The fintech industry is rapidly evolving and disrupting traditional financial systems. In this article, we bring you the latest research insights to help you stay ahead of the curve and understand the future of financial technology. Enjoy researching!

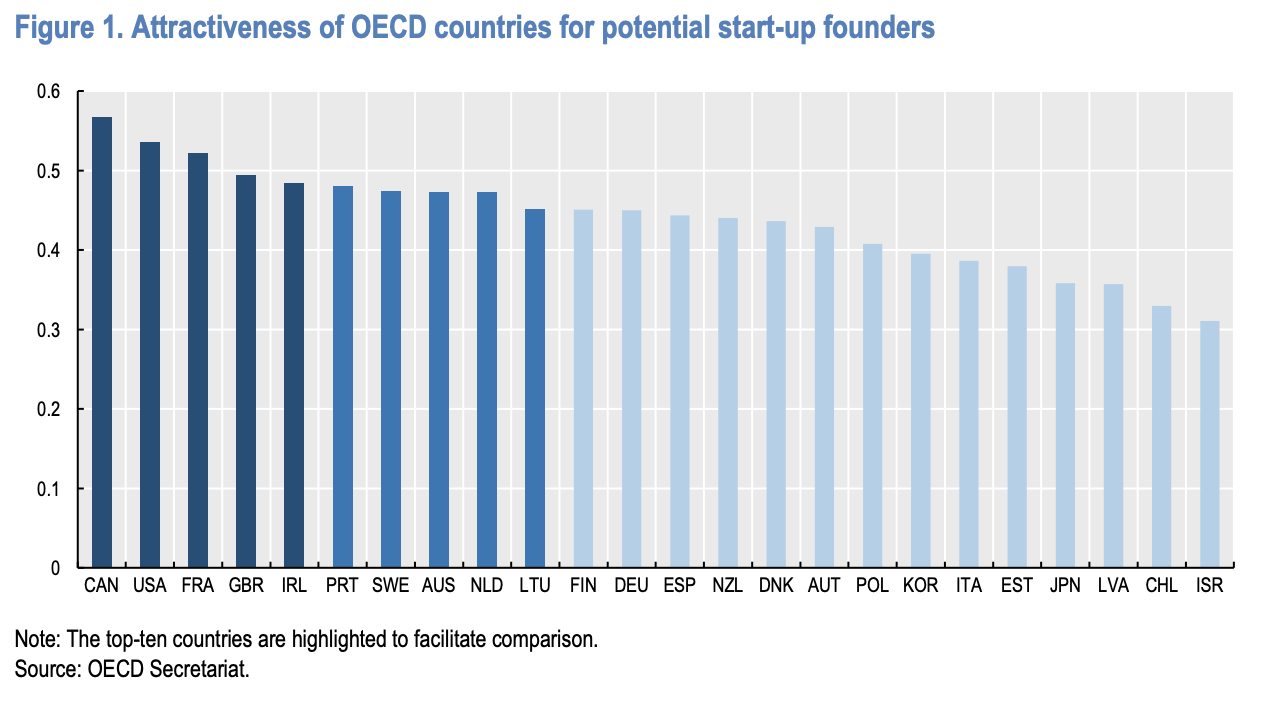

Talent Attractiveness 2023 (OECD)

The OECD Indicators of Talent Attractiveness (ITA) is the first comprehensive tool to capture the strengths and weaknesses of OECD countries regarding their capacity to attract and retain different types of talented migrants. The 2023 edition of ITA now includes 4 categories of talented migrants: highly educated workers, foreign entrepreneurs, university students and start-up founders, as well as an expanded range of dimensions for assessing a country’s attractiveness. Read more

