Case Summary

Disconnected Challenges

Teams were using status quo software that required multiple manual updates across disconnected spreadsheets and documents.

Connected Solution

NXP connected their people, data, and processes in mission-critical business activities by adopting Workiva for both SEC reporting and for SOX compliance.

Connected Results

- Better collaboration, without worrying about version control issues

- Cost savings with quicker collaboration with external auditors, reducing hourly expenses

- Increased trust and context in risk reporting with ability to connect SOX evidence to narratives

Why the company chose Workiva

- Assistant corporate controller had previously seen what is possible with Workiva

- Centralized platform provides single source of truth

- Customer feedback influences future releases

Solutions

SEC Reporting

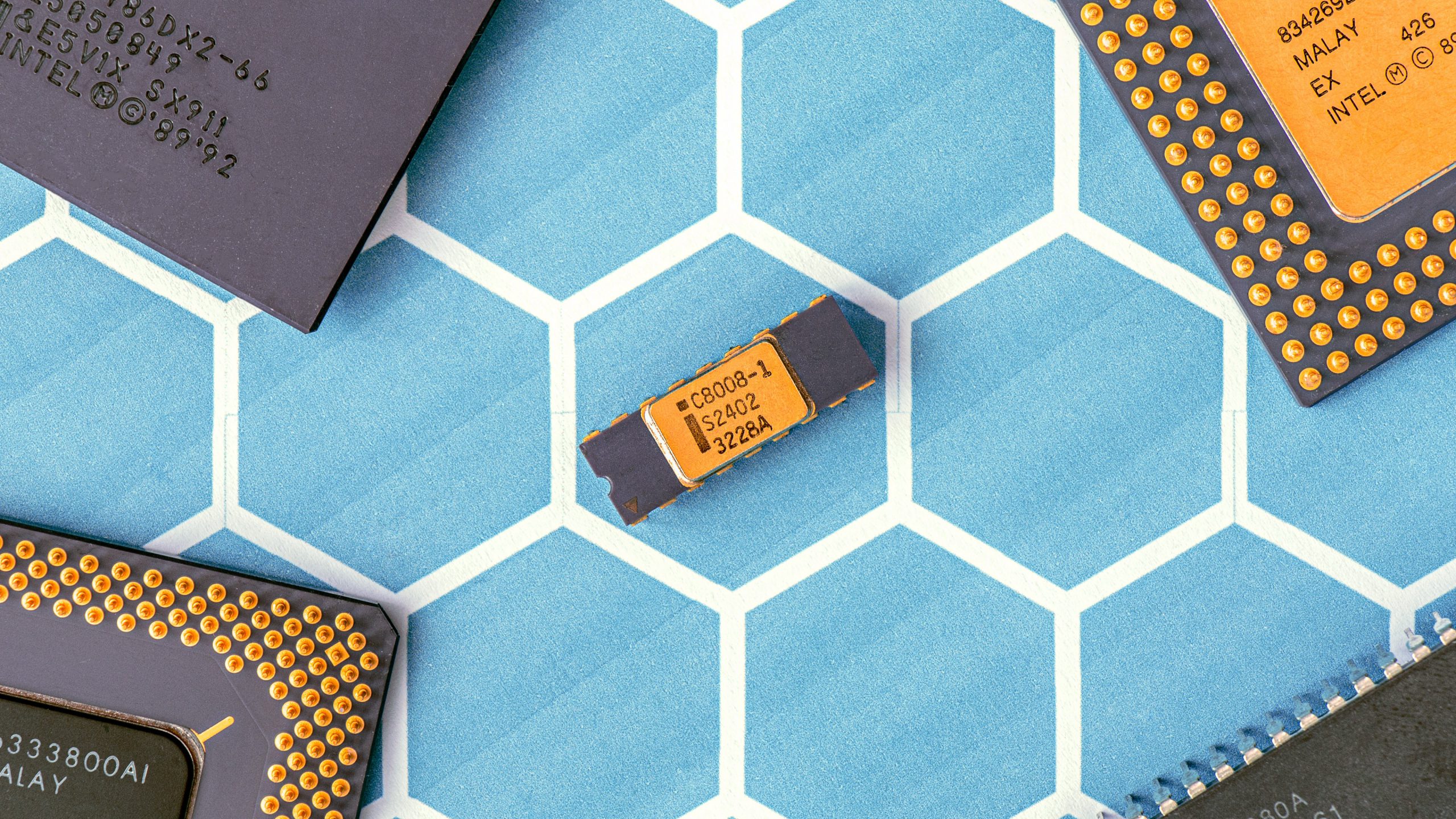

Introducing: NXP Semiconductors & Workiva Case

NXP Semiconductors makes products that enable secure connections and infrastructure for a smarter world. But, when it came to its own reporting and compliance programs, connectivity was likely not the first word that came to mind.

