Ibanity Blog

Despite all the challenges introduced by Open Banking and unstable API connections, Ibanity has always maintained its core values and mission, helping partners transform the way they interact with bank data through innovation and customer centricity.

Through this approach, we’ve made great strides allowing us to expand our products at a European level. Today, Ponto is connected to 1,800 banks in Europe and serves over 150 partners with harmonized Account Information and Payment Initiation APIs.

We’re committed to continue closing the gaps in bank connectivity and business automation. We’re excited to announce Ponto for Representatives, a new feature dedicated to automating financial data input in any software!

Bank Connections Can Be Established in Different Ways Depending on the Use Case

Throughout our journey, we’ve served multiple industries and learned that not every Open Banking use case is the same. Here’s why:

Open Banking is ultimately about being able to retrieve transaction information for Account Information (AIS) in an automated and structured manner. However, the way the data is used and the preferred method of connecting, authorizing, and maintaining bank connections differs from one case to the other.

When Ponto was launched back in 2019, the Payment Service User (PSU) or bank account holder was directed to Ponto’s website, where he created an account and authorized the connection between Ponto and the bank account. From Ponto’s portal, the user could create Ponto tokens to share with his favorite applications. The applications use the tokens to access Ponto and retrieve the desired data.

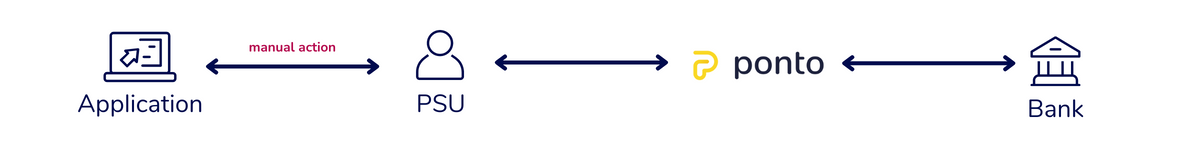

Through this method, Ponto interacts with the bank and the applications interact with Ponto. We still offer this integration under the label “Custom Integrations”. This method is used primarily by offline or on-premises solutions. The setup works well but it still requires some user interaction, which was the reason Ponto Connect was developed.

Custom Integrations

Ponto Connect allows the application to follow a more user-friendly redirect model to set up the connection. As part of the Ponto Connect flow, the PSU is sent directly from his application to Ponto, where he authorizes the bank connection and integration with the requesting application. The token is shared with the application using the OAuth protocol, so no further user interaction is required. Most of Ponto’s integrations today rely on this safe and user-friendly method.

Ponto Connect

.png)

Despite the success of Ponto Connect and Custom Integrations, we noticed that these two options did not cover every use case.

A Solution for the PSU Without Direct Access to the Application

At Ponto, we serve multiple software solutions including online, cloud based, offline and on-premise. However, a third scenario, where the PSU does not have access to the requesting application was missing!

______

Read the full blog here.