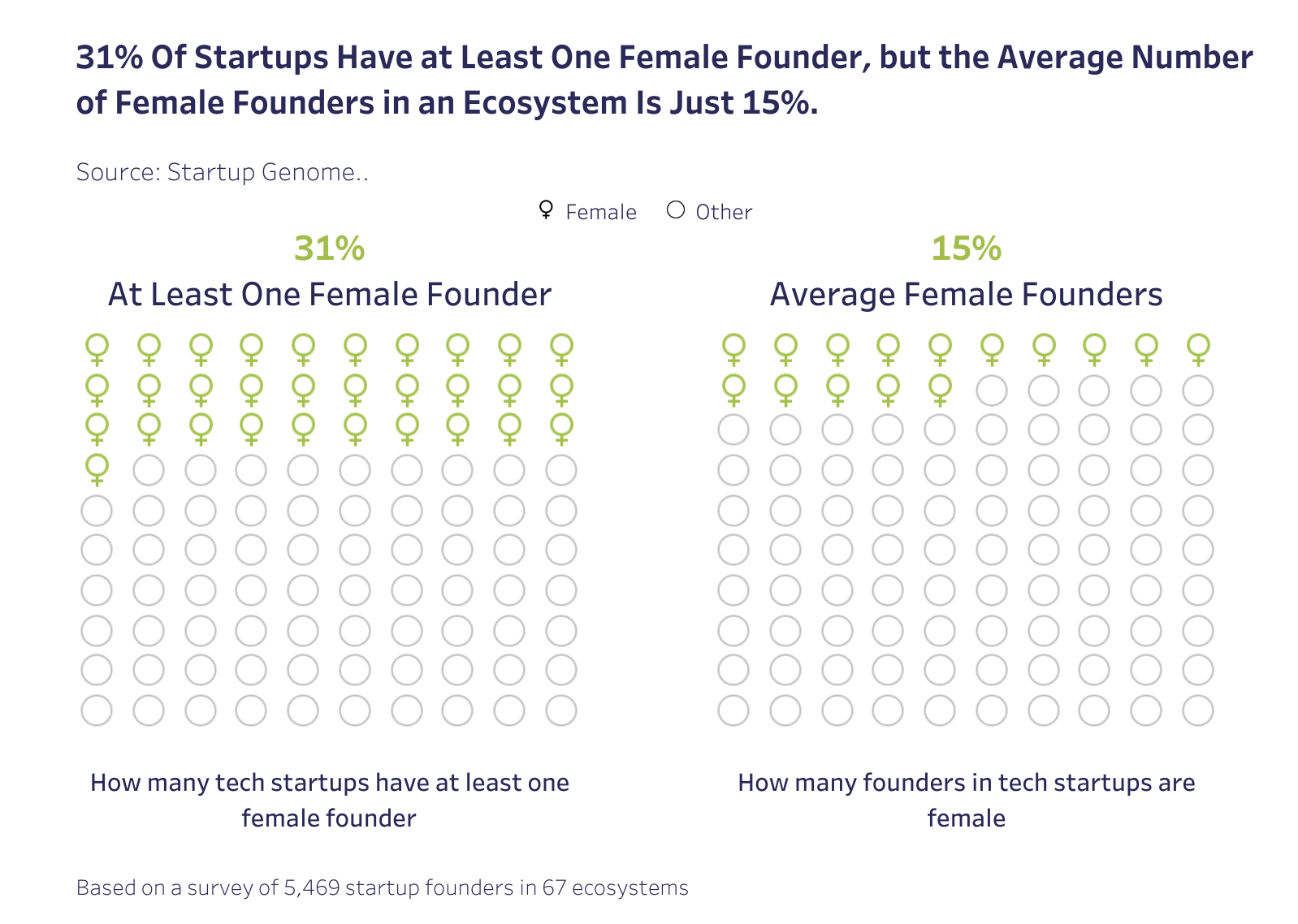

Only 15% of Tech Startup Founders Are Female (Startup Genome)

As part of our assessment research, we survey founders of technology startups and scalable ventures. As a part of these surveys, we ask respondents to select how many founders are in their company and how many are female. Perhaps unsurprisingly, the results show that women remain in the minority among tech startup founders. Of the 5,469 respondents surveyed across 67 global ecosystems between September 2016 and November 2022, 31% reported having at least one female founder. The overall average of female founders in an ecosystem (total number of female founders divided by number of startup founders surveyed) is just 15%. Read more