In fact, Trevor Harris remembers seeing his first demo of how the Workiva connected reporting and compliance platform could simplify the global Sarbanes-Oxley (SOX) process.

“I think my group controller said, ‘You can stop drooling now,'” said Trevor, a U.S.-based SOX manager for NXP Semiconductors. “There were many times a light bulb went off in my head and said, ‘Yes, this would be great. This would reduce my workload.'”

Now with the Workiva platform powering a number of its mission-critical processes, the company is enabling its back office to securely connect its entire financial reporting and compliance environment.

Winning over a new team for SEC reporting

NXP started by using Workiva for external reporting to the U.S. Securities and Exchange Commission.

Previously, NXP’s SEC reporting team manually checked Word® documents with embedded Excel® tables. Incorporating late changes throughout an SEC filing could be stressful, to say the least.

Assistant Corporate Controller Bryan Moiles, based in the Netherlands, had seen the results of using Workiva firsthand at a previous organization that was based in Silicon Valley and championed the cloud platform for NXP. After helping bring Workiva to the SEC reporting team at NXP:

- Users with the right permissions can pull data, create reports, and manage certifications in real time, so everyone works from the most recent version

- Teams can connect source data to multiple reports, across hundreds of instances, for consistency

- An audit trail automatically captures who made changes and when

- A commenting feature provides transparency into reviewers’ questions and how they were resolved, all within the platform

“Having that one source of truth has been key for us. That’s an instant time-savings right there,” Bryan said.

It’s especially helpful when working with colleagues around the globe.

“The concept of the connected solution is a big deal for us and allows me to run a 24-hour clock, and I don’t have to worry about a version issue,” Bryan said.

Supercharging the SOX process with Workiva

NXP previously managed SOX compliance with a third-party system that was inflexible and difficult to maintain, Trevor said.

“It wasted so much time,” he said. “At the end of the quarter, there were a lot of things that would break down. I would have to work until midnight on responding to emails in Asia and then wake up at 6:00 a.m. to deal with the emails I would get from Europe.”

NXP started using the Workiva platform to manage SOX compliance, including certifications. Typically, Trevor’s team sends 70–80 certification requests per quarter.

“This is the first time, I think, in my three years with certification that we actually got it all signed off before they’re all due,” he said, adding that a senior vice president of global sales completed the task within the Workiva platform with little to no training.

With Workiva, his team built a custom report on information provided by the entity (IPE), the related controls, who performed the last benchmark, and when.

Revolutionizing the way teams work

With NXP switching from filing as a foreign private issuer (FPI) to a U.S. domestic filer, Workiva is helping NXP meet timelines for producing new documents while still completing a statutory set of financial statements for local jurisdictions.

NXP has extended the use of Workiva beyond a single team and has even greater ambitions for the future.

“I have all kinds of ideas,” Bryan said. “It’s just going to be about holding back, taking steps, and not trying to get everything done at once.”

Next up: socializing the benefits of Workiva with business planning and analysis colleagues.

“What we’re doing will feed right into their processes and then save a lot of administrative time, so they can do things that add value—the analysis—as opposed to data entry,” Bryan said.

Bryan said Workiva will help keep NXP’s career-driven employees engaged.

“If I can reduce administrative work so that our people can focus on other areas that add value and allow the team to develop, that’s the ultimate goal for me. Whether it’s reading other filings, looking at best practices, or reinventing processes to save time overall, they are becoming more of a business partner,” Bryan said.

“If you really want to revolutionize how you do finance and accounting—your reporting, your risk analysis, and start drilling into automation as well—I would look at the Workiva suite of products and their partnerships,” Trevor said.