For this week’s research article, we dive into new insights on decentralized finance, insurance, green finance, ESG, fintech market and more. Happy reading!

Decentralised finance is booming, but it has yet to find its purpose (Economist)

Article by Fulwood: Wall Street Correspondent, The Economist, New York, states that it is common, in the minds of economists, academics and most regular folk, to think of the real economy and the financial economy as separate but interlinked spheres. This is the essence of the “classical dichotomy” at the heart of the neoclassical school of economics, which considers money “a mere veil” obscuring real underlying activities. Those labouring in the real economy grow wheat, write articles and build houses. Financiers simply shuffle money around on top of that. Yet at its best financialisation makes possible real activity that could not otherwise occur. This is apparent for a loan made to a startup, or a bond that enables the building of a new factory. But it is also often true of more complex areas of finance, such as exchanges and derivatives. It is here that 2022 will see exciting innovations. Read more.

Global Insurance CEO Outlook 2021 (KPMG)

COVID-19 has disrupted insurance industries across the globe, but of the 129 insurance CEOs surveyed for KPMG’s annual Global CEO Outlook, there’s an emerging optimism driven by a focus on innovation and a strong connection to organizational purpose which is building confidence in growth for the industry. Global insurance CEOs have a renewed confidence in the growth prospects of their organizations, the insurance sector and the global economy. Leaders in insurance expect aggressive growth and are looking to expand their businesses and organizations in new ways. As insurance CEOs look forward, a key focus will be embedding purpose into the fabric of their organizations and in return providing long-term value to customers, employees and stakeholders. Read more.

Regtech Can Boost Development of Green Finance Markets – Report (Regulation Asia)

Regulatory challenges are hindering widespread acceptance of green finance products, says a new paper from FTAHK and LITE Lab@HKU. FTAHK (The FinTech Association of Hong Kong) and LITE Lab@HKU have published a new white paper calling for the use of regtech to facilitate the development of green finance markets. While the demand for green finance products is expected to grow in the years to come, regulatory challenges are hindering widespread acceptance of such products, the paper says. Read more.

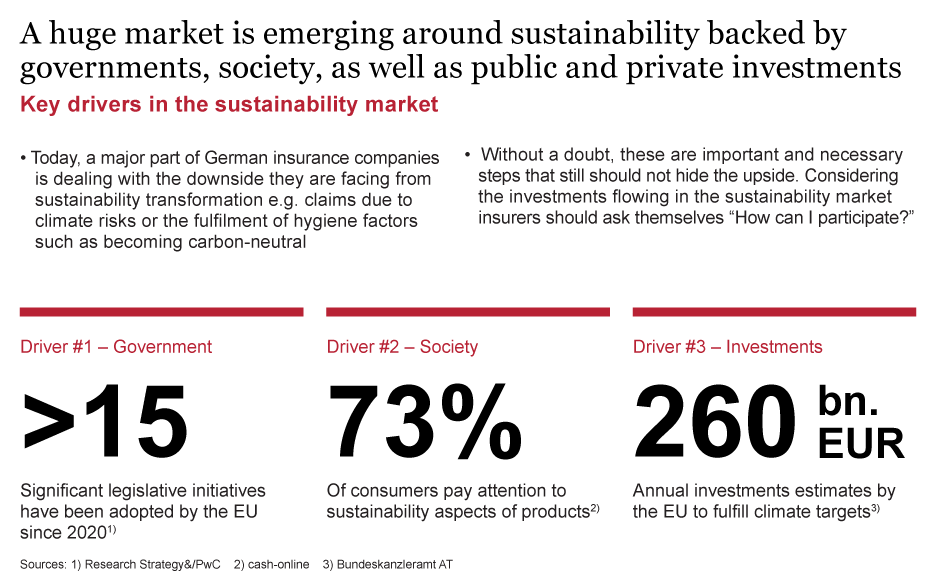

How insurers can enjoy the upside of the ESG transformation (PwC)

Tim Braasch | Partner, Strategy& Germany, states that many insurance companies are currently busy handling what is for them the downside of the transformation towards environmental sustainability. While meeting these expensive obligations, they should take care not to neglect the many revenue opportunities that this transformation will open. They should ask themselves how they can participate in the booming sustainability market and make the most of these opportunities. A 2021 PwC survey conducted in 22 countries revealed that a half of all customers say they have become more eco-friendly during the course of the COVID-19 pandemic, and are significantly more likely than in a similar PwC survey from 2019 to choose sustainable products in order to help the environment. Read more.

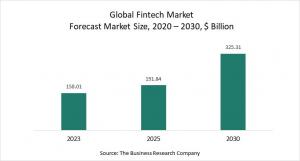

Fintech Market To Grow At Rate Of 11% Due To Increasing Focus Of Big Tech Companies On Financial Services (EIN News)

The Business Research Company’s Fintech Market – Opportunities And Strategies – Global Forecast To 2030 report, states that the global fintech is expected to grow from $111.24 billion in 2019 to nearly $158.01 billion by 2023 at a compound annual growth rate (CAGR) of 9.2%. Also, the market is expected to grow to $191.84 billion in 2025 at a CAGR of 10.2% and to $325.31 billion in 2030 at a CAGR of 11.1%. Big tech companies focusing on financial services are expected to positively impact the fintech market’s growth. Read more.

—

Do you have any news to share: please put [email protected] on your press list.

Curious to read and find out more from fintech? Then subscribe & read our full newsletters here: https://hollandfintech.com/featured/newsletters/ . In order to see our other weekly highlights, check out the following links: analysis & opinion.