Web-IQ has been crawling and monitoring darknet marketplaces since 2016. These anonymous marketplaces facilitate illicit trade, fraud, and other serious crimes. To avoid leaving a money trail that can be used in investigations, these markets rely on anonymous cryptocurrency. Web-IQ analysed 70 of the most significant darknet markets to measure the adoption of cryptocurrency and how that has changed over the past 6 years.

Cryptocurrencies and privacy coins

Bitcoin has been the main form of payment on darknet markets since Silk Road, which is considered the first ‘modern’ darknet market. Cryptocurrency such as Bitcoin are unregulated since there are neither financial institutions nor government institutions involved. Bitcoin transactions and wallets are anonymous since the identity of the person behind an address is difficult to trace. Bitcoin however, is not private since every transaction and wallet is publicly visible in the blockchain. Other more private cryptocurrencies have emerged, referred to as privacy coins, of which Monero is the most popular one. Started in 2014, Monero aims to hide the addresses of the sender, recipient, and the full transaction amount

Bitcoin and Monero are the preferred currencies on the darknet

For the analysis, we looked at 70 major darknet markets of which 35 are currently active and 35 no longer exist. All the markets support transactions in cryptocurrency.

Bitcoin is still the most popular

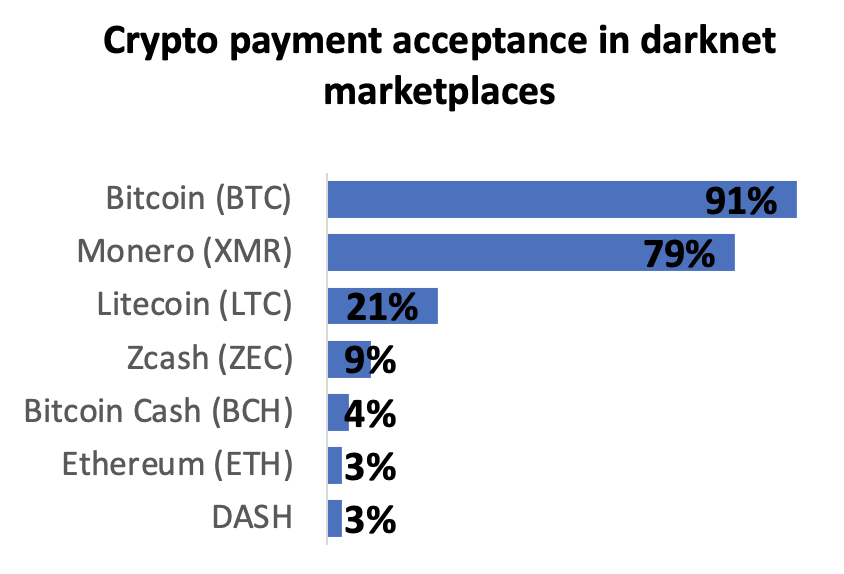

Of the 70 analysed darknet markets, 91% accept(ed) Bitcoin payments, 79% Monero, 21% Litecoin and a small percentage (<10%) accept ZCash, Bitcoin cash, Ethereum or Dash. The majority of the markets (69%) support two or more cryptocurrencies.

Monero is on the rise

While bitcoin is still the most supported currency on the darknet, the popularity of Monero is rapidly increasing. Four of the markets that opened this year only support Monero for payment. It will be interesting to see if Monero will push Bitcoin and other ‘traditional’ cryptocurrencies from darknet networks. This for a large part will be driven by the maturing of transaction monitoring and blockchain analysis tools like those supplied by Crystal Blockchain, Chainalysis and ScoreChain. These tools support law enforcement agencies and financial institutions in detection, investigation, and the de-anonymising process of suspicious transactions. Compared to Bitcoin, Monero so far has proven to be much more complex to track.

DarkCloud for Crypto Intelligence

Web-IQ continues to crawl dark corners of the web to detect and collect crypto addresses linked to suspicious behaviour. So far, Web-IQ has identified over 250.000 unique crypto addresses of which 15.000 have been labelled as high-risk. These numbers increase every day. By providing the relevant details, our customers are able to complement the collection of evidence and aid their investigations.

______

Download the full report here.