A snapshot of the financial services sector’s small business market opportunity in Europe

Business banking is the new fintech battlefield. Due to the large size and potential of the small and medium-sized enterprise (SME) market segment, financial services providers are increasingly focused on developing new services for small businesses. Hence, this article dives into the question: how big is the SME market in Europe and what are the key needs of SMEs?

Sole-traders and small enterprises represent a significant growth opportunity for financial services providers: As the economic engine of Europe, they make up 98.9% of all European Union’s enterprises. Furthermore, they contribute to 56% of total value added within the EU and account for 67% of all persons employed.

In total numbers, according to Eurostat and the Annual Report on European SMEs 2018/19 published by the European Commission, there are over 35 million solo-entrepreneurs, micro-SMEs and small-SMEs in Europe. Ninety-nine out of every 100 businesses are classified as SMEs, and nine out of ten SMEs are classified as micro-SMEs, which make up the largest part of the European small enterprise segment. In contrast, only 0.2% of all enterprises in Europe are classified as large enterprises, defined as companies with over 250 employees.

THE SME MARKET OPPORTUNITY

While the SME market offers a sizeable business opportunity for banks and fintechs, the high-level segmentation according to employee count and yearly revenue already illustrates the diversity of SMEs. This places high importance on granular market segmentation to understand the various segments and sub-segments whose business needs can differ greatly.

The state of the SME market in Europe’s largest economy, Germany

In Germany alone, over four million people have been self-employed in 2018, according to the German Federal Statistical Office. 1.8 million of them ran a business with at least one employee and 2.2 million were solo-entrepreneurs without any employees. According to the results of the Microcensus, most self-employed persons (586.000 businesses) were classified as freelancers (“Freiberufler”), which is legally defined as “provision of professional, scientific and technical services” – a special group of sole traders. The second largest economic section of the self-employed, with around 500.000 businesses, was trade and commerce, including the maintenance and repair of vehicles. This was followed by construction businesses with 467.000 self-employed workers.

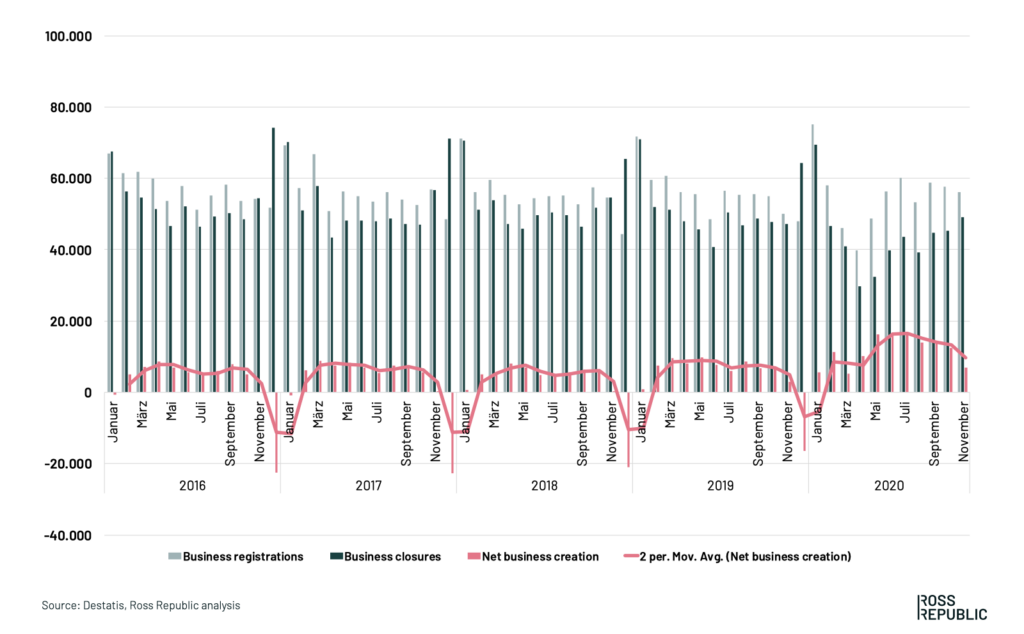

The SME market has proven to be very resilient and crisis-proof, as shown in the SME performance reviews by the European Commission. Our own analysis of the latest numbers from the Federal Statistics Office in Germany confirm such findings. There has been a stable business birth rate (net trade register entries, shown in pink below) from 2016 to 2020:

In our dataset, 1.282.634 new businesses have been registered in the last two years (within January 2019 and November 2020). Despite the negative economic impact of the Covid-19 crisis, the average number of new businesses registered even slightly increased in 2020. In conclusion, Europe and specifically Germany represent a significant target market for banks and fintechs that aims to serve SMEs. For more information about the SME industry structures in Europe, have a look at this country breakdown provided by Eurostat.

Further growth ahead

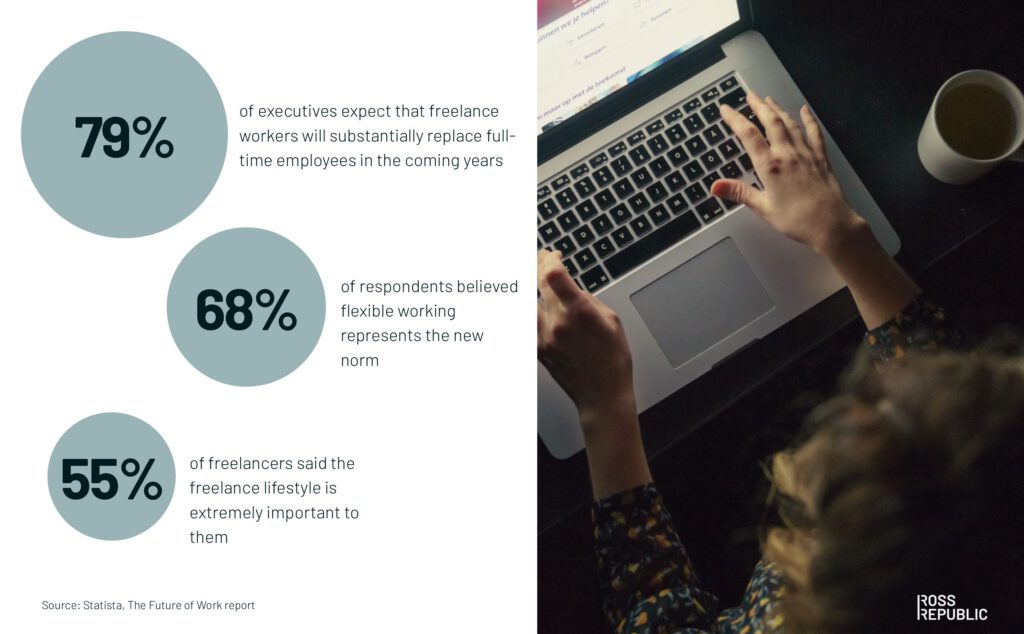

The ongoing Covid-19 crisis will likely lead to an increase in insolvency filings in heavily affected sectors, such as travel, accommodation or small local retailers. Especially as soon as governmental support programs are phased out, the global increase in insolvencies is expected to reach 26%, according to debt collection group Atradius. However, we expect that the crisis will not only boost the digitalisation of the SME industry, but simultaneously foster demand for gig workers, part-time workers, remote working sole traders and small agile enterprises, as professionals will search for additional income streams or want to share their expertise in a flexible on-demand manner. Simultaneously, as companies switch to a hybrid or even fully remote model, labour demand and supply will be sourced from an increasingly global talent and client pool in the post-Covid-19-era.

