Lenders should treat the coronavirus crisis as an opportunity to unlock new pockets of growth by relaunching the loan origination process digitally

Lenders are in a tough position right now. The volume of non-performing loans has increased. Consequently, default rates have climbed while profits have stalled due to reduced consumer spending.

Compared with 2019, we think bank earnings will fall by a double-digit percentage — and perhaps by nearly 25% depending on how quickly banks can reduce their funding costs — solely based on lower rates.

S&P Global

However, to restart the economy, financial services providers must take on the role of credit hero rather than credit holdouts.

Of course, this is easier said than done. But to get moving in the right direction, financial institutions must ask truly tough questions:

- How can we re-assess credit underwriting? Can we balance the need for restarting loan origination against the future level of possible losses?

- Which customer products and demographics are the most impacted by stalled lending? How can Intellias help?

- How can we remain operational and serve customers when face-to-face meetings are not always possible?

- With the drop in interest base rates, how can we deal with margin pressure paired with higher funding costs?

While there’s no silver bullet to fix all of these issues at once, there is one technological fix that can relieve some of these mounting pressures — strategic automation of the loan origination process.

The pressing need for digitizing the loan origination process

In the current uncertain climate, banks have a limited view of a customer’s economic viability. At the same time, manual underwriting practices subtract from rather than add to a financial institution’s ability to effectively navigate the current credit crisis.

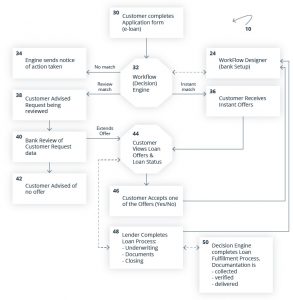

Automated loan processing systems are not a novelty. One of the first patents for a workflow engine providing real-time credit decisions was granted back in 2002.

Source: Google Patents

Such early loan origination systems relied on a small number of variables (10 to 20 max) to make decisions based on candidates’ applications. As the image above shows, in case of uncertainty, the system forwarded the application to a human advisor for further consideration.

Nearly two decades later, similar loan origination software is still employed by banks and other credit institutions, but it’s miles away from the AI-driven solutions used by newer FinTech industry players or progressive financial institutions.

Using emerging technologies such as AI, the blockchain, and cloud computing, the financial arms of Chinese super apps — WeBank, MYBank, and XWbank — condensed the entire loan origination process flow into a three-step model called “310.”

- 3 minutes to fill out the online loan application form

- 1 second between loan approval and funds transfer

- 0 human interventions in between

This probably leaves you wondering: what about the risks? Last year, all three banks had an average NPL ratio of 1%.

But it’s not just Chinese digital banks leading the lending pack. In 2018, 38% of personal loans in the US were issued by FinTech startups, while banks provided 28% of lending and credit unions 21%.

For comparison, in 2013, most personal loans (40%) were issued by banks, followed by 31% by credit institutions, while startups accounted for just 5%.

So how did lending startups manage to grow their market penetration by 7.6 times in 5 years?

They did this in several ways.

Early lending market entrants wooed consumers with a fully digital customer experience. Instead of going to a branch, filling out paperwork, and then waiting for days, borrowers could tap a few buttons and get a decision in 24 to 48 hours thanks to an automated loan processing system. And as banks already know from other operational areas, a better customer experience can sway consumer decisions in a heartbeat.

FinTech lenders offered lower interest rates. Pricing was a crucial factor for consumers five years ago and is even more so today. Thanks to automated loan origination and, subsequently, lower operational costs, FinTech lenders could set a lower interest rate on an array of loans. For institutions relying on manual checks, these were especially hard to beat.

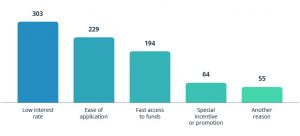

According to a 2020 consumer survey by Nomis, pricing and convenience are still the top drivers for deciding on a lending provider:

Source: Nomis — 2020 Consumer Lending Survey eBook

The compounding benefits of automating loan origination

Today, most lenders are pressed by the need for reducing risks, increasing profit margins, and delivering services remotely.

Fully digital, analytics-driven loan origination systems can help alleviate those issues as already proven by pioneering services providers.

Reduced risks. Any manual operation is error-prone, and underwriting is no exception. By automating the repetitive steps, you can minimize the risks of making an incorrect decision. In addition, new-gen loan origination systems can be augmented with a large array of data sources to quickly verify customer information.

By using an intelligent rules engine for contextualizing customer-provided information, your team can get an instant, comprehensive view of the borrower and make accurate decisions.

Operational cost savings. The purpose of an automated loan origination system is to streamline certain steps of the loan origination process while leaving more complex cases to human advisors. By acting as a digital filter, such systems can help you process a larger volume of loans without the added costs.

A US-based mortgage lending company gained a 3X increase in loan origination volume with no added cost after automating 85% of their standard loan setup tasks.

