The fintech industry is rapidly evolving and disrupting traditional financial systems. In this article, we bring you the latest research insights to help you stay ahead of the curve and understand the future of financial technology. Enjoy researching!

Home insurance rates to continue to rise, Insurify reports (Global Fintech)

Home market volatility will likely continue as home insurance rates are expected to continue to rise, a report my insurance comparison platform Insurify has revealed. The 2023 Insuring the American Homeowner Report revealed that home insurance rates in the US will increase an additional 9%, following a 7% increase from the previous year. Home values in in western states are declining, with an average 31% drop in home sales among major metropolitan areas like Las Vegas, Provo, San Jose, Seattle, and San Diego. The report also found that among new homeowners who bought in the past year, 27% are already underwater, and 58% worry that they will soon be. Further, about 89% of homeowners were confident that they had enough home insurance, and close to 98% were at least moderately confident that their insurer would resolve their claim to their satisfaction. Read more

TransUnion reports global increase in digital fraud attempts (The Paypers)

TransUnion released a 2023 State of Omnichannel Fraud Report that combines proprietary insights from its global intelligence network and a specially commissioned consumer survey throughout 18 countries and regions worldwide to examine fraud trends and prevention strategies to enable trust in the current omnichannel marketplace. Globally, the study showcased that 4.6% of digital transactions analysed were potentially fraudulent in 2022, similar to the rate seen in 2019. However, despite an easing of the digital fraud rate back to the 2019 level, the global volume of digital fraud attempts increased by 80% from 2019 to 2022, together with an increase in digital transactions throughout the same period. In Hong Kong, throughout 2022 17.5% of digital transactions were suspected to be fraudulent, the highest amongst the regions studied. The volume generally mirrored the global uptrend, with an 18% increase in digital fraud attempts originating from Hong Kong, compared to pre-pandemic 2019. Read more

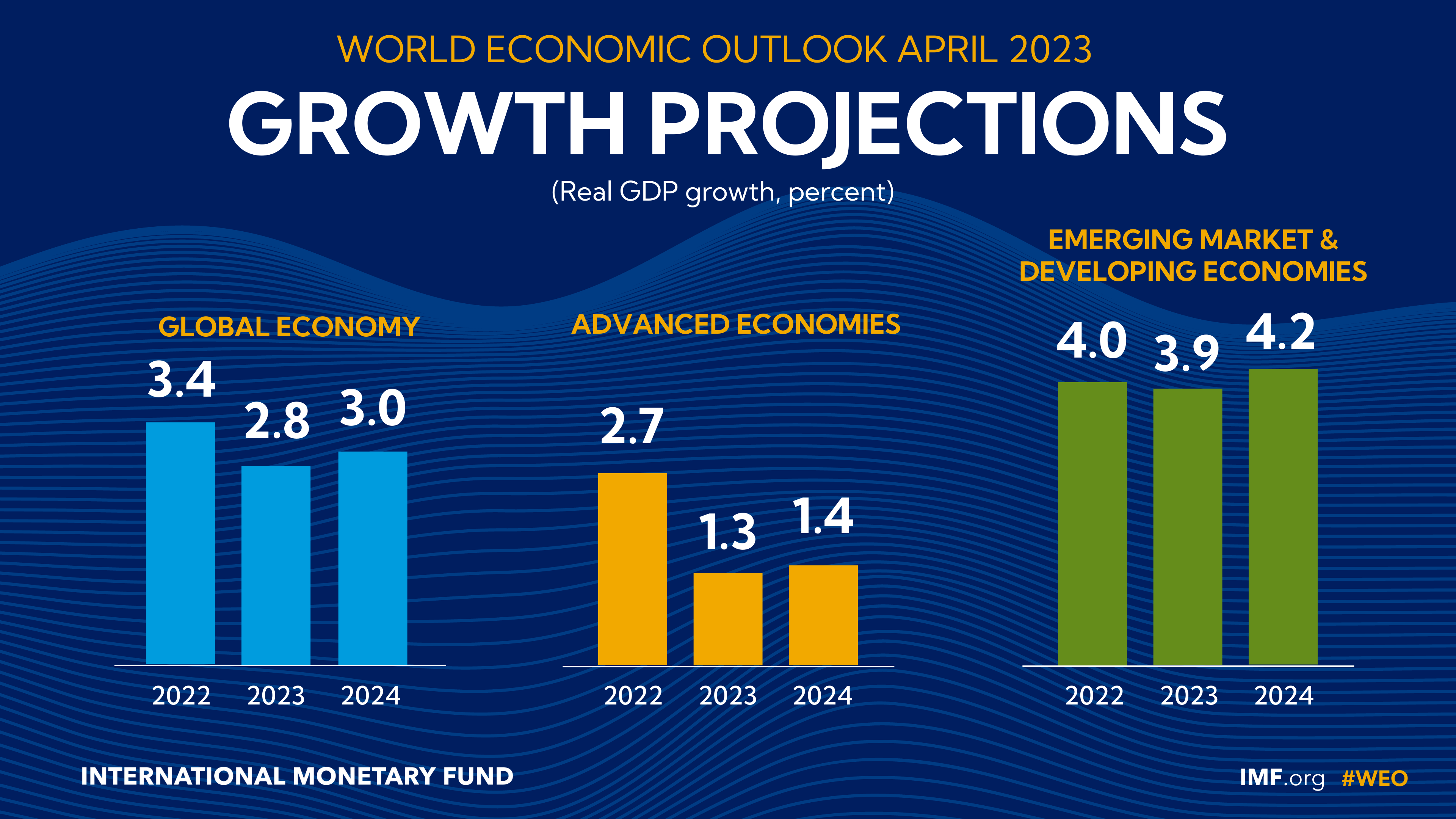

WORLD ECONOMIC OUTLOOK, A Rocky Recovery (IMF)