A recent study about the future of work by Statista has uncovered similar trends:

THE FREELANCE MARKET IS EXPECTED TO GROW FURTHER

Uncovering the true needs of SMEs

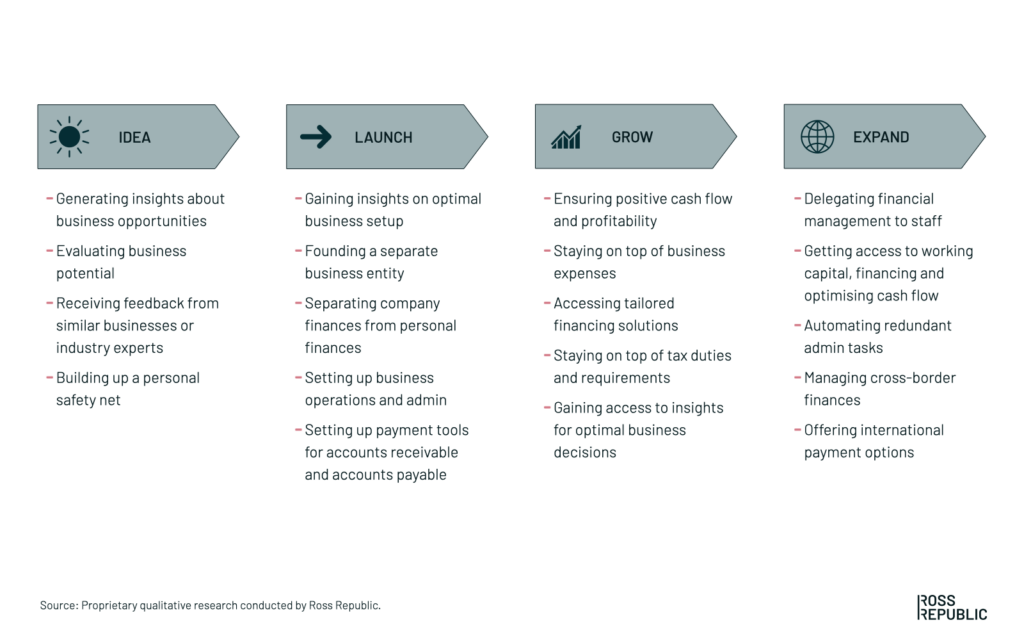

While SME segments are often segmented by annual revenue, headcount, or industry, such segmentation models rarely help in guiding the exploration of successful SME services and products. In our experience, applying the Harvard Business School professor Clayton Christensen‘s jobs-to-be-done theory is the best and most effective methodology to analyse the true needs of sole traders and users within SMEs. Simply speaking, a customer job is the desired functional and emotional end-goal that the customer is trying to achieve: “No one needs a quarter-inch drill, but a picture on the wall”.

The most successful fintechs are therefore focussing on finding unique insights into their target customer’s jobs and starting from first principles. Thereby, they create real solutions that solve validated customer jobs, instead of restricting themselves to narrow category- or risk-driven financial products.

Based on proprietary research that we carried out in several SME-related projects we have clustered some of the high-level customer jobs of SMEs by the maturity of their business:

CORE NEEDS OF SMES

Each maturity stage and the underlying jobs-to-be-done unlock opportunities for both incumbent banks and fintechs to create truly customer-centric banking products. Customer-led service development allows to rethink how financial services can alleviate typical pain points and serve client needs holistically. This is especially important when creating new solutions for SMEs, whose needs differ greatly: a highly specialised remote-working freelance software engineer has different workflows and business needs than a local repair shop with three employees.

Lessons learned from launching founder accounts at Holvi

Holvi is a Finnish fintech scale-up that serves over 200.000 small business clients. While I’ve been part of its business development team, we noticed that opening up a business account in was a strong pain point for founders of new businesses in Germany. After visiting the notary, founders must pay in their initial share capital and send a valid proof back to the notary. Afterwards, the notary registers the business at the commercial register. For a founder, this is just one step out of many, thus simple and efficient business banking onboarding journeys are key. Yet, most traditional banks require a branch visit and many documents up front. For most founders, comparing, choosing and opening up a suitable business bank is therefore very stressful and time-consuming.

