The disclosure of nonfinancial information is vital for managing change toward a sustainable global economy.

Nonfinancial reporting—also referred to as extra-financial, pre-financial or environmental, social and governance (ESG) reporting—is no longer simply a nice gesture in the interest of transparency, but rather it is now a statutory reporting requirement in the EU, thanks to Directive 2014/95/EU.

The directive requires large public-interest entities with more than 500 employees to disclose nonfinancial information to local competent authorities, increasing the demands of statutory reporting for approximately 6,000 companies and groups across the EU.

Adding to the complexity is the fact that since the last financial crisis, G20 members have published over 50,000 regulatory documents impacting public interest companies. Understanding and interpreting the volume, variety and velocity of regulation, and capturing this knowledge cumulatively and systematically, has clearly become a daunting task for compliance practitioners.

With the costly risks that stem from noncompliance of key legislative requirements, it is time to think about the strategy your organisation is utilising for its compliance data.

Two key challenges to statutory reporting processes

1. Multiple regulatory authorities and voluntary reporting mechanisms

Regulatory divergence, the inconsistent regulation between different jurisdictions, complicates statutory reporting.

According to a recent report by the International Federation of Accountants (IFAC), inconsistencies in supervisory interpretations and practices, fundamentally different regulatory frameworks and different regulatory or data definitions significantly increase compliance risks and are the biggest challenges to corporate statutory reporting teams.

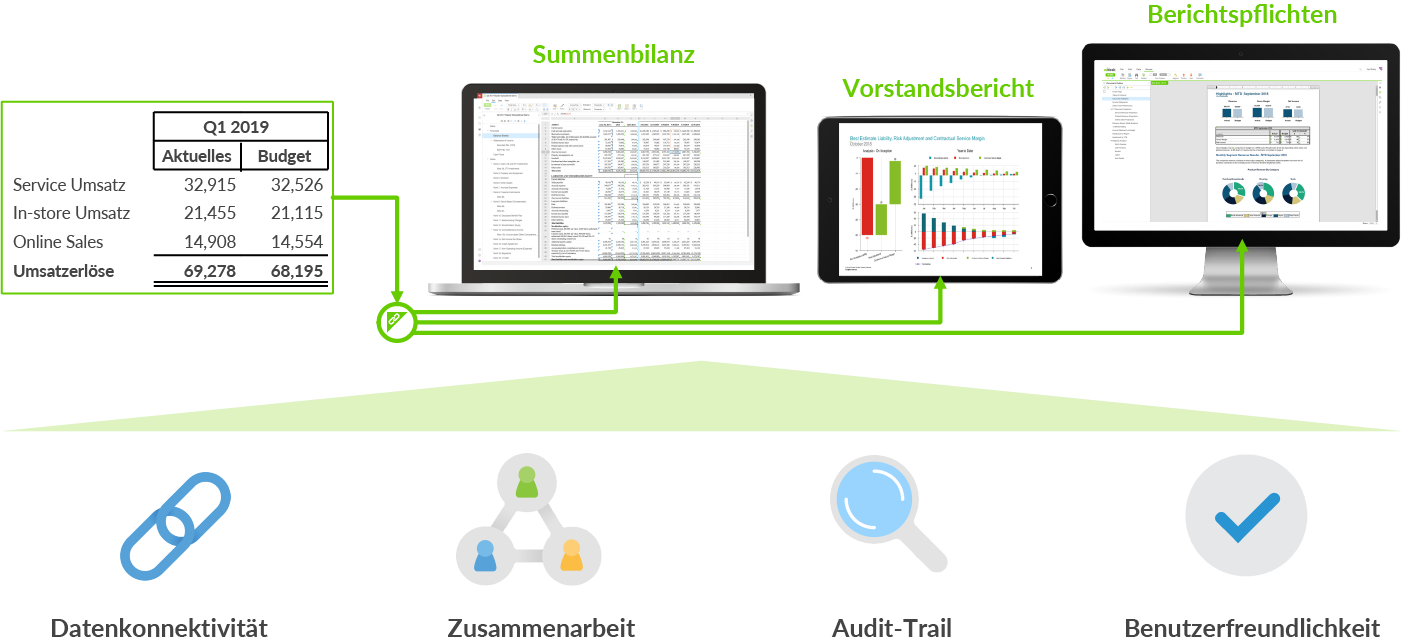

A typical statutory reporting process requires the time-consuming effort of collecting disparate structured and unstructured data and then manually manipulating the data in different formats for a wide range of internal and external reports. In fact, an average EU regulated company reports financial and nonfinancial data to approximately 14 different submission platforms in just one jurisdiction.

2. Multiple truths of statutory reporting information across the company

A regulated entity’s data architecture defines how data is collected, stored, transformed, distributed and consumed. Today, the approach to statutory reporting across many organisations features unique risk. Multiple teams—including sustainability, legal, human resources and other statutory reporting contributors—often operate in silos and carry out their own evolving approach and methodology in response to increasingly complex laws, regulations and market expectations.

Information stored throughout the company and across its supply chains has measurable, material value to the statutory reporting process and should be treated as an asset. Leaving valued statutory reporting information trapped inside traditional documents, spreadsheets, slide decks and ad hoc reports severely limits the value of the data and how it can be used.

According to an EY survey, nearly 75% of enterprises rely on more than six different reporting systems—such as ERP, CRM and HCM systems. However, that data loses context and risks inconsistency when exported and disconnected from its source. To make matters more difficult, the supporting compliance documentation is often managed independently across multiple departments, entities and systems.

These decentralised methods give way to increased expenses, redundancy or even worse, multiple truths to the data that is to be submitted to regulatory authorities.

Connect your data and trust your statutory reports with an enhanced data governance framework

To meet the requirements of diverse statutory reporting environments, forward-thinking companies are developing enhanced data strategy frameworks built on the concept of a single source of truth connected to multiple applications of the truth.

These frameworks enable users to unify, enrich and explore data at scale with advanced data preparation—and then create a single connected data source for reporting and analysis. As information changes at the source, cloud platforms allow it to automatically update across all linked instances in presentations, reports and spreadsheets.

Today’s regulatory disclosure requirements have significantly increased the compliance risk in doing business. Failure by an organisation to consider the impact of its actions on its shareholders, customers, employees and the markets may result in adverse publicity and reputational damage, even if no law has been broken.

The practical aspects of statutory reporting data management may not be as exciting as analysing revenue growth displayed in beautiful dashboards, but they are vital to high-quality regulatory adherence. Therefore, creating a culture of smart data management should not only be the concern of the CFO, CIO and CRO, but of all C-suite executives, starting with the CEO.

Organisations face mounting pressure to continuously improve performance, create value, provide greater transparency, be more accountable to multiple stakeholders, minimise the impact on natural resources and be socially responsible. In order to accomplish these many feats, they need new methods for gathering and communicating the expanded information sets (increasingly focused on nonfinancial, ESG information) sought by investors, analysts and others. And, they need a more evolved vision to support and nurture these new types of disclosures.

Find out more about Workiva here.