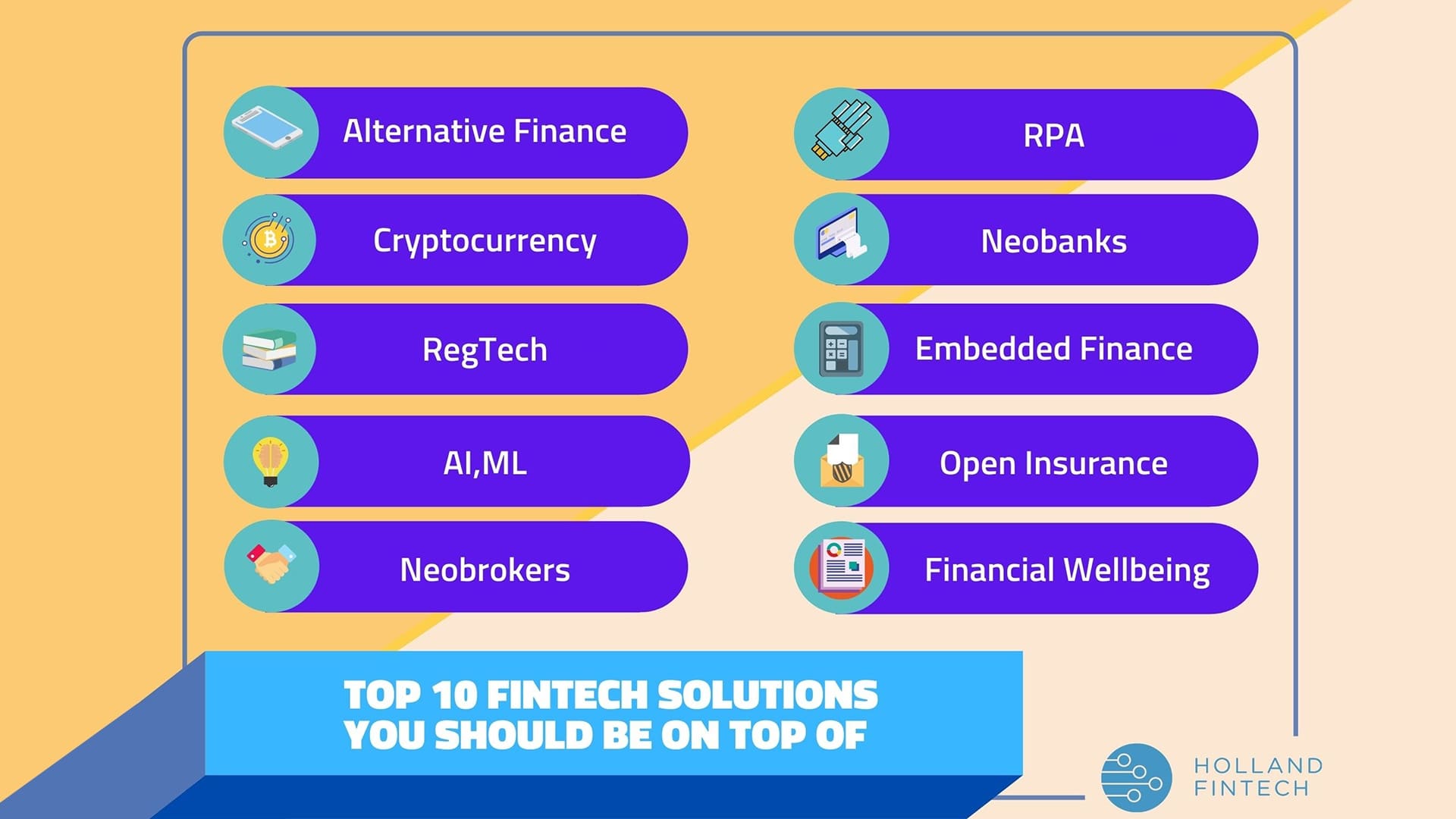

Although 2020 and the pandemic have definitely left its solemn tolls on society, it drives several positive changes in the fintech industry. Therefore we wanted to dive in the changes and explore what trends have been amplified by the pandemic, and will impact the future of finance furthermore. What are going to be the main drivers behind growth? What are investors looking at? Read up here, to stay on the forefront of the financial services industry. Here are the top 10 biggest fintech trends!

