The fintech industry is rapidly evolving and disrupting traditional financial systems. In this article, we bring you the latest research insights to help you stay ahead of the curve and understand the future of financial technology. Enjoy researching!

Crowdfunding in the Netherlands 2022 (crowdfundingcijfers.nl)

In 2022, 1.08 billion euros will have been raised in the Netherlands via crowdfunding. That is a growth of 48% compared to a year earlier. Never before has so much been financed with crowdfunding in a year. In 2022, companies raised an amount of 972 million euros through crowdfunding. That is 48% more than in 2021. Companies raised an average of 350,000 euros in 2022. For creative projects, such as film, music and theatre, the total amount raised has remained about the same at 12 million euros. The average amount per creative project was 12,000 euros. For social projects, such as a playground or school project, the total amount raised has fallen to 25 million euros. The average amount per social project was 3,000 euros. Consumers who financed a personal loan via crowdfunding for, for example, the purchase of a car or the extension of their house, raised a total of 72 million euros. That is more than double compared to 2021. Read more

Over 20% of Brits are ‘financially vulnerable’, according to research (IBT)

A recent study conducted by financial technology firm Tink reveals that many Britons are “financially vulnerable” due to the persistent cost-of-living crisis. Of the respondents surveyed, 23 per cent were considered financially vulnerable, with their salaries no longer covering their basic expenses. Over half of these individuals anticipate further reductions in their disposable income in the next year, leading to missed payments and difficult decision. The report highlights the need for financial institutions to assist vulnerable clients while fulfilling their regulatory obligations. With one in two “financially vulnerable” respondents calling for greater support from banks during these tough economic times, institutions are under increased pressure to prioritise the needs of their customers and deliver better outcomes. Read more

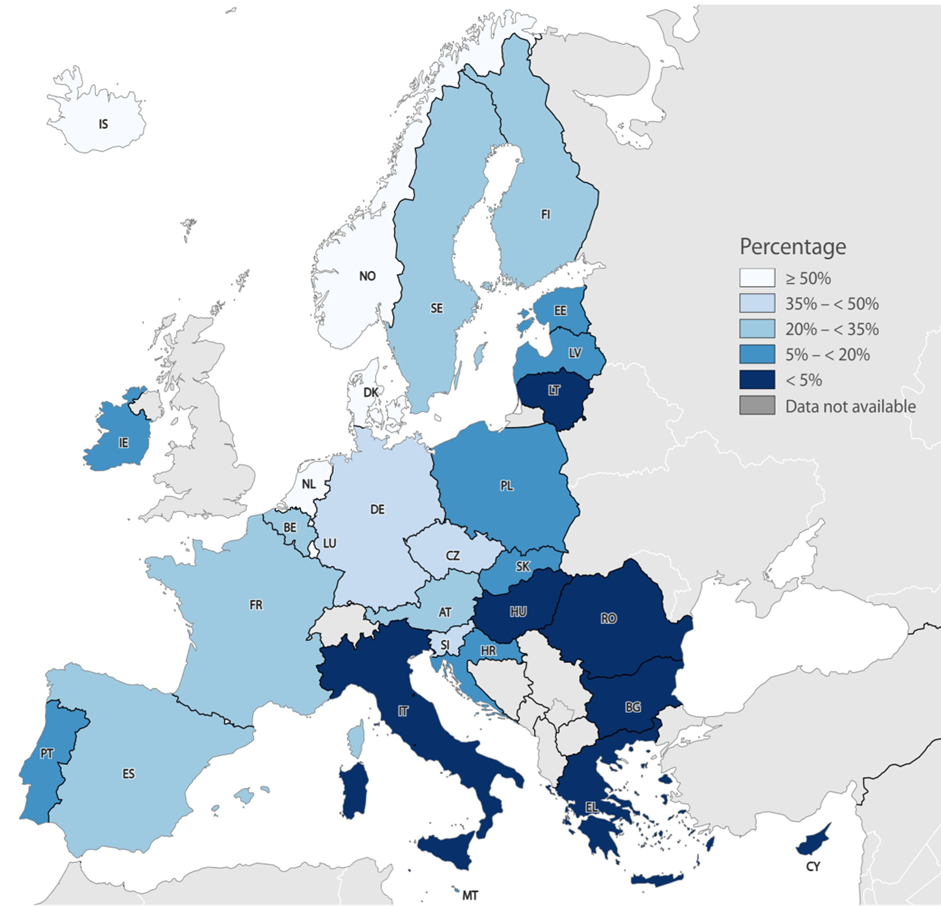

What to do about Europe’s climate insurance gap (European Central Bank)

