The fintech industry is rapidly evolving and disrupting traditional financial systems. In this article, we bring you the latest research insights to help you stay ahead of the curve and understand the future of financial technology. Enjoy researching!

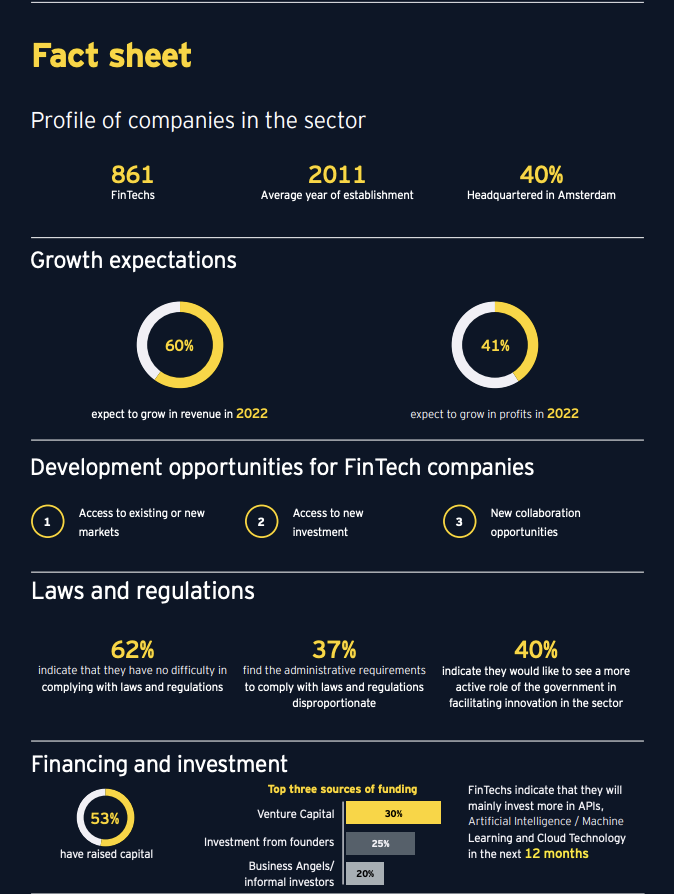

Dutch FinTech Census 2023 Report (EY)

The Dutch FinTech sector has grown significantly, with 861 FinTechs in 2023 (up from 635 FinTechs in 2019).FinTechs are still relatively young and concentrated in the Randstad area. Amsterdam is most attractive, with 40% of the FinTechs based here. The level of financial activity and its international character makes Amsterdam stand out.

In general, the Netherlands is seen by FinTechs as an attractive location for FinTechs, owing to its digital infrastructure, English language proficiency and culture. The biggest challenges for FinTechs are attracting qualified or suitable talent, the general economic climate and geopolitical developments. Dutch FinTechs cite access to existing or new markets, as well as access to new investments as major development opportunities. Moreover, FinTechs no longer see collaboration as one of their biggest challenges, but as an important opportunity for further growth and development. Access to an existing customer base, a stamp of quality and access to investment budgets are the main drivers for cooperation for FinTechs. Read more