Alternative Finance

The term Alternative Finance itself is a big umbrella with a lot of categories falling underneath it. The best definition you can find is from Judge Business School at Cambridge University: “financial channels and instruments that emerge outside of the traditional financial system (i.e. regulated banks and capital markets)”. A shining example for alternative finance is small business loans. Entrepreneurs and small businesses nowadays may find it easier to secure funding for their companies with low interest rates and flexibility in how the borrowed money can be used. Other types of alternative finance are: Asset Finance, Invoice Finance, Property Finance, Stock Finance, Supply Chain financing, Crowd Funding and Pension Backed. In the midst of the pandemic, the natural characteristics of P2P firms (resilient and flexible planning) enable them to reap benefits from government funding schemes. Daniel Rajkumar, founder and MD of P2P business lender Rebuildingsociety, suggests that BB doesn’t just have to provide this finance through mainstream providers, but that P2P platforms could have a role, being well positioned to serve regional businesses (according to Grant Thornton). The funding costs for them are still higher than traditional banks, who have the tendency to fund themselves at negative rates. You can find more information about it here.

Artificial Intelligence, Machine Learning

Whenever we talk about the future, we talk about Artificial Intelligence (AI). AI really sparks our imagination about what computers could potentially do, or as Larry Tesler asserts, “AI is whatever hasn’t been done yet”. We may still be very far from creating and utilizing sentient intelligence, but at this very moment we have been constantly exploiting a great variety of tools which are so efficient at processing mountains of data that they are able to yield the most relevant and valuable insights, beyond human’s capabilities. As the World Economic Forum stated, AI is going to be strategically important to the fintech sector and banking industry in the upcoming years. The technology, of course, is not going to stop at simply scrunching down big chunks of data. The technology & financial services industry is planning to integrate it into risk management, process automation, customer service, and other vital functions.

RegTech

Around the globe, LexisNexis reported that it took approximately $180.9 billion for all financial institutions in the key markets (APAC, EMEA, LATAM and North America ) to cover the cost of compliance. As the expense is indispensable, firms can still look for methods to make sure the costs will be mitigated and increase the efficiency in the process. This is exactly where RegTech steps in! With the use of big data and machine-learning technology, regtech makes life easier for a company’s compliance department by offering data and insights, as well as reporting tools. Over the past years, while regulators raised the bar for financial services companies, Anti Money Laundering has drawn much attention, including KYC (Know Your Client), but also new privacy regulations, security requirements and fraud detection. .

Cryptocurrency

Cryptocurrency refers to virtual currencies normally secured by cryptography. According to BNN Times, the digital currency is decentralized, and records of ownerships are stored in blockchain systems. More and more attention has been drawn to cryptocurrency because of its promise of high returns. Another benefit of using cryptocurrency is the high liquidity. In other words, it is super quick to buy and sell crypto whenever you want. With some trading organizations, they offer the option of auto trading, which makes the process of purchasing and selling even much more convenient. Furthermore, crypto currencies are free from government interference as they are not regulated by governments like national currencies. This promotes retail investors and gives everyone a fair chance to invest. Moving funds overseas is easier and safer when using crypto, which makes it a great alternative to all regardless of race, color, or country of origin.

RPA

With the year of 2020, we have seen a lot of unprecedented incidents, making a great number of firms suffer from loss of money. In an attempt to reduce costs and improve work efficiency, we could expect there is going to be a rise in RPA as the system acts like a personal digital assistant or employees by clearing the onerous, simple tasks that eat up part of every office worker’s day. By creating and deploying a software robot with the ability to launch and operate other software, the system actually allows employees to focus on other high-return tasks.

Gartner has predicted that there is likely to be a 19.5% increase in 2021 over 2020 in RPA.