Based on this initial insight, we kicked off a project to build a fully digital bank account that has been specifically designed for founders of new businesses. Everything from the initial sign-up, the document upload, the customer identification (KYC) and business checks (KYB), to the underlying onboarding flow has been optimised to make the first steps of the business banking process as efficient and user-centric as possible. This allowed us to target new client segments in pre-foundation phase and to build valuable client relationships right from the beginning of the entrepreneur’s journey.

After an initial beta phase, the founder accounts have turned into a successful, fast-growing product line.

HOLVI’S FOUNDER ACCOUNT. SOURCE: HOLVI.COM

Digital services are a hygiene factor

Freelance businesses and SMEs are increasingly adopting modern digital software solutions to run their business. Seamless workflows, connectivity via APIs and intuitive digital apps are gradually becoming basic requirements. This is especially true for freelance and micro-businesses: Even though they behave like a business buyer, their product expectations and usage patterns are often shaped by retail banking activities, i.e. modern apps such as N26 or Revolut. This phenomenon is often described as consumerised B2B.

A recent survey by our technology partner Marqeta confirms the need for improved digital user experiences and connectivity in business banking:

- 68% of SMEs surveyed claimed that the digital features of business accounts aren’t as innovative as consumer bank accounts

- 76% were willing to connect other business systems and share more data with their bank, if it means getting quicker loan approvals

While the digital maturity varies between industries and individual businesses, the pandemic accelerated the shift towards digital, contactless, cloud-based solutions. As a case in point, Shopify, a popular e-commerce tool for SMEs, almost doubled its revenue during the pandemic. The Google for small business program enables SMEs to acquire new clients online, Shopify allows to pivot to e-commerce solutions, Stripe Checkout offers online payments and many small business accounting software tools, such as Xero, directly integrate with bank accounts. Thus, any banking service that targets SMEs cannot be an isolated product anymore, it needs to weave into a network of digital tools in order to fulfil a growing demand in connected, digital banking services.

OVERVIEW OF DIGITAL SERVICES FOR SMES – BANKING PRODUCTS NEED TO OPERATE ACROSS THE SME DIGITAL ECOSYSTEM

An underserved, digital-savvy target group

Upon analysing the various business and banking needs of SMEs, it becomes evident that the sole trader and SME segment has not been served well so far. Working as a freelancer or founding, running and scaling a company still involves many pain points that are not sufficiently addressed by traditional banking providers. Even worse, traditional banks often find it difficult to profitably serve the various segments of SME clients and specifically to underwrite loans due to their lack of credit history and lack of tangible assets. This results in SMEs having to pay higher premiums and mostly receiving substandard products built to serve the least common denominator.

SMEs increasingly use digital-first tools to run their business, which generate a plethora of data that can be leveraged to create tailored banking products.

Such old economy approaches have become outdated. Freelancers and micro- and small SMEs increasingly use digital-first tools to run their business, which generate a plethora of data that can be leveraged to create tailored banking products. Beyond that, new forms of digital-era business models and assets are underpinning the growth of completely new types of businesses, such as highly specialised freelancers, global gig workers, drop shipping firms, direct-to-consumer e-commerce sellers, passion economy creators (using new platforms like Substack, Shopify, Patreon, Teachable or Cameo, to name a few), niche marketplaces and platforms or highly specialised technology firms.

All of these businesses seek financial products that fit their business needs, not the other way around. Promising directions include fully digital business accounts with superior user experiences, data integration and automation, self-service, 24/7 onboarding solutions, founder accounts in order to pay in share capital, individual business financing solutions built on real-time data, as well as modern digital banking interfaces that integrate with third party business software.

The combination of a growing, fragmented market that incumbent players have traditionally neglected and an increasing digital adoption rate has now resulted in the formation of several innovative fintechs that aim to re-design business banking. Stay tuned for our next post, which provides a deep-dive analysis of Europe’s leading SME-focused fintech companies.