Our research and analysis puts five BNPL myths to rest

With buy now, pay later (BNPL) becoming ubiquitous in digital retail, and the numbers of users rising steadily, it’s likely you’ve heard of Klarna, Afterpay, Affirm, and other BNPL providers.

You may have even considered using (or have already used) BNPL at some point. But knowing about BNPL – and using it once or twice – won’t answer some of the financial industry’s biggest questions about its longevity, its customer base, and its future.

Current accepted knowledge tells us that the BNPL phenomenon is being driven by a younger cohort of consumers: Gen Z. But push the stereotype of fast fashion twenty-somethings who can’t afford to “pay now” but want instant gratification from your mind. As with any generation, Gen Z is a diverse collection of goals and aspirations, encompassing a massive landscape of financial proclivities.

At FintechOS we believe Gen Z is critical to understanding the future of financial services. We also believe that we are dealing with something much bigger with BNPL disruption.

If there’s one thing everyone has to accept about digital financial services, it’s that you can’t get away with one size fits all anymore. So, to inform the FintechOS product and better understand the solutions our customers are building with our platform, we set to find out more about the end consumers who use BNPL – and we busted some commonly accepted myths in the process.

Our survey, in partnership with Censuswide, spoke to consumers of all ages in France, Germany, and Spain and here are some of our initial findings.

BNPL myth 1: it’s only for younger consumers

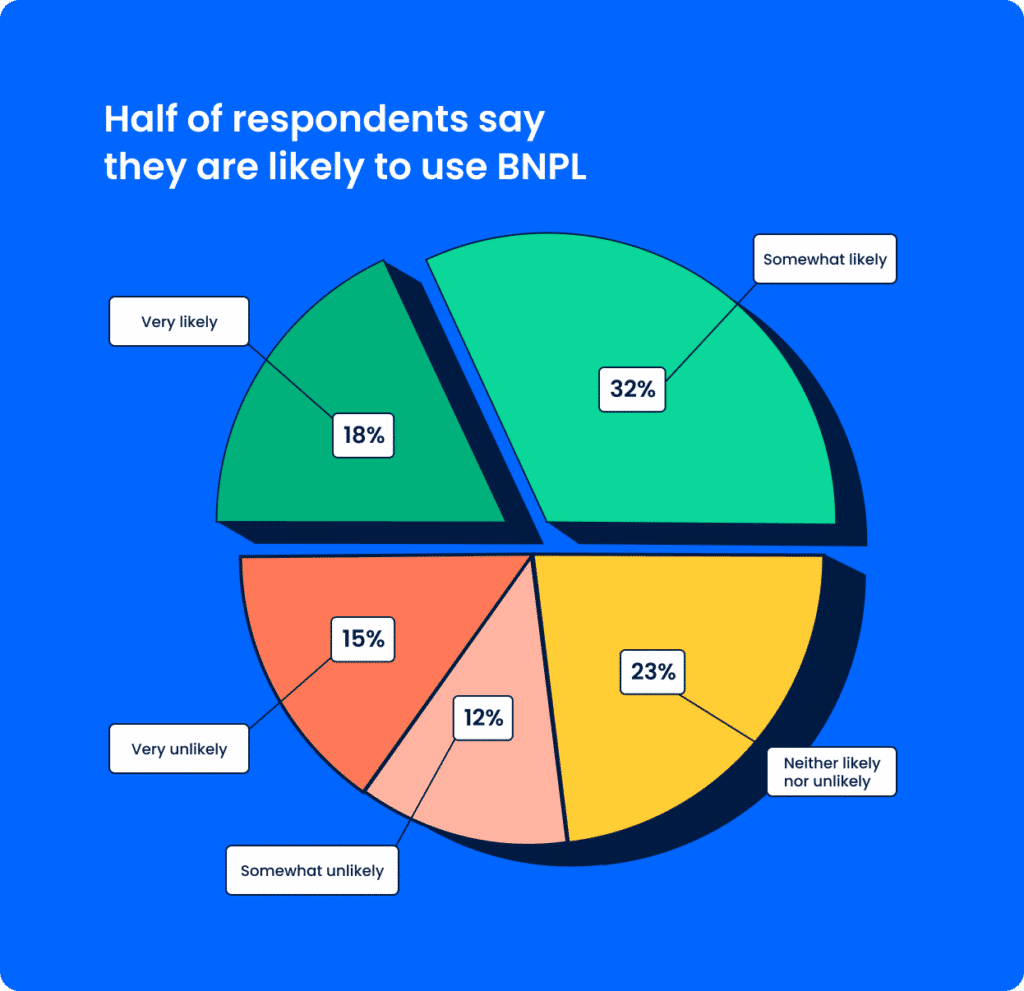

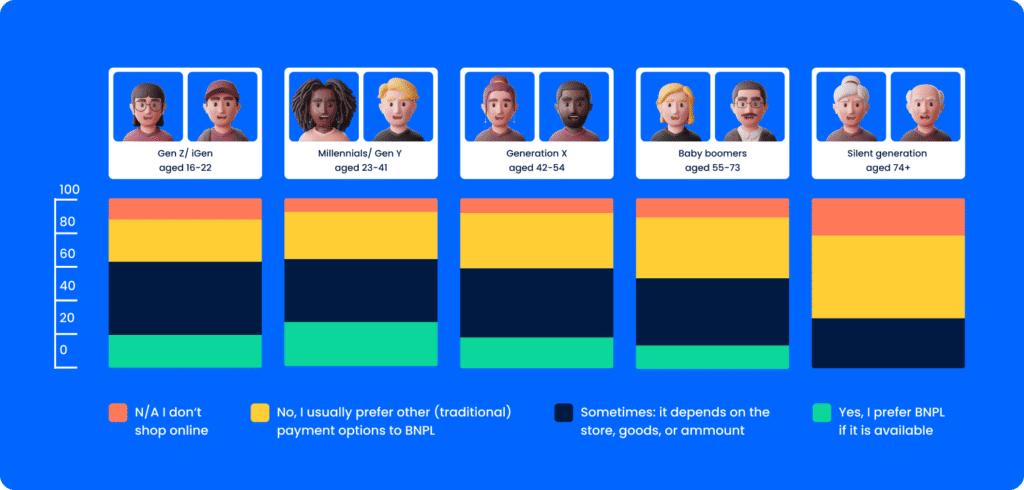

Our survey numbers clearly disagree, showing that it is for everyone. While it’s true that the data shows it is weighted to the young generations, even the boomers are not all negative.

Yes, Gen Z and millennials are 1.5x more likely to use BNPL than boomers. And yes, there are twice as many people who are very unlikely to use BNPL among boomers compared to younger generations. However, over a third of boomers would still consider using BNPL.

So while the drop-off is certainly there, the ongoing mainstreaming of BNPL is clearly reaching every age group, even to the point that a growing percentage of shoppers would take BNPL not just as a payment option possibility but as their first choice.

____

Read full article here.