A little bit of last year and some of new year, but here we go - selected research news that hopefully will help for the better! Enjoy researching!

Visa explores auto payments for crypto wallets (Finextra)

Researchers at Visa have been investigating how to enable automatic recurring payments for self-custodial crypto wallets. In a new technical paper, the researchers investigate how to bring the commonplace automatic recurring payment option to the world of crypto and blockchain. This, the paper says, “is not a trivial task on a blockchain like Ethereum”, adding: “For self-custodial wallets where the user has sole control over the wallet and private keys, automated programmable payments that can pull payments automatically from a user’s account at recurring intervals requires engineering work.” Read more

Cash remains king but digital payments are catching up, ECB study finds (Fintech Global)

A study by the European Central Bank (ECB) has found that while cash is the most commonly used form of payment, electronic payments are quickly catching up. The study measured the payment attitudes of consumers in the euro area. According to the research, cash was used for 59% of point-of-sale transactions, which was down from 72% in 2019. A majority – 60% – also consider it important to have cash as a payment option. Consumers perceive cash as helpful to remain aware of their expenditures to protect their privacy and to allow transactions to be settled immediately. Overall, consumers are satisfied with their access to cash, with a large majority of consumers finding it easy to get to an ATM or a bank to withdraw cash in most countries. Read more

The Fintech Times FINTECH: Middle East & Africa 2022 (The Fintech Times)

For those who are reading this – whether you live in the Middle East and Africa, follow fintech regularly, working in the sector, or just simply curious about it – we all hope the Fintech: Middle East and Africa Report 2022 will prove useful for you. Despite its complexities, our aim is to make topics as simple as possible to be accessible to all levels. For those of you who are more ‘in-tune’ with fintech and goings-on in MEA, I hope you will learn new things with not only about others but also your own contributions to the wider global community. Now come with me as I take you on a journey through the exceptionally diverse region of the Middle East and Africa. -Richie Santosdiaz. Read more

Anti-money laundering and countering the financing of terrorism: Supervision Report 2020-22 (UK Government)

This report provides information about the performance of AML/CTF supervisors between 6 April 2020 – 5 April 2022 and fulfils the Treasury’s obligation, under Section 51 of the MLRs, to publish an annual report on supervisory activity. The report includes supervisory and enforcement data on both the Statutory and Professional Body Supervisors, highlighting any notable changes in supervisory activity and any fines that supervisors have issued. This report provides supervisory and enforcement data for both the 2020-2021 period (6th April 2020 – 5th April 2021) and the 2021-2022 period (6th April 2021 – 5th April 2022). The two years have been combined to address delays in reporting that developed during the pandemic and ensure data is available as close to the relevant period as possible. Read more

