Amid the huge economic implications of the war in Ukraine and with inflation at its highest in three decades, Chancellor Rishi Sunak’s Spring Statement included a number of new measures designed to support homes and businesses. Find out what’s new:

The chancellor had hoped to move to a single budget this year, and use the Spring Statement on 23 March as a means to update the nation on economic forecasts and tax change ideas.

But with inflation at a 30-year high and the cost of living continuing to soar, the Government announced measures intended to help ease the burden on households and businesses. The measures include:

1. National Insurance threshold raised

From July 2022, the government will raise the threshold for the amount people earn before national Insurance to £12,570 a year. “That’s a £6bn personal tax cut for 30 million people across the United Kingdom” and “a tax cut for employees worth over £330 a year.”

2. 0% VAT on energy-saving materials

For the next five years, homeowners will pay 0% VAT on energy saving materials such as solar panels or heat pumps.

If you’re looking to invest in green technologies for your business, you could be eligible for green business finance. You can use it to fund green assets like electric vehicles and solar panels, green projects, and sustainable products and services.

3. 5p fuel duty cut

Fuel duty is cut by 5p, which the chancellor says is “the biggest cut to all fuel duty rates ever”. The cut will apply from 6pm tonight and last until March 2023. The RAC says cutting fuel duty by 5p will take £3.30 off the cost of filling a typical 55-litre family car.

4. Support for Ukraine

“We have a moral responsibility to use our economic strength to support Ukraine” including “to impose severe costs on Putin’s regime”, said Sunak.

The government is supplying military aid to help Ukraine defend its borders and approximately £400m in economic and humanitarian aid - as well as up to $0.5bn in multilateral financial guarantees. The new ‘Homes for Ukraine’ scheme will help ensure “those forced to flee have a route to safety here in the UK.”

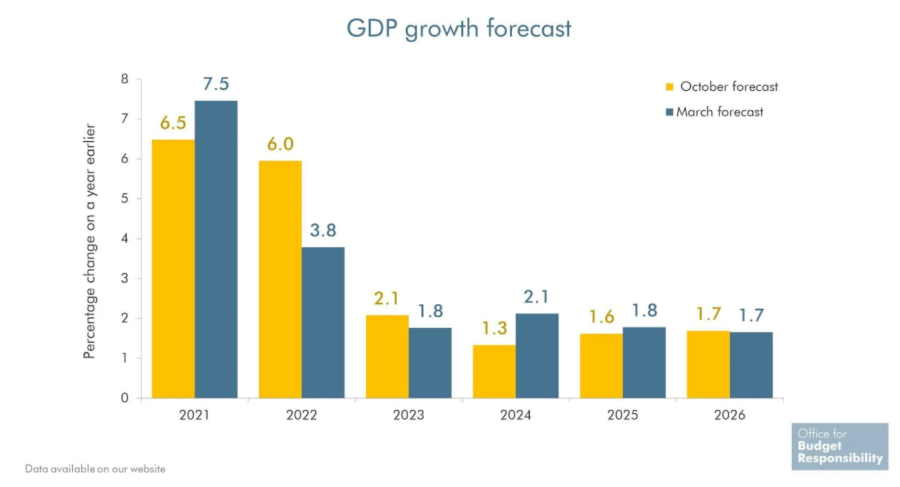

The OBR cut its forecasts for economic growth this year due to the Russia-Ukraine war leading to a spike in inflation.

5. Employment allowance rise

In two week’ time the Employment Allowance, which allows eligible employers to reduce their annual National Insurance liability, will increase from £4,000 to £5,000.

____

Find out more here!