For this week’s research article, we dive into new insights on blockchain, biometric automation in finance, biometrics, urban technology, identity verification and more. Happy reading!

Global Industry Study Reveals Fintech Lenders are Evolving Fast and Moving Up Market (Yahoo Finance)

New Economist Impact research study shows changing mindset of traditional banks to partner with fintechs; 76 percent of industry leaders see partnerships as the future for small business lending. Q2 Holdings, Inc. , a leading provider of digital transformation solutions for banking, released a global research study conducted by Economist Impact in collaboration with Salesforce. Entitled What is shaping the ecosystem of small business lending?, the study reveals a rapidly shifting landscape in small business lending where “partnership thinking” is increasingly the norm, enabling small business lenders to move more quickly, effectively and at scale with the help of technology. Read more.

Tech Trends Shaping The Future Of Urban Technology (Finextra)

Thematic Research Report shows that 70 percent of the global population will live in cities by 2050, compared to the current 50 percent. State-of-the-art technologies such as blockchain and virtual reality have a number of applications in the age-old fashion world that allow production and distribution methods to evolve with changing tastes and fashion trends. From sketchpads to shelves, every aspect of the fashion industry is automated and enhanced with technology that speeds production, more effective inventory management and a broader range of online and brick and mortar retail experiences. Read more.

New Study from StrategyR Highlights a $8.7 Billion Global Market for FinTech Blockchain by 2026 (Yahoo Finance)

A new market study published by Global Industry Analysts Inc., the premier market research company, today released its report titled “FinTech Blockchain - Global Market Trajectory & Analytics”. The report presents fresh perspectives on opportunities and challenges in a significantly transformed post COVID-19 marketplace. Read more.

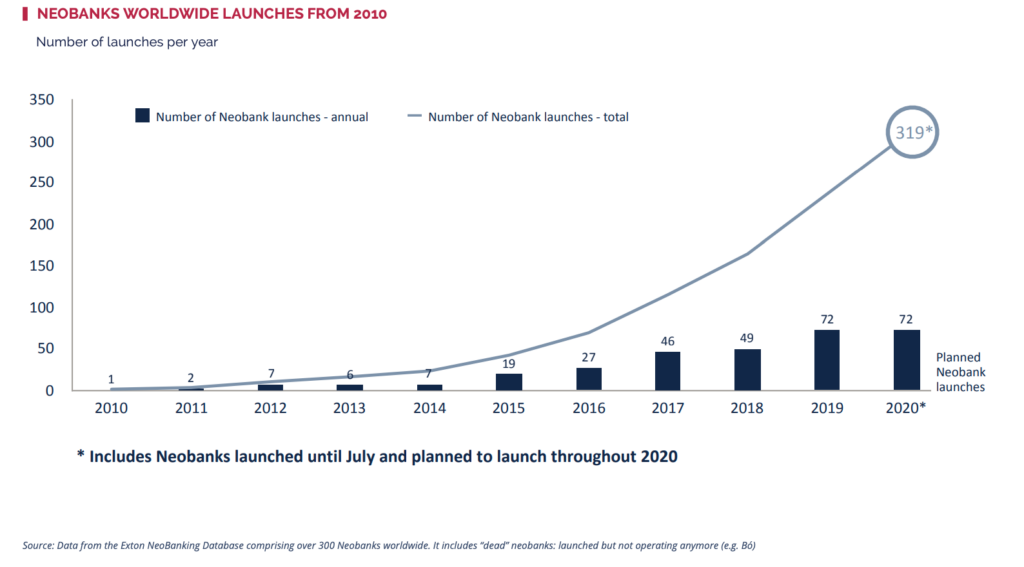

Demand for Digital Identity Verification Surges Amid Booming Virtual Banking Sector (Fintech News)

A new report by analyst and consultancy company Goode Intelligence, states that by 2026, the industry is expected to generate US$17.2 billion in revenue, translating to a compound annual growth rate (CAGR) of 22% over the six-year period. An evolving regulatory landscape, rising digital adoption and the surge in fintech usage is pushing demand for digital identity verification. It ensures that there is a person behind a process matches the one that is supposed to be. It’s an essential requirement in most procedures to avoid fraud and theft, and is referred to know-your-customer (KYC) in the banking sector. Read more.

BNPL Solutions and Products: the Next Big Thing in Finance and FinTech (Finextra)

The ongoing COVID pandemic, global inflation, and overall uncertainty has aggravated the problem of global debt. According to a recent summer report by UBS, the scale of this problem has become truly tremendous. While governments, central banks, and large corporations try to deal with these challenges on their own, individual households and providers of financial services are also trying to shape an answer to this new situation. These attempts have generated a great demand for Buy Now Pay Later (BNPL) products that are rapidly growing in popularity. Read more.

—

Do you have any news to share: please put [email protected] on your press list.

Curious to read and find out more from fintech? Then subscribe & read our full newsletters here: https://hollandfintech.com/featured/newsletters/ . In order to see our other weekly highlights, check out the following links: analysis & opinion.