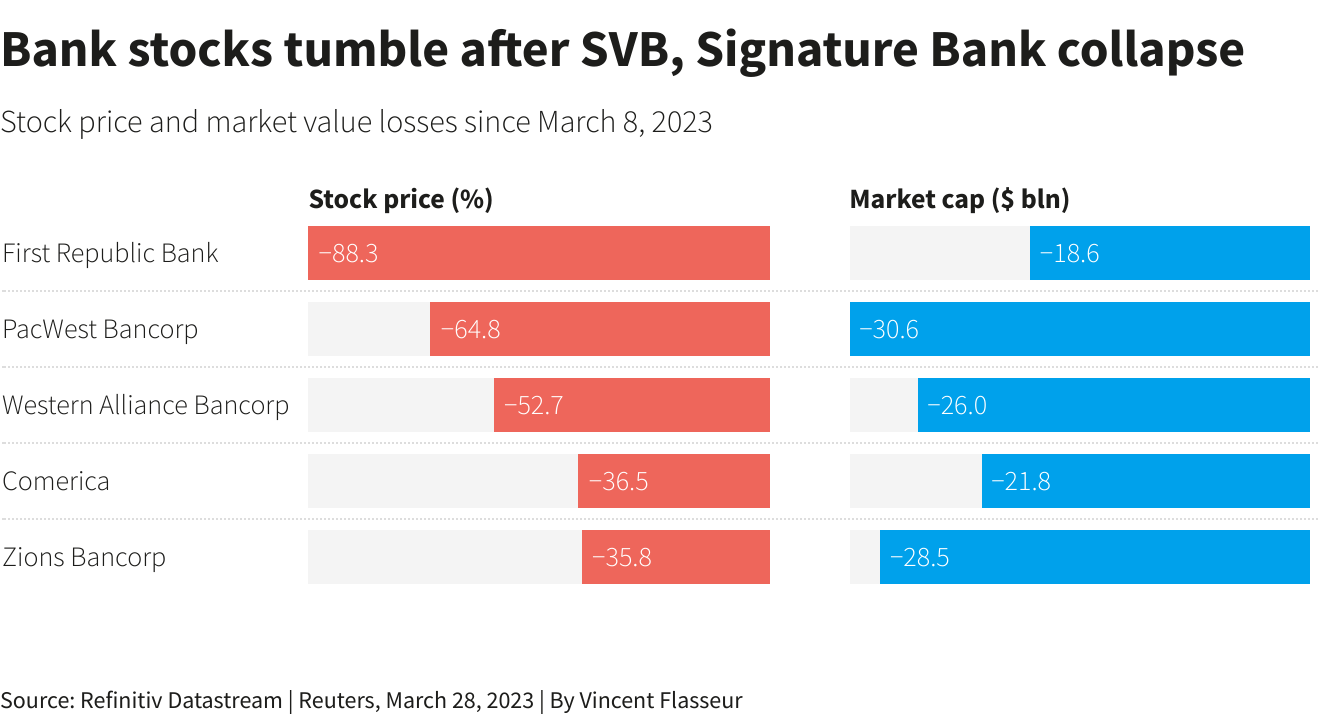

Signs of pain as easy cash era ends are growing (Reuters)

The easy-cash era is over and markets are feeling the pinch from the sharpest jump in interest rate in decades. The collapse of U.S.-lender Silicon Valley Bank (SVB) in early March after heavy losses on its bond portfolio as rates climbed was a wake-up call for markets that monetary tightening will likely bring more pain. Since late 2021, big developed economies including the United States, euro area and Australia have raised rates by almost 3,300 basis points collectively. Banks remain at the top of the worry list after the collapse of SVB, as well as Credit Suisse’s forced merger with UBS, sparked turmoil across the banking sector. Investors are alert to which other banks might be sitting on unrealised losses in government bonds, the prices of which have dropped sharply as rates have risen. The SVB bond portfolio losses have highlighted similar risks for Japanese lenders’ gigantic foreign bond holdings, which carry over 4 trillion yen ($30 billion) in unrealised losses. Japanese, European and U.S. banks stocks, while off recent lows, are still well below levels seen just before SVB’s collapse. Read more

