The fintech industry is rapidly evolving and disrupting traditional financial systems. In this article, we bring you the latest research insights to help you stay ahead of the curve and understand the future of financial technology. Enjoy researching!

GPT-3 Use Cases in Banking, Finance and Fintech (Fintechnews Switzerland)

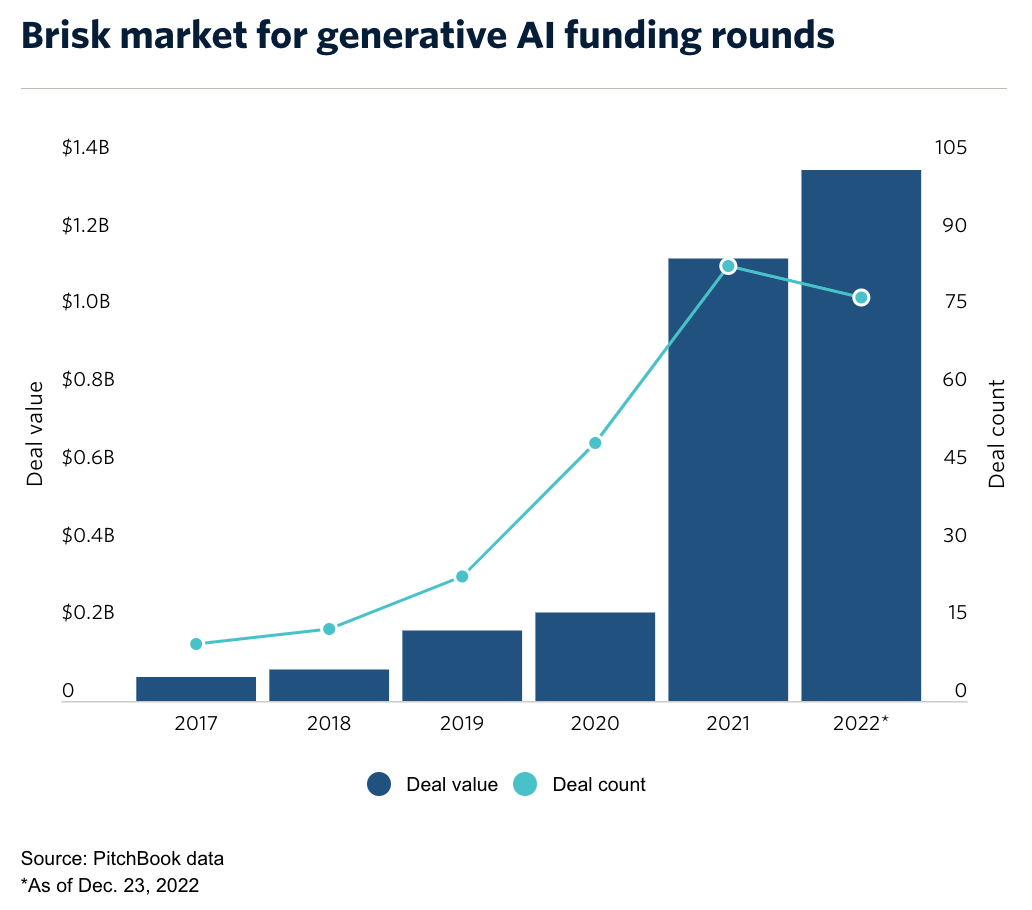

Since its release in November 2022, artificial intelligence (AI)-powered chatbot ChatGPT has garnered much excitement in the technology industry, praised by industry observers and experts for its ability to accurately answer questions, mimic human language and complete a wide range of tasks, from creating software to formulating business ideas. Developed by American AI research laboratory OpenAI, ChatGPT is a chatbot that’s able to articular answers across many domains of knowledge, handle complex queries, debug computer programs, compose music, write poetry, and much more. With 175 billion parameters, GPT-3’s language model is said to be one of the largest language processing AI models to date, making it better than any prior model for producing human-like text. In the banking and fintech sector, applications for GPT-3 are wide-ranging, encompassing chatbots for customer inquiries, document processing and report generation, personalized financial advice, financial forecasting and fraud detection, to name a few. OpenAI’s AI chatbot ChatGPT went viral shortly after its release on November 30, 2022, surpassing one million users in just five days. Venture capital investment in generative AI, or algorithms that can be used to create original content, increased nearly 500% between 2020 and 2022 to US$1.37 billion, data from Pitchbook show. Read more

ECB publishes financed climate-related indicators and emissions (The Paypers)

The European Central Bank has announced the publishment of a new series of statistical indicators that aim to help analyse and manage climate risks in finance. The new series of statistical indicators show that the volume of sustainable and green bonds has grown faster that the larger bond marketplace. This number is doubled in the euro area in the past two years. The data indicators cover three important areas, including sustainable finance, the impact of physical climate risks on loan and security portfolios, as well as financed emissions. The carbon emissions financed by companies and financial institutions are indicated as well, including information on the carbon intensity of the organisation’s securities and loan portfolios, as well as on the sector’s exposure to counterparties. They offer information on models that include carbon-intensive representations. Indicators of this industry cover financed emissions and the total greenhouse gas emissions of an issuer or a debtor. For the sustainable finance area, the indicators follow the issuance, while holding debt instruments with sustainability characteristics. These include social, green, sustainability, and sustainability-linked bonds in the Euro area. The aim of the indicators that focus on climate-related risks is to analyse the impact of natural hazards, such as wildfires, floods, storms, and the performance of loans, equities portfolios, and bonds. Read more