Cognizant

In addition, intelligent engines can be configured to automatically predict the optimal loan terms and structures for customers so your company can pad the profit margins without alienating borrowers.

Increased compliance. With a greater degree of predictability and repeatability coded into your origination process, your business can protect itself against biased decisions and remain compliant with regulations around equal access to credit.

Access to new customer demographics. In less than five years, Millennial and Gen Z consumers will hold the largest share of disposable wealth, as we identified in our New Age in Banking Whitepaper. At the same time, Millennials are one of the most debt-burdened generations and comprise a good chunk of the “thin file” consumers with an average credit score of 668, lower than the national average of 703 in 2019.

Five years ago, less than 50% of the youngest Millennials had established credit, down from 80% for the same age group in 2006.

The Financial Brand

All of the above often mark Millennials as less desirable applicants with traditional institutions and a solid target for FinTechs, who leverage alternative credit data in their loan origination processes. Traditional providers can take a similar route to tap into new pockets of growth among this demographic.

Improved customer experience.A more streamlined loan origination process is good for the business and good for customers too, as they can receive faster decisions, more competitive rates, and accelerated access to funds. All of the above is key to effective retention — and steady profit growth.

How to approach loan origination automation

A fast end-to-end loan application process can differentiate your business.

Yet attempting to digitize the full cycle of loan origination in one sweep may not be feasible for every financial institution due to legacy software constraints. Still, this isn’t a good excuse for postponing transformations.

Automation can be gradually applied to all loan origination process steps. By opting for paced adoption, you can reduce the operational and budgetary strain on your systems while still capitalizing on the benefits of automation.

Let’s walk the automation walk together, shall we?

Loan applications

Paper-based loan applications are low-hanging fruit for automation. Implementing an online portal for collecting the necessary customer information and requested documents along with performing basic KYC enables:

- Remote customer sign-ups and onboarding

- Reduced volume of errors/missing documents

- Lower pressure on the operational team

Borrowers are already on board: 67% of Millennials feel comfortable completing a mortgage application from their computer.

To get a better sense of how to create an intuitive and effective online loan application process, check out our guide to digital account opening systems. Design- and compliance-wise, many of the steps are also applicable to lending.

Application processing

As we already mentioned, a simple automated loan origination system can help sort all incoming applications into the right buckets: instant yes, needs more thought, a hard no. That’s what most systems have been doing for a decade.

However, the true power of automation lies in creating advanced scorecards for lenders using both traditional credit data sources and alternative sources such as self-submitted data, rental payments, and information on asset ownership. Mobile data, in particular, presents an interesting opportunity for lenders since it acts as a good proxy for repayment capabilities for credit-thin or credit-invisible customers.

Risk evaluation

Big data, predictive analytics, and ML algorithms are a triumvirate of technologies that can further improve the accuracy and precision of credit scoring. The latest generation of algorithms can sift through huge volumes of data to identify hidden patterns and make highly accurate predictions on how customer attributes determine a customer’s ability to repay their loan on time.

Such intelligent systems can crunch predictions in a matter of minutes and present findings to your team. Or they can automatically approve all borrowers above a certain threshold. In either case, you have a highly accurate picture of potential risks to act upon.

Loan underwriting

Greater automation can reduce the time underwriters need to draw conclusions and suggest optimal loan terms. This increases your ability to deliver real-time decisions and appeal to price-sensitive consumers who are shopping around for the best deal (without magnifying the risk of a default).

Beyond that, automated loan underwriting can lead to:

- Unified implementation of all compliance requirements

- Improved auditing and more consistent lending decisions

- Higher team productivity due to a reduced volume of mandatory manual reviews

Built-in loan origination system analytics can also help your business identify decisions that increase credit risks and subsequently improve portfolio yields by offering the right rates and the right time.

Loan decisions

Adopting fully automated decision-making may not be feasible for all types of lending products and in all cases. However, by reassigning easy cases to intelligent algorithms, you can provide your team with more room to focus on complex decisions. These decisions will also be backed by comprehensive insights courtesy of automated scoring.

Loan approvals and funding

Lastly, you can create an online mechanism for borrowers to sign off on loans. You can leverage e-signature software or biometrics to validate customer identities and automatically store document copies in your systems.

You should also enable same- or next-day account funding for smaller personal loans. Set the timeline expectations for larger amounts of funding in a personalized email.

Automation bridges the distance between lenders and borrowers

With strict social distancing still in place around the world, digital channels have become the prime avenue for making new connections and expanding existing partnerships.

Digitization and automation of lending processes help you become a step closer to your customers. By assuming the role of an eager, nimble, and data-driven helper, your institution can win over new business despite funding pressure and carefully rebuild its portfolio, one digitally vetted borrower at a time.

Read the original article here. Find out more about Intellias here.