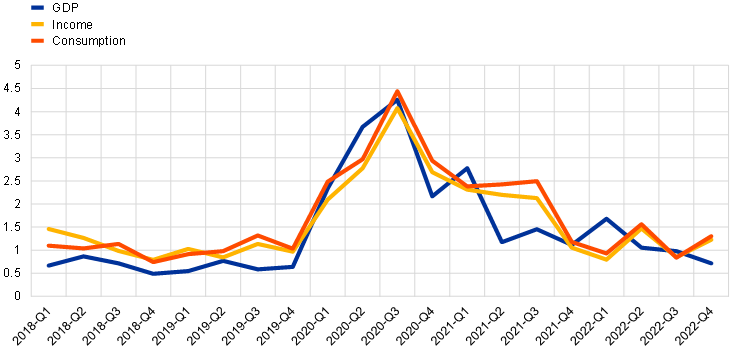

A problem shared is a problem halved – the benefits of private and public risk sharing (European Central Bank)

Europe is coping with two unprecedented economic shocks, caused by the global pandemic and the war in Ukraine. Even though these shocks have hit every Member State, their effects on income, employment and other economic variables have varied widely across the euro area. This poses a major challenge for the ECB’s single monetary policy and makes risk sharing a necessary tool to increase resilience and preserve convergence within the Economic and Monetary Union (EMU). Common, external shocks like the coronavirus (COVID-19) pandemic result in asymmetric impacts across Member States due to these states’ different economic, financial and institutional structures. European countries have also been affected differently by shocks caused by the war in Ukraine. The implementation of sanctions imposed on Russia and different dependencies on various energy sources matter for their exposure to the shock, leading to asymmetric impacts across Member States (Figure 1). The close resemblance between the variation in Gross Domestic Product (GDP), income and consumption dispersion suggests limited (or a lack of) risk-sharing. Read more

Closing the tech talent gap: Adopting the right mindset (McKinsey)

German companies have focused on filling tech jobs, yet the tech gap in the German economy continues to grow—from 700,000 open positions in 2023 to an expected 780,000 by 2026.1 While recent fluidity in the tech talent market may be cause for optimism, it should not be seen as a cure. In North America, about 80 percent of tech workers who had been let go in 2022 found a new position within three months, and new tech job postings far outnumbered laid-off workers.2 Considering that Europe’s tech industry was hit with fewer layoffs, the German tech talent gap is unlikely to vanish anytime soon. Unlocking the potential of German companies will require fundamental shifts in how companies think about tech skills and talent. Previous research from the McKinsey Global Institute highlights how skill-based talent management could make all the difference. In this approach, employees are not hired, developed, or rewarded based on the specific role or their experience but on current and potential skills. Read more

How a B2B company drove engagement by transforming its D2C platform (EY)

Merck Animal Health modernized its HomeAgain e-commerce site to offer customers a robust online experience and drive growth and expansion. Pet recovery is a big business that helps unite families with their beloved pets. Merck Animal Health’s HomeAgain® program, a pet recovery and protection service that helps locate lost pets, has located more than three million pets during the last two decades. The business historically focused on providing pet-tracking microchips through veterinarians in a business-to-business (B2B) model, with pet owners registering for related monitoring and recovery services through its direct-to-consumer (D2C) site. To meet a growing demand in the market for pet wellness information, products and services from trusted companies, the HomeAgain team embarked on a transformation of its D2C platform, enabling an improved customer experience for existing and prospective customers and accelerated business growth. Read more

–

Do you have any news to share: please put [email protected] on your press list.

Curious to read and find out more from fintech? Then subscribe & read our full newsletters here. In order to see our other weekly highlights, check out the following links: analysis & opinion