Open Insurance

According to Accenture, open insurance is “ a new way to do business”. It requires carriers to open their data resources to other organizations and to share and consume data and services from many sources and across lots of industries. In order to build an open insurance model, it is crucial to have these 3 factors: consume, share, elaborate. Insurers can definitely benefit from open insurance by creating innovative customer propositions. Furthermore, open insurance also gives carriers a larger market for their products and services. This can be done by integrating their products with the non-insurance offerings of their business partners to deliver a broader and more enticing seamless customer experience (Accenture). Other advantages include: extra revenue sources and operational efficiencies.

Neobanks

It is common knowledge that almost every respectable-size bank now offers omnichannel- banking which grants their customer mobile and web-based access. But digital-only banks are now taking it up a notch! As being 100% app-based, they proved to be more convenient when money transparency, waiting time and restrictions are taken into consideration. Another great thing about digital-only banks is that they are available 24/7- anytime, anywhere (As long as you are connected to the internet). Not to mention, for digital-only banks, they have low exchange rates and low/no ATM withdrawal fees worldwide, enabling traveling a whole lot easier (and cheaper) than with traditional banks- especially in the eurozone. As the banks themselves remove all the branch networks and operate solely on a digital interface for customer onboarding and service delivery, they are able to save much more in the long run, in terms of retail and office costs.

Embedded Finance

The term merely suggests the combination of a non-financial service provider (eg: retailer) and a financial service (payment processing, lending,..). There are several reasons why embedded finance is the future of the financial industry. It creates opportunities for organizations and enterprises to open new revenue streams and revamp the services that they’ve been offering to the customers. In addition to that, embedded insurance makes our lives easier by eliminating the third-party bank or lender in the financial processes.

Neobrokers

It has never been a better time to be a retail investor! Like what we discussed before with how neobanks have changed the landscape of the banking industry, neobrokers would do the same thing to trading. What makes them so great? they are capable of digitising and tokenizing traditional asset classes, (such as stocks, bonds, gold, currencies, ETF’s )— and eventually, conventionally illiquid ones — such as real estate or private equity (Medium.com). And as the name suggests, the whole process would be digitized, cost efficient and have high levels of transparency.

Financial Wellbeing

As the financial services industry continues to expand further and further, the needs for applications or web-based financial learning becomes more urgent than ever. Of course, there is no shortage of videos, texts or tutorials already available and covering this subject, a large number of applications now also offers opportunities to sharpen your trading skills in real time by making use of dummy accounts on stimulated exchange platforms. This does not stop at targeting potential traders, there are hundreds applications out there to help eradicate financial illiteracy. (Disruptor Daily)

And a little bonus…

Digital Identity

Customer identification is rather a pressing concern in the financial services industry as in every single process, it requires some personal data from the customer. From the business perspective, they are obliged to a lot of regulations, assess the risk and provide customized service to their customers. In a recent finding, Deloitte pointed out that digital identity might be the solution to all these problems, while removing inefficiencies from processes that are largely manual today. With a right digital identity system, firms can increase their efficiency. For banks, they can be better at building risk profiles for their clients. It does not stop here. Digital identity also generates more revenue from other businesses who lack access to that kind of customer information or don’t wish to hold it themselves, or from people who aren’t customers but must verify their identities for some other purpose. Lastly, by using digital identity, firms can even look beyond their business model. They could even act as a trusted broker between parties in other industries and provide identity services to the public sector (think social services and tax filing). Customer service might extend to non-financial advisory work.

Cybersecurity

Cybersecurity can be defined as the act of protecting the internet-connected system and data against cyber threat. Cybersecurity could be put into different categories such as: application security; information or data security; network security; disaster recovery/ business continuity planning; operational security; cloud security; critical infrastructure security; physical security; end-user education. With the popularity of the internet and increasing numbers of mobile devices users, there have been more opportunities for businesses to go digitized than ever before. However, the downside to this is the corresponding growth in the volume and sophistication of cyber attackers and attack techniques. With the implementation of cyber security, firms can safeguard themselves against such a grim outlook. In the event of such things happening, businesses are able to improve the recovery time and protect their customer’s data.