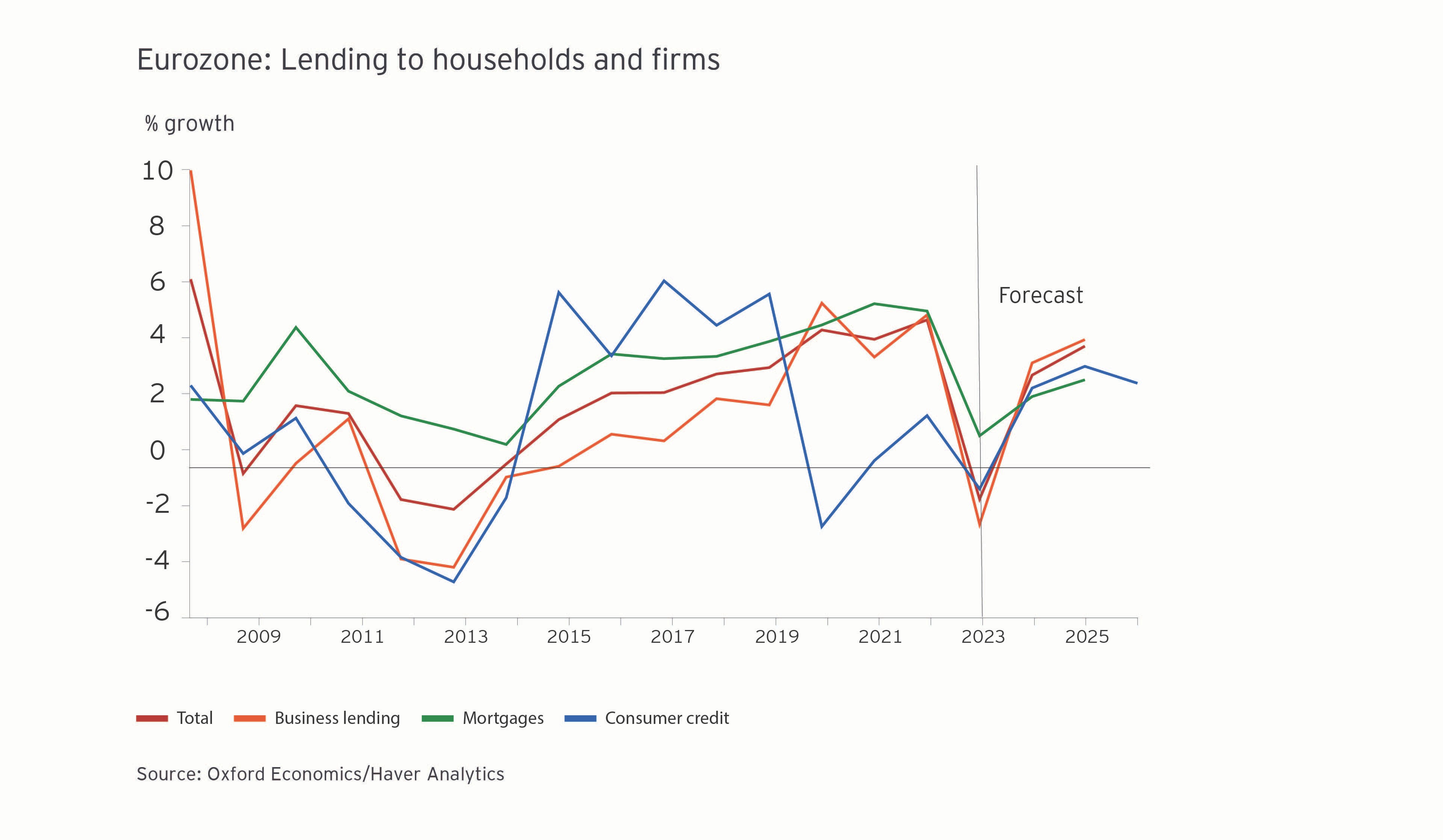

Eurozone bank lending to fall for first time since 2014 as major economies slip into recession – with Germany and Italy set for sharpest declines (EY)

Bank lending across the eurozone is expected to rise 4.6% by the end of this year but will contract 1.8% in 2023 – the first decline since 2014 – as eurozone economies slip into recession, according to the latest EY European Bank Lending Economic Forecast. Germany – traditionally the strongest of the major eurozone economies – and Italy are forecast to see the steepest declines in net bank lending next year, of 1.7% and 1.8% respectively, principally due to the economic consequences of their exposure to high energy prices. As market demand for loans falls across the region, banks are also expected to tighten their lending criteria as they contend with rising interest rates and a volatile economic outlook. The forecast fall in total bank lending in 2023 is driven principally by rising energy prices, interest rates and inflation and falling real household incomes affecting confidence and demand. The fall, however, is expected to be short-lived, providing the war in Ukraine does not escalate. A return to growth in bank lending of 2.7% is forecast in 2024 across the eurozone, followed by 3.7% in 2025, assuming inflation falls back, energy prices stabilize and confidence returns. Read more

–

Do you have any news to share: please put [email protected] on your press list.

Curious to read and find out more from fintech? Then subscribe & read our full newsletters here. In order to see our other weekly highlights, check out the following links: analysis & opinion