The fintech industry is rapidly evolving and disrupting traditional financial systems. In this article, we bring you the latest research insights to help you stay ahead of the curve and understand the future of financial technology. Enjoy researching!

2023 Thales data threat report reveals causes for data security breaches (The Paypers)

France-based technology company Thales has released its ‘2023 Thales Data Threat Report’, showcasing a surge in ransomware attacks and increased risks to data in the cloud. The annual report from Thales reveals the latest data security threats, trends, and emerging topics based on a survey of nearly 3000 IT and security professionals in 18 countries. Nearly half (47%) of IT professionals surveyed believe that security threats are increasing in volume or severity with 48% reporting an increase in ransomware attacks. More than a third (37%) have experienced a data breach in the past 12 months, including 22% reporting that their organisation had been a victim of a ransomware attack. Respondents identified their cloud assets as the biggest targets for cyber-attacks. Over a quarter (28%) said SaaS apps and cloud-based storage were the biggest targets, followed by cloud-hosted applications (26%) and cloud infrastructure management (25%). The increase in cloud exploitation and attacks is directly due to the increase in workloads moving to the cloud as 75% of respondents said 40% of data stored in the cloud is now classified as sensitive compared to 49% of respondents in 2022. Read more

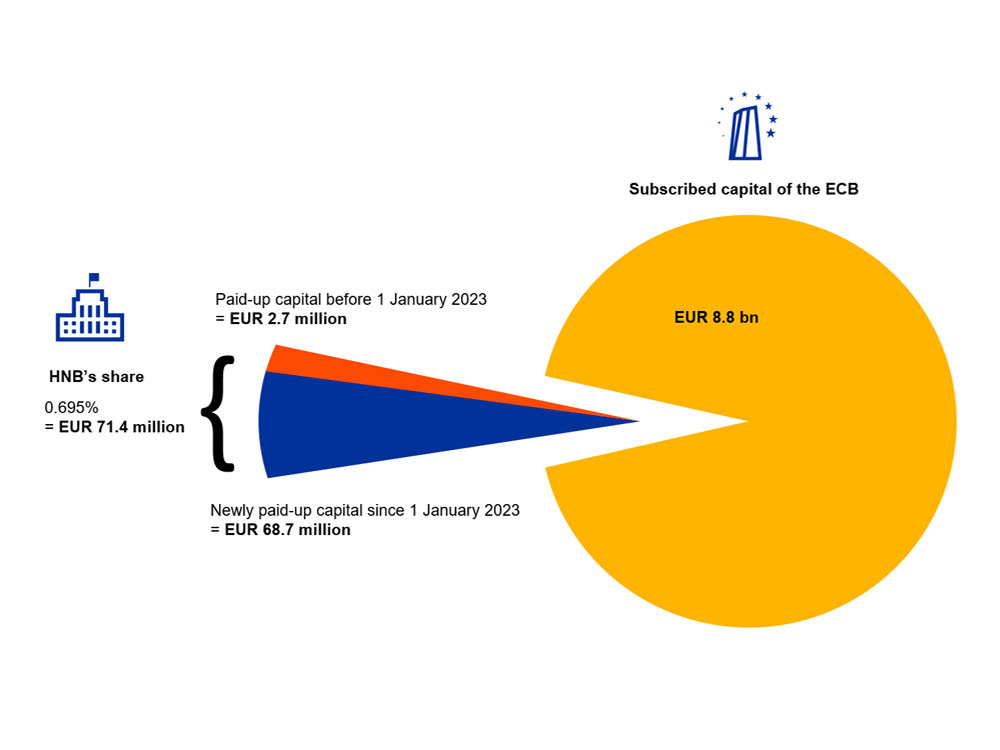

Welcoming Croatia to the family: what’s changed at the ECB? (European Central Bank)

When a country adopts the euro, there is always extensive coverage of the economic implications of adopting a new currency. Consumers can travel without exchanging money, businesses can trade more easily in the Single Market, and people might argue about whether the change triggers extra inflation (not really, it turns out). But of course, the change has also substantial effects on the monetary union. When someone joins the family, and gets a seat around the table, some things change or need to be rearranged. Here we focus on the capital of the ECB and voting rights in the Governing Council. The ECB’s total subscribed capital of €10.8 billion is divided between all of the NCBs of the EU. Each NCB’s share is calculated using the ECB’s capital key, which is based on the respective Member State’s share in the total population and gross domestic product of the EU. Under this key, Hrvatska Narodna Banka’s (HNB) share of the total is 0.6595%, corresponding to €71,390,921. This was true even before the country’s adoption of the euro on 1 January 2023. What did change on that date, however, is the amount of the subscribed capital that HNB actually paid up to the ECB. That’s because the NCB of every EU Member State that has not joined the euro area yet is required to pay up just 3.75% of its subscribed capital as a contribution to the ECB’s operational costs. Before joining the Eurosystem, Croatia had already paid up just under €2.7 million. Read more