Drought affected two-thirds of the European Union in 2022, likely the worst episode in 500 years. Agricultural production withered, river transport was disrupted and hydroelectric power generation fell, which exacerbated the energy crisis. Just a year earlier, severe flooding across the continent killed hundreds and caused substantial damage. Climate change will make catastrophes like these more frequent and more severe. So, are we covered when disaster strikes? No, the EU actually has a major climate insurance protection gap. Only a quarter of climate-related catastrophe losses are insured. In some countries, the figure is less than 5% (Figure 1). Moreover, the growing effects of climate change mean that coverage is likely to shrink as rising premiums choke demand and insurers withdraw from particularly exposed areas. Read more

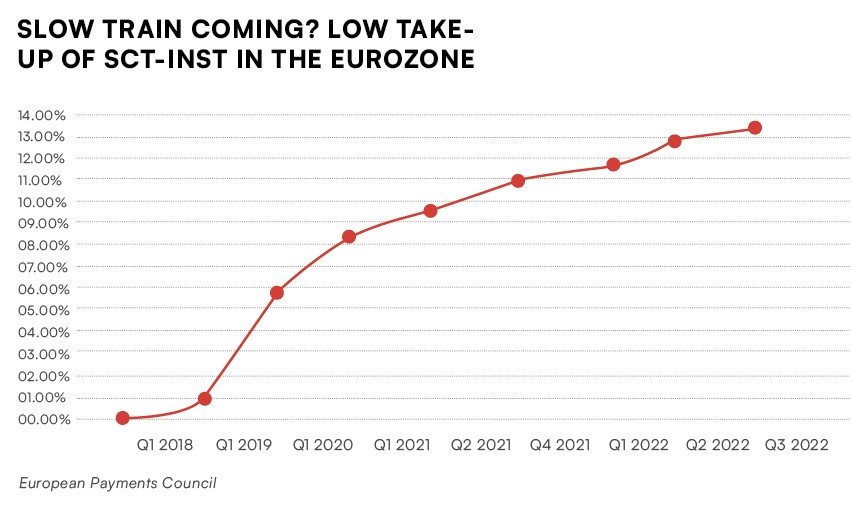

Europe’s EPI: EPIc fail in the making? (Payments Cards and Mobile)

The European Payments Initiative (EPI), launched to some fanfare in 2020, was supposed to offer a payments solution “catering and corresponding to European needs.” But as the EPI’s scope changes and several partners lose interest, James Wood asks if market development isn’t best left to the market itself. Ronald Reagan’s speechwriters first minted a line that has passed into modern folklore: “These are the words everyone dreads – ‘I’m from the government, and I’m here to help you.’” Reagan’s words spoke to a belief that individuals and markets are better judges of what’s needed for success than governments or regulators. In payments, it’s pretty easy to find examples of where Reagan’s dictum does not apply. In the UK, one thinks of the work done by Pay.UK to develop the Faster Payments system now growing at 25 percent a year and used to process £2.6 trillion of payments in 2021. Read more

AltFi Research presents this deep dive into the fast-growing embedded finance and lending landscape in 2023 (AltFi)

AltFi Research presents Embedded Finance: The New Frontier Of Lending, a deep dive into the fast-growing embedded finance and lending landscape in 2023. This report traces the history of ‘embedded’ from early online payments, through to its present popularity in lending, the potential it holds to disrupt sectors like insurance and asks whether consumers will get on board with increasingly embedded finances. The research explores what the limits of embedded finance are, how lenders are adapting their offerings to embrace embedded, why the embedded insurance sector is poised to become a $700bn industry in its own right, where embedded payments are going next, and whether consumers are ready to adopt these embedded financial services. Read more

EIF Working Paper 2023/88, Fairness in algorithmic decision systems: a microfinance perspective (EIF)

The paper discusses fairness in AI-enabled credit-scoring systems. By means of a case study, focusing on a European non-profit microfinance organisation, it unveils the typical challenges associated with implementing fairness principles in practice. This Working Paper is the first paper resulting from a research project on “Strengthening Financial Inclusion through Digitalisation” (SFIDE), initiated by EIF’s RMA division. The project is funded by the EIB Institute under the EIB-University Sponsorship Programme (EIBURS). It aims to investigate the potential of technological and financial innovation to increase the efficiency of the inclusive finance sector, through the identification and promotion of best practices. Read more

–

Do you have any news to share: please put [email protected] on your press list.

Curious to read and find out more from fintech? Then subscribe & read our full newsletters here. In order to see our other weekly highlights, check out the following links: analysis & opinion