For this week’s research article, we dive into new insights on decentralized finance, POS, and payments. Enjoy researching!

Visa: More Than One Third of APAC Consumers Likely to Use DeFi in Next 6 Months (FinTech Singapore)

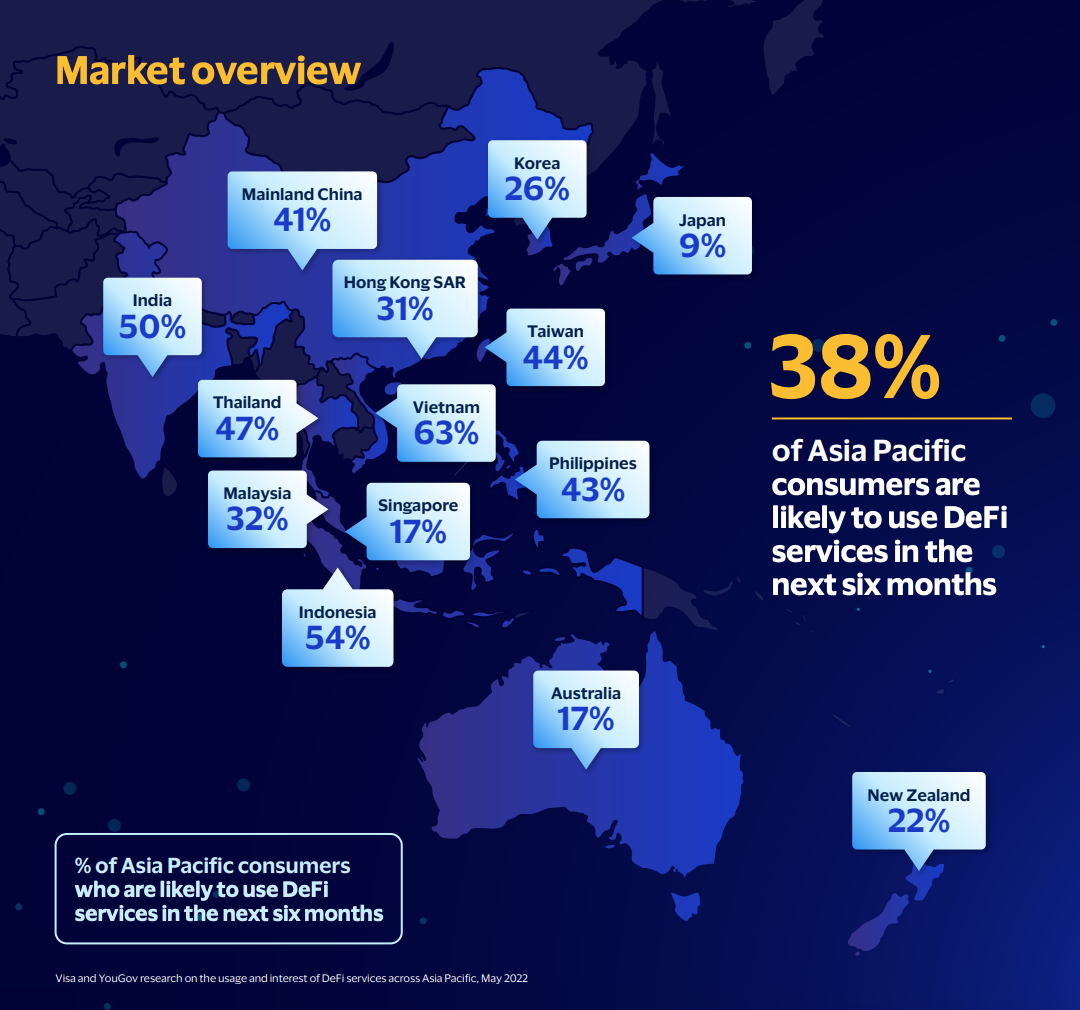

In Asia-Pacific (APAC), though decentralized finance (DeFi) remains a nascent sector, adoption of DeFi services among consumers is growing rapidly, fueled by the region’ burgeoning blockchain and cryptocurrency startup scene. A 2022 survey conducted by Visa and YouGov, which polled 16,295 adults across 14 markets, found that 21% of APAC consumers had used DeFi services before, a proportion that’s expected to grow 17% points this year, with a further 38% expressing interest to try DeFi services in the next six months. Read more

Metaverse and decentralised identity flagged as emerging tech to watch - Gartner (Finextra)

Research by Gartner identified 25 “must-know” emerging technologies across three key areas which it predicts will greatly impact business and society over the next two to ten years. Importantly, Gartner explains that these technologies will assist CIOs and IT leaders in their efforts to achieve digital transformation. Across the three main themes of evolving/expanding immersive experiences, accelerated artificial intelligence automation, and optimised technology delivery, Melissa Davis, VP analyst at Gartner explained: “All these technologies are at an early stage, but some are at an embryonic stage, and great uncertainty exists about how they will evolve.” Read more

Apple to drive huge surge in soft POS adoption (Fintech Global)

The number of merchants deploying soft POS solutions will surpass 34.5 million globally by 2027, rising from six million in 2022. The finding from Juniper Research’s new report ties the growth of the soft POS with the entrance of Apple into the space, with iOS users able to access an affordable mobile point-of-sale solution. A soft POS solution enables NFC enabled smartphones or tablets to accept contactless payments, without additional hardware. Juniper claims that Apple’s decision to enable third-parties to develop soft POS solutions leveraging iOS NFC capabilities will result in an influx of iOS-specific services. Read more

State of play: BNPL (Fintech Futures)

BNPL has become one of the most divisive credit products of the modern age. To some, it’s the future of fairer, affordable and transparent credit, while others claim it’s the next ‘payday loan’ crisis in waiting. In truth, it is likely somewhere in-between, and a topic I’ve been keen to explore in-depth for a while. BNPL, in essence, is a win for all parties. It increases customer conversion for the merchant and is often far cheaper for consumers than traditional credit cards while providing more flexibility to pay off. However, it has garnered criticism surrounding users falling into debt and not reporting information to credit agencies, although Klarna is now doing so as of June 2022. Read more

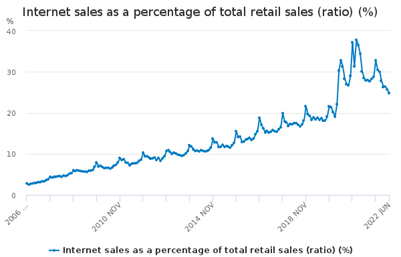

Source: Office of National Statistics

Source: Office of National Statistics

—

Do you have any news to share: please put [email protected] on your press list.

Curious to read and find out more from fintech? Then subscribe & read our full newsletters here. In order to see our other weekly highlights, check out the following links: analysis & opinion.