Female leaders call for regulation to combat gender pay gap (Fintech Global)

UK FinTech female leaders have called for regulation to help narrow the gender pay gap and encourage stronger female progression in the sector. The call comes from a new report from EY and Innovate Finance, ‘Changing the face of UK FinTech: from glass ceiling to open doors: championing equality and career progression for women in FinTech.’ The research includes interviews with the 120 nominees of the Innovate Finance Women in FinTech Powerlist. Contributors cited a lack of industry recognition for their contribution (27% of respondents) and non-transparent promotion processes (25%) as barriers to career progression. As for solutions to this problem, regulation of the gender pay gap came out on top, with 17% of respondents putting this as their first choice of how to improve gender diversity, equity and inclusion. Read more

The multiplier effect: How B2B winners grow (McKinsey & Company)

B2B buyers have made up their minds. After three years of seismic shifts—including the acceleration toward digital channels triggered by the pandemic—these decision makers are rewarding companies that deliver on a great omnichannel experience backed by personalized marketing, and punishing those that don’t. The consumerization of B2B buying appears nearly complete. After years of wanting a seamless B2B buying experience similar to that of the B2C world3—and with B2B companies saying it wasn’t possible due to factors such as complexity, technical requirements, value, and the number of decision makers—our survey found that omnichannel is now table stakes for B2B companies. We also identified five other clear trends: The “rule of thirds” holds.4 Customers still want an evenly divided mix of traditional, remote, and self-service channels, such as face-to-face sellers, inside sales, and e-commerce, respectively (Exhibit 1). We see continued growth in customers’ preference for online ordering and reordering, especially in the Western European and Australian markets where usage is as high as 40 percent of total orders. Read more

Eurora releases report on AI’s impact on cross-border trade (The Paypers)

Estonia-based platform for cross-border trade compliance Eurora has published a report on how AI can assist in complying with diverse cross-border trade regulations. The report, titled ‘The Case for AI in Cross-Border Trade’, addresses the challenges faced by logistics providers and the ecommerce sector due to an increasingly diverse and complicated regulatory environment, including the US STOP ACT, Singapore’s new GST rules, Dubai’s customs duty charges, the UK Customs Declaration Service, Canada’s CARM importing regime, the European Union’s Import Control System 2 (ICS2), VAT in the Digital Age (ViDA), and the EU’s Carbon Border Adjustment Mechanism (CBAM). Read more

State of the Industry Report on Mobile Money 2023 (GSMA)

Mobile money is now considered a mainstream financial service in many countries During the COVID-19 pandemic, mobile money enabled millions of people in low- and middleincome countries (LMICs) to access digital financial services (DFS) for their daily needs. As the impact of the pandemic eased, mobile money services grew faster in 2022 than during pre-COVID times. The habit of using digital payments, enforced by the pandemic, has stuck for many. In many countries, growth in mobile money activity is now outpacing new registrations – a sign that the industry is maturing beyond a handful of markets. The pandemic itself led to a significant global expansion of mobile money services and accounts. Data from the annual GSMA Global Adoption Survey suggests that registered accounts and 30-day active accounts grew faster than forecast in 2019. The pandemic was partly responsible for an additional 400 million registered accounts between 2019 and 2022. This is at least 30% higher than forecast in 2019. Pandemic lockdowns and restrictions on movement drove up the use of digital payments, including mobile money, globally. The State of the Industry Report on Mobile Money 2023 looks at the growth of mobile money in a post-pandemic world. The report highlights what this has meant for mobile money providers (MMPs), agent networks and the millions of new and existing customers that embraced mobile money in 2022. Read more

–

Do you have any news to share: please put [email protected] on your press list.

Curious to read and find out more from fintech? Then subscribe & read our full newsletters here. In order to see our other weekly highlights, check out the following links: analysis & opinion