The call to become an “Agile financial company” has been making the rounds since the early 2010s. But despite being nearly a decade in the making, there’s still a lot of mystical woo-woo around what it means to be Agile.

Many talk about Agile as a cultural practice. But a strong culture emerges out of shared best practices, which, in turn, are based on processes. In this post, we talk about how any incumbent bank can put the right Agile practices at its core.

What is Agile in the banking industry?

Agile is an operational strategy focused on breaking lofty, long-term, hierarchical processes into smaller increments for continuous execution. Originally conceptualized as an approach to software development, Agile has since made its mark across an array of operational processes, from marketing to procurement.

Agile is not a destination — it’s a path towards changing how your organization define roles, plans, accountability, and mechanisms for responding to market changes.

An Agile financial company, in turn, is an entity that has a strong but flexible process for determining which product features are due for production next, who will take the lead, and how a new project will be integrated with other operations.

Unlike traditional chain-of-command financial organizations, Agile financial players focus on solving targeted pain points on customers’ journeys with equally sized teams that are fully responsible for developing solutions for particular issues.

Key characteristics of Agile tech teams:

- Small and multidisciplinary

- Innovation-driven

- Bounded by specific projects

- Self-governing and accountable

- Aligned with overall business goals

Agile development in banking

Agile is also a methodology for setting up a software development lifecycle (SDLC) — the cadence for delivering new products to market.

Financial leaders are already in the know about Agile best practices in these contexts:

- Continuous delivery and continuous integration (CI/CD)

- Automated quality assurance (Agile QA)

- Scrum adoption and product backlog planning

- Infrastructure orchestration and optimization

- DevOps and DevSecOps adoption

The idea of the Agile SDLC is to break down the software delivery process into a series of predictable steps and feedback loops augmented by automation.

Such an approach allows for complex software products to be delivered incrementally.

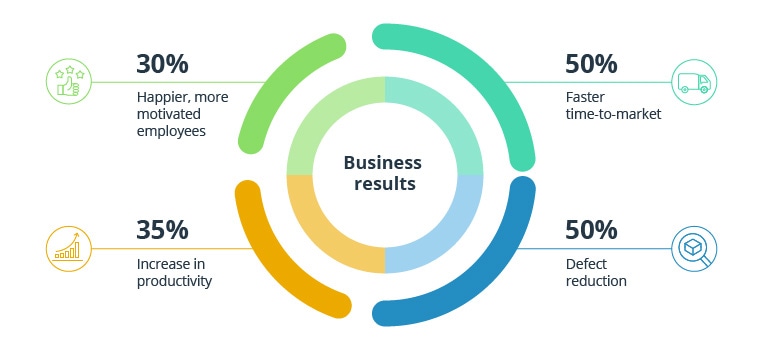

Source: Scaled Agile — How SAFe empowers businesses to compete in today’s marketplace

FinTechs and digital-only banks are setting the trend for implementing Agile methodologies in the financial services industry.

- Starling Bank treats software as something that’s never finished and needs to constantly evolve. They keep iterating on what they’re doing while also being the only digital bank in the UK with a full banking license (and all the compliance burden that comes with it) since day one.

- Revolut scaled to five million users in under five years by maintaining lean practices despite an increasing headcount and by relying on rapid prototyping, the API economy, and rapid feedback loops to quickly deploy and test new products.

- Tencent is a proponent of feature-driven development (FDD), a strong product ownership culture, Scrum, automated testing, and continuous integration for speeding up release times.

What sets these Agile financial companies apart is that they have concurrent processes for defining the product vision and determining the execution:

- The product vision (WHAT) is defined collaboratively, based on grassroots feedback and a strategic vision from top management.

- The execution (HOW) is fully determined by multi-disciplinary teams who know the ins and outs of the technology infrastructure, customer demands, and corporate goals.

As a result, Agile organizations can pursue multiple growth vectors at once to scale the business in the right direction. They can experiment (fail and succeed) fast, embrace change, and take full responsibility for outcomes while retaining a strong connection with customers.

“61% of CX leaders say their company has a clear view of which technology platforms they need to leverage in order to remain competitive and relevant to customers—compared to only 27% of their peers.” - Accenture

For more, click HERE to read the full article.