Cash or cashless? How people pay (ECB)

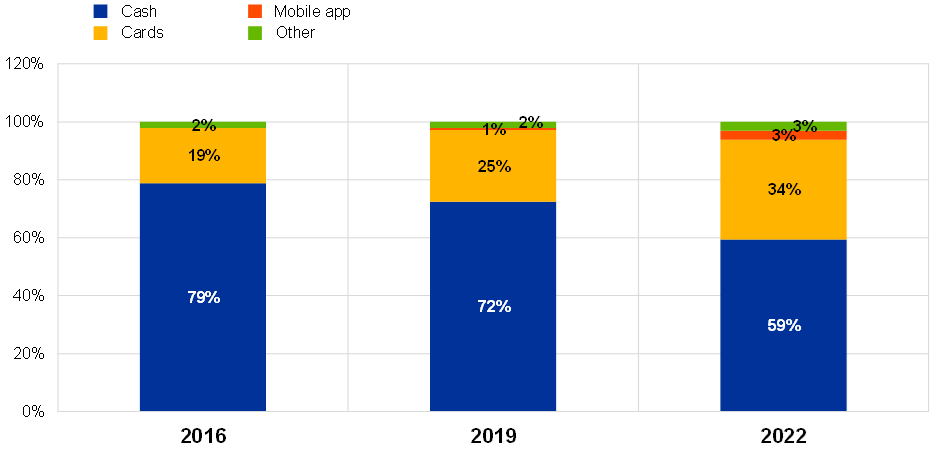

Digitalisation has changed, and will continue to change, the way people make payments. Today’s payment options are in some ways unrecognisable from what was available a decade ago. The study on the payment attitudes of consumers in the euro area (SPACE) is conducted on a regular basis and sheds light on payment trends. The study demonstrates that cash is still the most frequently used means of payment at point of sale, although its use in the euro area has declined. In 2016 and 2019, 79% and 72% of the total number of transactions at points of sale, such as shops and restaurants, were made in cash. In 2022, this figure had fallen to 59%. Although most payments were still made in cash, 55% of euro area consumers prefer paying with card or other cashless means of payment. This is mostly due to the convenience of cashless payments: people do not need to carry hard cash. Still, cash is the preferred means of payment for 22% of those surveyed, largely because it helps to track people’s expenses and is more private. Despite the preference for cashless payments, 60% of euro area consumers state that they value having the option to pay in cash. Read more

Australian Government publishes token mapping consultation paper (Finextra)

The Treasury of Australia is seeking responses to its latest consultation paper, exploring crypto assets in the Australian financial services regulatory context. In August 2022 the Government announced that it would take a more serious approach to the crypto ecosystem, and that “token mapping” would be a “foundational step in the Government’s multi-stage reform agenda that commits to developing appropriate regulatory settings for the crypto sector.” The paper explains that “token mapping is the process of identifying the key activities and functions of products in the crypto ecosystem and mapping them against existing regulatory frameworks.” Read more

Corporate centricity: The future of competitive advantage in banking & payments (The Paypers)

For banks & financial institutions (FIs), there’s only one issue that will impact the success and growth of their institution: competition. Banks & FIs will need to compete for customers; to do that, they need to be aligned with their clients’ priorities and can deliver on their demands for new functionality. They can do this by accelerating their digital payments transformation and continuing to evolve their solution offerings. It may seem like a daunting task, but this article will reveal the top corporate priorities for 2023. It will also enable banks & FIs to benchmark themselves against their competition in meeting and delivering on these expectations. To gauge the bank’s priorities, Vitus and Zhenya will be using statistics from Bottomline’s 2nd annual The Future of Competitive Advantage in Banking & Payments report based on results from a survey of 320+ banking & FI players across Treasury, Fraud, Operations, Innovation, Product, and Technical Implementation at C-Level in 34 countries globally. For the corporate view, we have used statistics from our range of Bottomline global 2022 surveys. This will provide the 360-degree view required. Read more

Digital injection attacks 5-times more common than presentation attacks (Finextra)

Digital injection attacks, where criminals bypass video biometrics with synthetic imagery, are now five times more common than presentation attacks, i.e. wearing a mask or showing a photo. The finding comes from iProov’s new ‘Biometric Threat Landscape 2023 Report’, which it claims is the first of its kind. The report explores the attack trends facing biometric systems. A digital injection attack is where a malicious actor can bypass a camera feed to trick a system with synthetic imagery and video recordings. The report cites the rise in digital injection attacks is due to the ease in which they can be automated, as well as the rise in access to malware tools. It claims that over three quarters of malware available on the dark web is available for under $10, with the rise of malware-as-a-service and plug-and-play kits, just 2-3% of threat actors today are advanced coders. Read more

–

Do you have any news to share: please put [email protected] on your press list.

Curious to read and find out more from fintech? Then subscribe & read our full newsletters here. In order to see our other weekly highlights, check out the following links: analysis & opinion