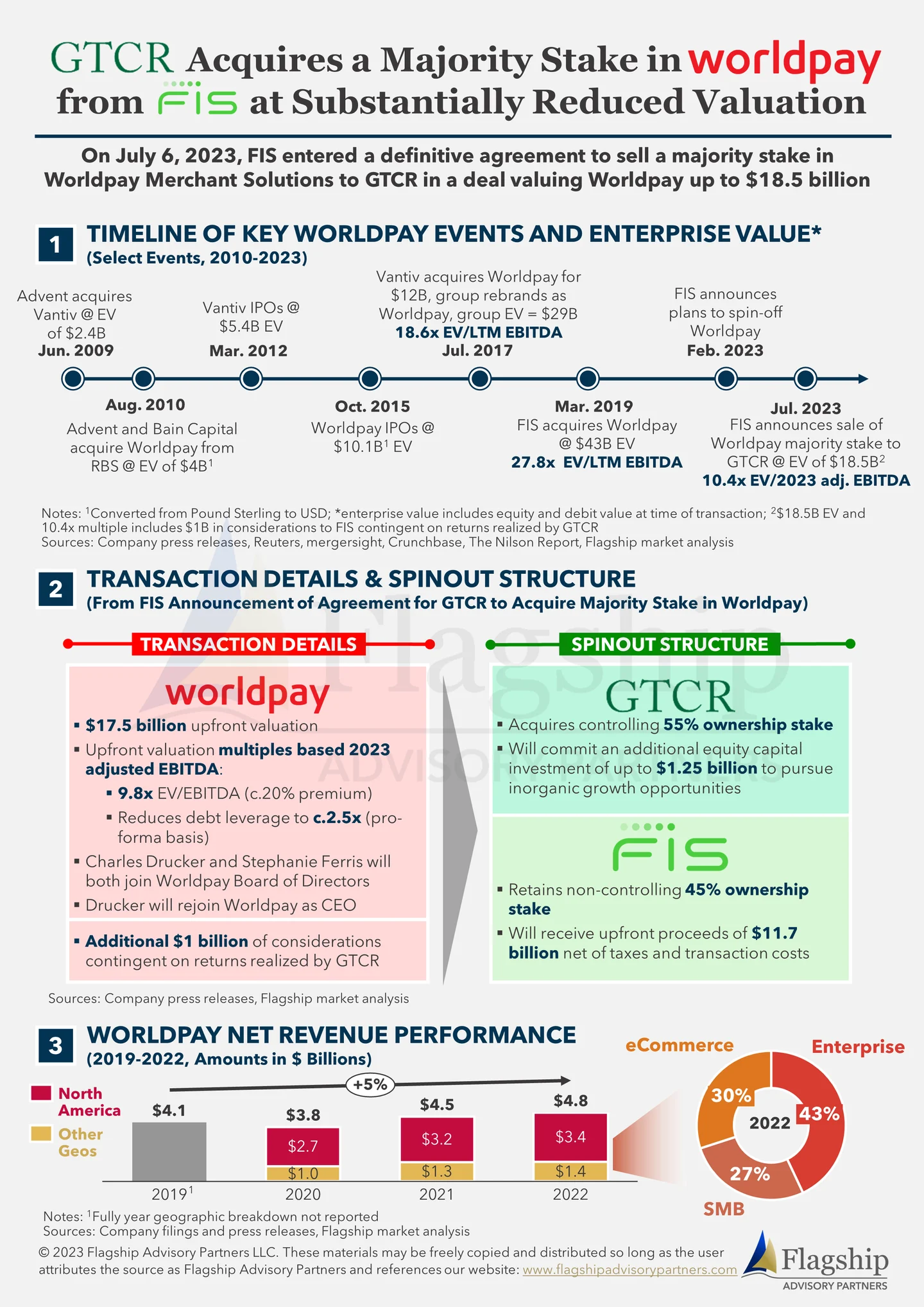

Infographic: GTCR Acquires a Majority Stake in Worldpay from FIS at Substantially Reduced Valuation (Flagship Advisory Partners)

Read more

SEPA Credit Transfer: The Complete Guide (Treezor)

According to the European Central Bank, with over 184.2 trillion euros worth of transactions in 2021, credit transfers account for 93% of all amounts exchanged in the euro zone. It is number 1 in cashless payments (by value), well ahead of direct debits and payments through cards. Credit transfers are favored by companies and public authorities for large-value transfers, as well as for smaller B2C and C2C transactions. Indeed, it offers numerous advantages in terms of fraud prevention and speed of transaction execution. Read more

Address validation solutions: How Address Risk API stands out (Ekata)

One of the big advantages of a digital economy is the ability to connect and transact around the world, regardless of physical location. Of course, this advantage brings with it some challenges for fraud prevention teams; namely, bad actors can now attack from across the globe. The ability to assess address risk through address verification and address validation software and APIs software is a must for any consumer business with an online presence. Of course, not all address verification APIs are built the same. Before we examine what makes our Address Risk API stand out, let’s examine what address verification is and why address validation is necessary. Read more

OECD Economic Surveys: Netherlands 2023 (OECD)

The Dutch economy swiftly returned to its pre-pandemic growth path, but rapidly rising inflation disrupted growth, magnifying existing challenges, such as the urgency of the transition to net zero, ageing-related fiscal pressures, and pervasive labour shortages. Significant investments in low-carbon infrastructure and technologies are needed to reduce fossil fuels dependence and exposure to global energy price fluctuations. Read more

–

Do you have any news to share: please put feed@hollandfintech.com on your press list.

Curious to read and find out more from fintech? Then subscribe & read our full newsletters here. In order to see our other weekly highlights, check out the following links: analysis & opinion