. Ultimately, it is about the best solution.”

iDIN

With the product iDIN, you have invested in the subject of digital identity (eID). The use of iDIN is growing, but compared to DigID the numbers of 7.5 million transactions in 2020 are still very limited, and that also applies to the number of organisations using iDIN. Do you think iDIN has a fair chance in the long term to show the same kind of growth as iDEAL?

“It is very unfortunate that the Netherlands is at risk of lagging behind in the field of digital identity, despite its enormous potential. This has consequences for the reliability and security of digital services. Strange for a country that, together with the Scandinavian countries, is at the forefront of digitization. Compare that with a country like Sweden, with a few billion transactions a year to securely identify, log in and sign contracts.”

How come?

“iDIN is a relatively difficult product to sell. Consumers and retailers share the need to complete a payment quickly. iDEAL is a simple payment method that responds perfectly to that need. iDIN is less crucial to purchase for many retailers. After all, logging in with a username and password also works, although this means a lower security level. Until a hack takes place … But you can see that iDIN is still mainly used in environments where personal data and privacy are crucial, such as financial services and BKR.”

What about the applicability of iDIN in the (semi-) public domain?

“There are indeed conversations underway, but they are currently being hindered because the government is hugely shielding its own identification method, DigID. The result is that iDIN cannot be used in the public (BSN) domain. And vice versa, the public means may not be used in the private domain. What does that remind you of?”

Chipper / Chipknip?

“Exactly. The new law that regulating a multi-resources policy, the Digital Government Act, is still not there. I would be very much in favour of issuing some sort of BankID in the Netherlands, such as Sweden. That could greatly enhance digital security. The Netherlands is too small for two competing standards. We really need to organise this differently.”

Life after Currence

You are now saying goodbye to Currence and the Payments Association. What will you miss the most?

“The dynamics, the colleagues from the Payments Association and Currence (all super good people with a lot of knowledge and expertise in our field) and the colleagues from the banks, payment institutions and stakeholders. I have very fond memories of this.”

Do you already know what you will be spending your time on?

“To be honest, I’m so busy that I’ve barely gotten around to it. There are some things going on, but I haven’t made up my mind yet. Corona volente, I will first go on holiday for a few weeks. I do plan to do some other things for about three days. This can be in the form of advice, coaching or a supervisory board position. I think it would be nice to do something in the payment system, but it could also be something else.”

Aiming to promote cooperation?

(laughs) “That could well be.”

Read the full article here (in EN/NL). Find out more about Connective Payments here.