The outlook is uncertain again amid financial sector turmoil, high inflation, ongoing effects of Russia’s invasion of Ukraine, and three years of COVID. The baseline forecast is for growth to fall from 3.4 percent in 2022 to 2.8 percent in 2023, before settling at 3.0 percent in 2024. Advanced economies are expected to see an especially pronounced growth slowdown, from 2.7 percent in 2022 to 1.3 percent in 2023. In a plausible alternative scenario with further financial sector stress, global growth declines to about 2.5 percent in 2023 with advanced economy growth falling below 1 percent. Global headline inflation in the baseline is set to fall from 8.7 percent in 2022 to 7.0 percent in 2023 on the back of lower commodity prices but underlying (core) inflation is likely to decline more slowly. Inflation’s return to target is unlikely before 2025 in most cases. The natural rate of interest is important for both monetary and fiscal policy as it is a reference level to gauge the stance of monetary policy and a key determinant of the sustainability of public debt. Read more

Fintech and the Future of Finance (The World Bank)

Fintech and the Future of Finance: Market and Policy Implications explores the implications of fintech and the digital transformation of financial services for market outcomes, on the one hand, and regulation and supervision, on the other hand—and how these interact. The report, which provides a high-level perspective for senior policy makers, is accompanied by notes that focus on salient issues for a more technical audience. As the financial sector continues to transform itself, policy trade-offs will evolve, and regulators will need to ensure that market outcomes remain aligned with core policy objectives. Several policy implications emerge. 1. Manage risks, while fostering beneficial innovation and competition. 2. Broaden monitoring horizons and reassess regulatory perimeters. 3. Review regulatory, supervisory, and oversight frameworks. 4. Be mindful of evolving policy trade-offs as fintech adoption deepens. 5. Monitor market structure and conduct to maintain competition. 6. Modernize and open financial infrastructures. 7. Ensure public money remains fit for the digital world. 8. Pursue strong cross-border coordination and sharing of information and best practices. Read more

The State of Customer Engagement Report (Twillio)

The past year has mandated a new approach to business. Facing economic uncertainties and a contraction of marketing budgets, brands know they need to do more with less. To create Twilio’s annual State of Customer Engagement Report, we incorporated insights from 4,700 B2C leaders in key sectors across the world as well as more than 6,000 global consumers, plus data from our own customer engagement platform, including Twilio Segment, a CDP. Twillio found that, in 2023, the most successful brands use digital customer engagement to drive growth and increase resilience in a rapidly changing landscape. Sixty percent of brands say that investing in digital customer engagement has improved their ability to meet changing customer needs. It’s also critical to move beyond data collection and into data activation. In a data-saturated world, companies need the ability to not just collect and organize, but to actually make use of customer data in real time. The future is bright for businesses that have a sharp, forward-looking plan to make the most of a highly personalized landscape without compromising on data safety and privacy. Read more

The individual health insurance market in 2023 (McKinsey)

This represents an outsize year for insurer and enrollment growth. More than 3.6 million new consumers entering the market are choosing among an average of 88 plans. The year 2023 marks the tenth year of operation for the US health insurance exchanges since they launched as part of the Affordable Care Act in 2014. The individual market has remained fluid during this time, with insurer participation, pricing, and plans changing from year to year. Consumer participation increased 25 percent to approximately 16 million from 2020 to 2022, coincident with extended enrollment periods and enhanced subsidies implemented under the American Rescue Plan Act of 2021 and extended through 2025 by the Inflation Reduction Act of 2022. Looking ahead, consumer participation could continue to grow. Open enrollment results from November 1, 2022, through January 25, 2023, show 13 percent growth from 2022. The upcoming resumption of Medicaid redeterminations, which states may begin as early as April 2023, could result in an estimated additional 2.7 million individuals becoming disenrolled from Medicaid coverage and eligible for individual market premium subsidies. Read more

Majority of UK retail investors are focusing on sustainable funds, study finds (Fintech Global)

A Kana Earth study has found 65% of UK retail investors are more likely to invest in funds that provide more carbon footprint information and transparency in their plans. According to Asset Servicing Times, the UK retail investors are more likely to invest in funds that provide more information about their carbon footprint and are transparent in their plans to reduce it. The study – headed by Kana Earth – polled more than 1000 consumers from the UK in November of last year. Up to 34% of UK retail investors were found to consider the carbon footprint of stock market-related investments before they invest, while a further 26% saying they prioritise carbon footprint over its charges when considering an investment. Looking towards the future, 46% of those polled predict an increase in allocation to investment funds with a carbon emission-reduction focus, meanwhile 15% expect this increase to be dramatic. Read more

–

Do you have any news to share: please put [email protected] on your press list.

Curious to read and find out more from fintech? Then subscribe & read our full newsletters here. In order to see our other weekly highlights, check out the following links: analysis & opinion